Stocks? Who Cares? You Should Worry about Something Else, Bonds!

Interest-Rates / US Bonds Feb 27, 2018 - 03:12 PM GMTBy: Arkadiusz_Sieron

Investors are still worried about the stock market. It’s quite understandable, given the recent correction, but it draws their attention away from the really important developments. Let’s analyze the hidden threats and consider how they could affect the gold prices.

Investors are still worried about the stock market. It’s quite understandable, given the recent correction, but it draws their attention away from the really important developments. Let’s analyze the hidden threats and consider how they could affect the gold prices.

It’s Bonds, Stupid!

Let’s establish one thing at the beginning. The bond market is more important than the stock market. First, it’s significantly bigger. The global bond market exceeds $100 trillion, while the global stock market is higher than $70 trillion. Point for bonds.

Second, the bond market is more diversified, or, less sensitive to sentiment – and more to fundamentals. The indicators of the bond market are not so famous as S&P 500 and Dow Jones, while fixed returns make bond returns more predictable.

Third, the bond market exerts stronger effects on the stock market than the other way around. When bond yields are high, there’s no reason to invest in equities. Why should you invest money in a risky project, when you can pick up nice profits in the less risky bond market? Please also note that the Fed injects new money into the bond market – to lower interest rates and put upward pressure on stock prices.

Unfortunately, despite its importance, the bond market doesn’t get enough attention. Until something bad happens, of course. Recently, everyone talks about Treasuries hitting 3 percent. What would it mean for the gold market?

Will 3% End the World?

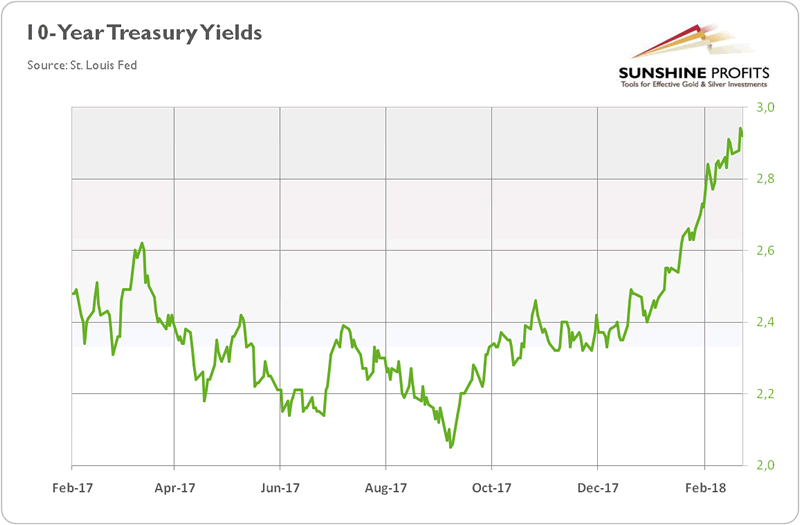

Yields on the 10-year Treasuries are heading toward 3 percent. As one can see in the chart below, they touched 2.94 last week.

Chart 1: 10-Year Treasury Yields (in %) over the last twelve months.

What does it mean? Well, bond guru Bill Gross claims that the bear market in bonds has finally begun. Higher yields should make the stock market look less attractive. However, investors should remember that climbing Treasury yields imply lower bond prices. Hence, fund managers may shift their allocations toward foreign fixed income. Such changes should further weaken the U.S. dollar. Thus, gold may shine – even if Treasury yields are rising.

But it all boils down to the reason why yields are rising. Interest rates may be a leading indicator, which signals anticipated economic growth. In such an environment, stocks should continue to perform well. And gold bulls may leave empty-handed. Let’s examine the recent behavior of real interest rates.

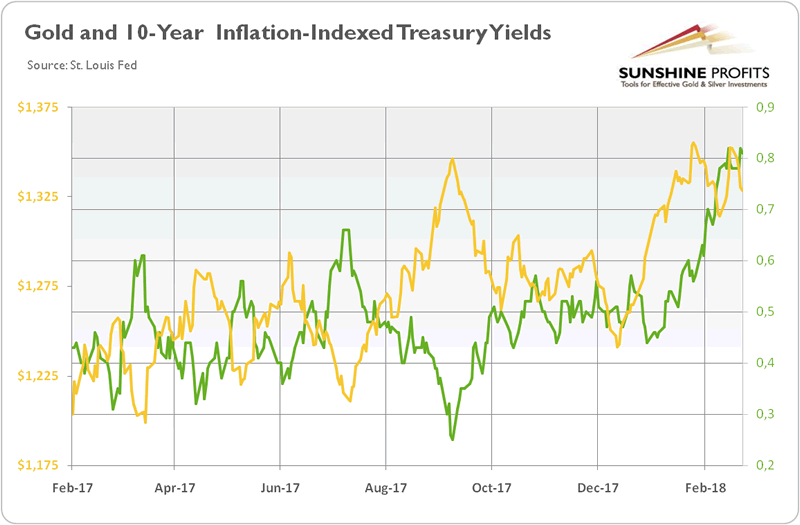

Chart 2: Gold prices (yellow line, left axis, London P.M. Fix, in $) and real interest rates (green line, right axis, 10-year inflation-indexed Treasuries, in %) over the last twelve months.

As the chart above shows, real interest rates have gone up as well. It means that inflation is not rising faster than yields – and investors expect a cyclical uptick in economic growth. Thus, although there might be turbulences on the way, the economic airplane shouldn’t crash into Treasury yields at 3 percent or above.

Implications for Gold

Look at the second chart once more. In 2018, the well-established negative correlation between gold prices and real interest rates collapsed. But will this last forever? We doubt. At some point, real interest rates high enough could halt the slump in the U.S. dollar – and the yellow metal will struggle.

But in the very short-term, all eyes are on Powell who will testify before Congress today. If traders don’t like his remarks, we will see more volatility in the financial markets. Gold, as a safe-haven asset, may benefit then. We bet that although Powell may change the rhetoric a bit, he is not likely to radically alter the Fed’s course. Will this come true? We will see, stay tuned!

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.