Three Trades For This Wild Stock Market

Stock-Markets / Stock Markets 2018 Feb 07, 2018 - 02:27 PM GMTBy: Chris_Vermeulen

It has been an emotional ride for most traders since stocks started to sell off last Friday in a big way. This crash we just experienced is VERY much like the Aug 2015 crash. Price and volatility both have parabolic price movements that could either make you a lot of money or lose a bundle depending on where your money was positioned.

This post is to quickly share three recent trades we have taken one of them (REALLY BAD) and what to expect in the markets moving forward.

On Monday while the markets were under serious pressure cascading lower our only open position at the time was DUST. This is an inverse gold miners fund that allows us to profit when gold stocks fall in value. We had been expecting gold stocks to fall for a couple weeks and got into the position on Jan 26th. Gold stocks fell quickly and we took partial profits at 11% within 3 days.

We continued to hold the balance of DUST in anticipation of a second leg down in gold stocks which our technical analysis was showing should happen within a couple days which it did. On Monday, Feb 5th while stocks were under more selling pressure money rotated into the gold stocks as a safe haven and that is we decided to close the position with a 20% profit it 7 days. This was a good trade, but the next one isn’t.

You can see our play-by-play trade alerts for this here

Also, on February 5th we were anticipating the panic selling and looking for a washout low to be put in place Monday/Tuesday of this week. Thus far everything has played out exactly as we expected in terms of price action. What I love about technical analysis is that if done correctly you can predict, or at least have a very good idea of what price should do next, and because we knew panic selling was coming we were not totally caught off guard. But I will admit, I expected half the price movement and volatility that actually took place this time around.

TERRIBLY UNFORTUNATE TRADE

– I always short UVXY when the vix is high, and fade the fear. But no shares were available to short Monday.

– The only other way to do this was to buy XIV and inverse VIX fund which works in most cases but not nearly as good as short selling UVXY.

– Volatility jumped 100% Monday, XIV fund imploded and lost 98% of its value catching hedge funds, professional traders, and us off guard.

– XIV is still trading, it will take many months to regain and reduce some of its drawdown.

Tuesday’s Clawback Trade

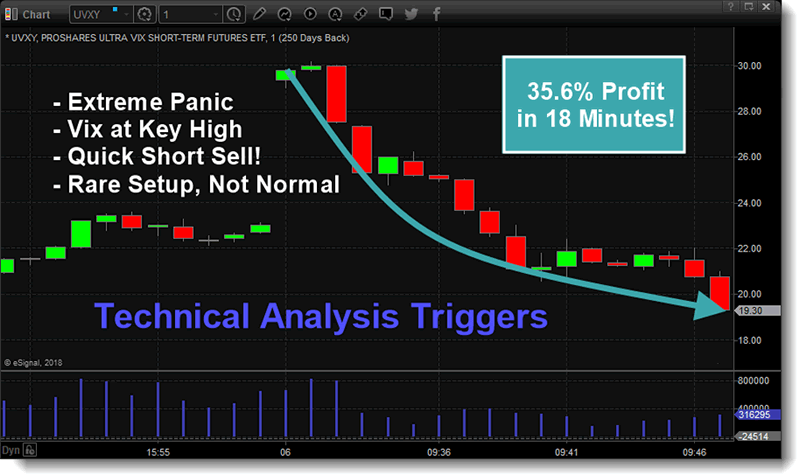

During extreme situations like XIV position dropping 98% there are two ways to deal with it. Take the loss and move on, or use the extreme market conditions to get back into a trade and catch the next big move to help minimize XIV drawdown. So we took a short sell trade on UVXY Tuesday at the open. The Vix was set to gap sharply higher into a level it has only ever reached a few times in before. By shorting the vix it means we profit when the vix falls in value which it did.

We opened the trade right at the opening bell and the vix when into free fall hitting our first protic target within 18 minutes for a 36% profit. We still hold half the position expecting a larger gain over the next few days. Currently, this short UVXY position is up over 50% and we are looking for roughly 70% before we close it out.

Take a listen to my audio Squawk Box broadcast today to subscribers to get a feel for the XIV, volatility, and the stock market.

Conclusion:

In short, February has been exciting, to say the least. I feel this price action is a major warning and signal that the bull market is coming to an end. What I feel is going to unfold is similar price action we say from Aug 2015 crash – Feb 2016. Big price rotation, and elevated volatility. And this time, stocks may not find support at the lows created this week and trigger the first leg down in a new bear market.

It’s likely going to take most of 2018 to form and unfold, but we aware…

Join us at Technical Traders Ltd. Wealth Building Newsletterand take advantage of the next major trend changes and profit.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.