Will the Stock Market Make Another Correction this Year?

Stock-Markets / Stock Markets 2018 Mar 14, 2018 - 05:21 PM GMTBy: Troy_Bombardia

The S&P made an 11.8% “small correction” from January – February 2018.

The S&P made an 11.8% “small correction” from January – February 2018.

When the stock market begins and finishes a “small correction” in the first quarter (January-March) of a year, it ALWAYS makes another correction that year. Hence, we can expect that there will probably be another 6%+ “small correction” sometime later this year. The U.S. stock market will be much choppier in 2018 than in 2017. This is not a “goldilocks” year.

- January – February 2014: 6.1% “small correction”

- February – March 2011: 7% “small correction”

- January – February 2010: 9.2% “small correction”

- February – March 2007: 6.6% “small correction”

- January – February 2000: 10.3% “small correction”

- January 1990: 11.3% “small correction”

- January 1988: 8.2% “small correction”

- January 1983: 6.2% “small correction”

- March 1955: 6.8% “small correction”

- January – February 1952: 6.3% “small correction”

Let’s look at these historical cases in detail.

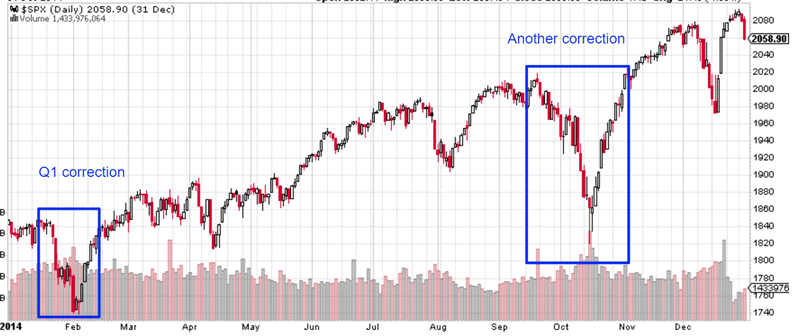

January – February 2014: 6.1% “small correction”

The S&P made another 9.8% “small correction” in the same calendar year: September – October 2014.

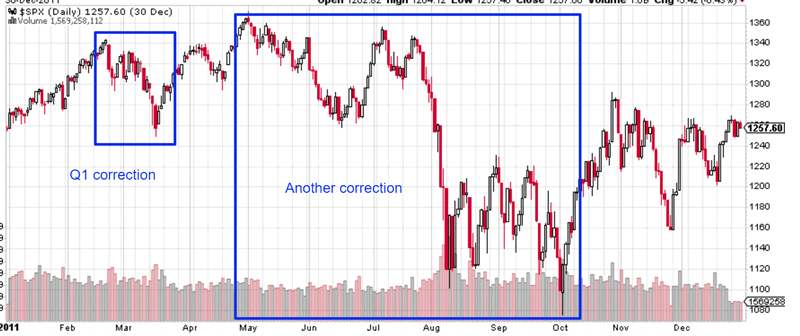

February – March 2011: 7% “small correction”

The S&P made a 21.5% “significant correction” in the same calendar year: May – October 2011.

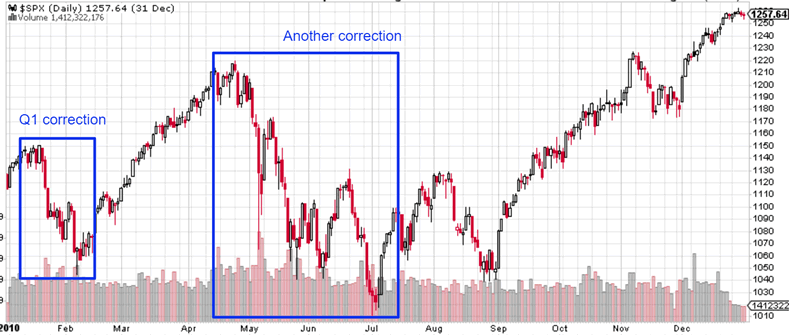

January – February 2010: 9.2% “small correction”

The S&P made a 17.1% “small correction” in the same calendar year: April – July 2010.

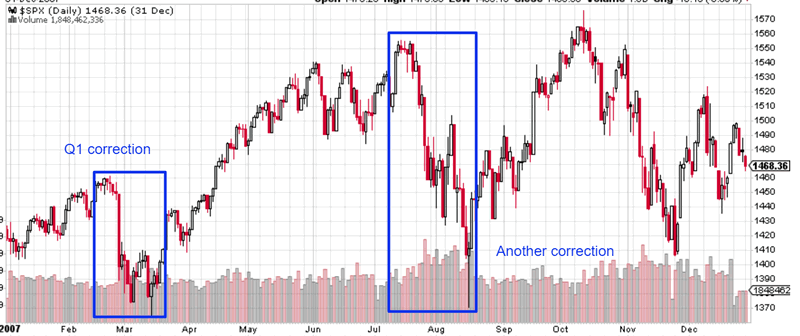

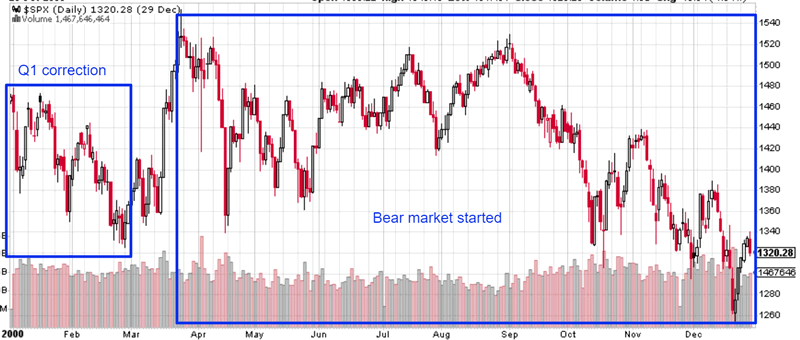

February – March 2007: 6.6% “small correction”

The S&P made another 11.9% “small correction” in the same calendar year: July – August 2007. A bear market started in October 2007.

January – February 2000: 10.3% “small correction”

The S&P’s bull market ended 1 month later in March 2000.

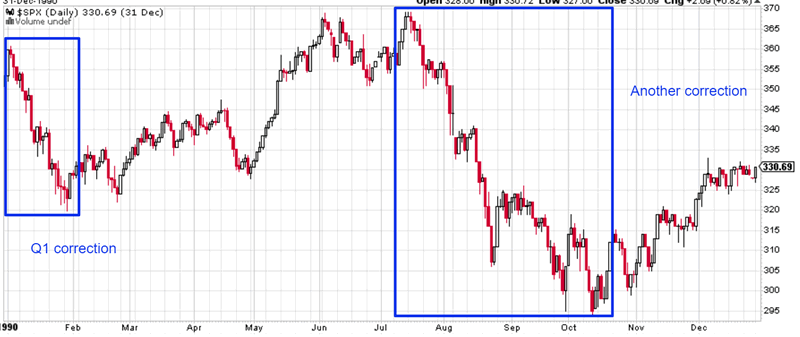

January 1990: 11.3% “small correction”

The S&P made a 20.3% “significant correction” in the same calendar year: July – October 1990.

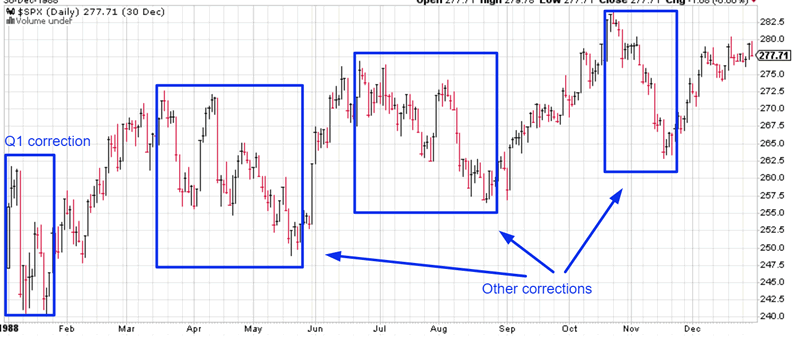

January 1988: 8.2% “small correction”

The S&P made 3 more “small corrections” in the same calendar year:

- March – May 1988: 8.7% “small correction”

- June – August 1988: 7.3% “small correction”

- October – November 1988: 7.4% “small correction”

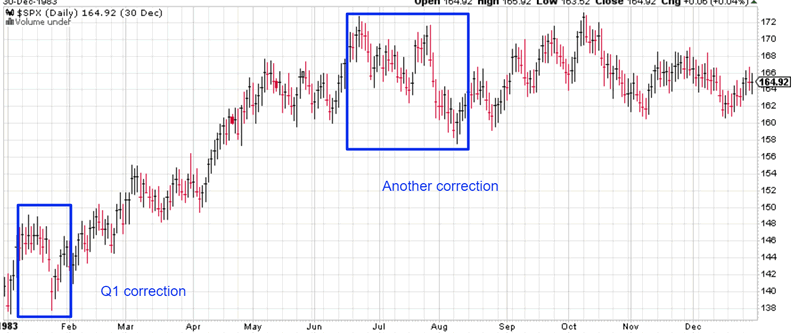

January 1983: 6.2% “small correction”

The S&P made another 7.6% “small correction” in the same calendar year: June – August 1983.

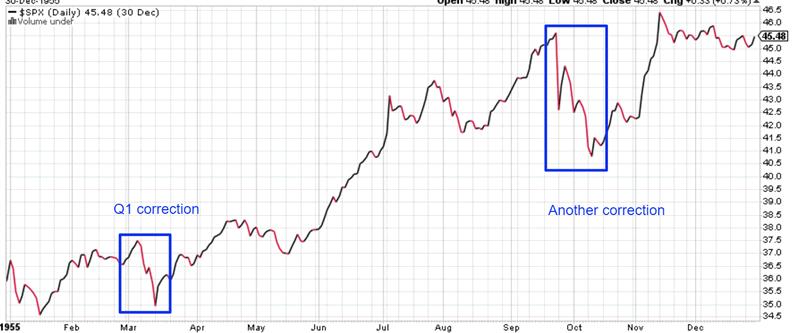

March 1955: 6.8% “small correction”

The S&P made another 10.5% “small correction” in the same calendar year: September – October 1955.

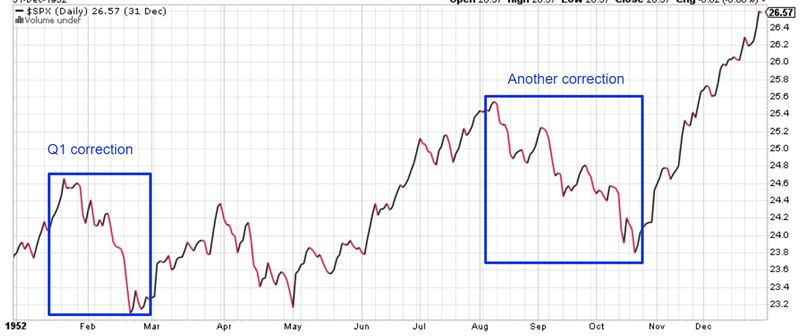

January – February 1952: 6.3% “small correction”

The S&P made another 6.8% “small correction” in the same calendar year: August – October 1952.

Conclusion

- 7 of these 10 cases saw another 6%+ “small correction” sometime later in the same calendar year.

- 2 of these 10 cases saw another “significant correction” sometime later in the same calendar year.

- 1 of these 10 cases (2000) saw a bear market begin in the same calendar year.

This is the year to be patient. It’s ok if you miss the stock market’s rally. There will be another correction for you to buy stocks. Stocks will not rally nonstop the way they did in 2017.

*The Medium-Long Term Model predicts that a bear market will not begin in 2018.

Read Stocks on March 13, 2018: outlook

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.