Make Gold, Not (Trade) War!

Commodities / Gold and Silver 2018 Mar 09, 2018 - 10:22 AM GMTBy: Arkadiusz_Sieron

“So it begins.” This is what King Theoden said right before the Battle of Helm’s Deep in the Lord of the Rings. Fortunately, the army of Uruk-hai doesn’t threaten the kingdom of men. But something else – also dreadful – endangers us. Trade wars.

“So it begins.” This is what King Theoden said right before the Battle of Helm’s Deep in the Lord of the Rings. Fortunately, the army of Uruk-hai doesn’t threaten the kingdom of men. But something else – also dreadful – endangers us. Trade wars.

Are Trade Wars Good?

President Trump shook the world last week, saying: “(…) trade wars are good, and easy to win.” Wrong! Each economist will say that. It’s true that economists often argue with each other. People even said “two economists, three opinions”. But economists do agree on many fundamental issues. One of them is the proposition that free trade is better than protection.

Why is that? The reason is very simple: people have different skills. It pays countries to trade because they have comparative advantages in producing distinct goods. Instead of producing all stuff independently, it’s better for each country to specialize in the industries where it has a comparative advantage and to trade their output then. It’s much more effective when the French focus on making wine and exchange it later with the Germans for beer (although Rieslings are great!).

Or you can consider foreign trade as a kind of a technology which transforms one good into another. Just think what happens when the U.S. exports bourbon to Japan and imports cars. It’s basically a way to turn bourbon into automobiles! Alchemists always dreamt of such transmutation – and free trade turns out to be the real philosopher’s stone.

Cohn Abandons ‘USS Washington’

Gary Cohn, Trump’s top economic adviser, had already threatened to leave after the President’s comments following the deadly riot in Charlottesville. But he stayed, at least for a while. Trump’s remarks about imposing tariffs on steel and aluminum imports were too much for him. Cohn was against such a move – and he announced his resignation after he lost the tariff battle.

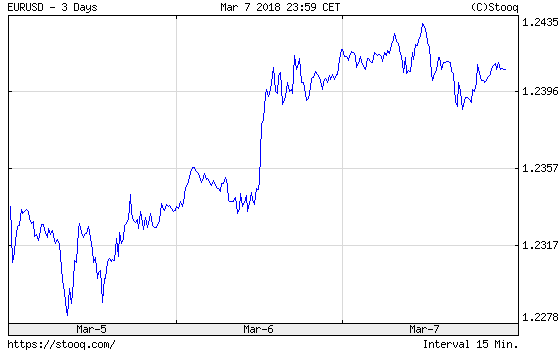

Wall Street didn’t welcome the news about Cohn’s exit. Business leaders considered him a person at the White House they could rely on. As he was believed to understand the needs of industry, the S&P 500 Index fell slightly, while the U.S. dollar declined against the euro, as one can see in the chart below.

Chart 1: EUR/USD exchange rate over the three last days.

Hence, Cohn’s departure might increase the ‘fear factor’ and spur some safe-haven demand for gold. However, his exit is not the end of world, especially that we don’t know who will be his successor.

Will Trade Wars Boost Gold Prices?

Trade is beneficial for both parties – no matter if they live in the same or in two countries. So Trump was wrong on Tuesday, saying: “the trade war hurts them, not us.” It hits both partners – especially if the initial tariffs entail retaliation. The EU has already announced that it would respond with its own tariffs to hit $3.5 billion of American goods. In response, Trump declared that he would consider tariffs on automobiles if the EU retaliates. Such a rhetoric sparked fears of a tit-for-tat trade war.

How will gold behave in such a scenario? History doesn’t provide a clear guide. Since the price of gold was freed at the beginning of the 1970s, global trade has become more and more free. But we know the results of the Smoot-Hawley Tariff Act, which raised tariffs on over 20,000 imported goods to record levels. Although the bill didn’t cause the Great Depression, it didn’t help the U.S. economy recover. Actually, it prolonged the suffering – and laid the ground for WWII. As the saying goes, when goods don’t cross borders, soldiers will.

The implications are clear: trade wars, when implemented, would be positive for gold prices. They would increase risk premia and undermine the trust in the U.S., sending the greenback lower and supporting the yellow metal. Having said that, investors shouldn’t panic, at least not yet. A full-blown trade war is still improbable. We have so far some trade disputes – which happened under Obama and previous presidents as well. But the unpredictable Trump and higher international uncertainty will not improve the negative sentiment toward the U.S. dollar. Gold may benefit on that. Indeed, its price increased on Tuesday – although the yellow metal erased gains on Wednesday. Stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.