Stock Market Study Shows Why You Shouldn’t “Sell in May and Go Away”

Stock-Markets / Stock Markets 2018 Apr 24, 2018 - 03:48 PM GMTBy: Troy_Bombardia

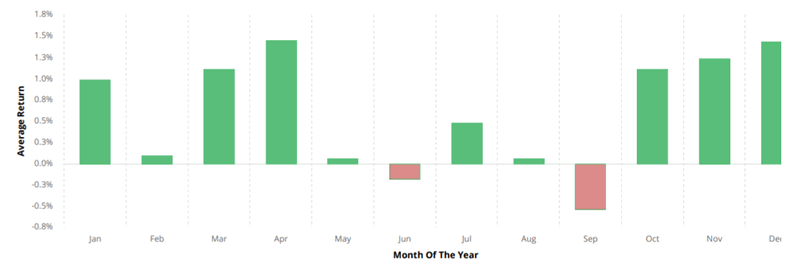

You’ve probably heard of the saying “sell in May and go away”. This piece of conventional trading “wisdom” states that the stock market is seasonally weak from May to September while it’s seasonally stronger from October to April. Hence you should not own stocks from May to September. From a seasonality perspective, that is only partially true.

You’ve probably heard of the saying “sell in May and go away”. This piece of conventional trading “wisdom” states that the stock market is seasonally weak from May to September while it’s seasonally stronger from October to April. Hence you should not own stocks from May to September. From a seasonality perspective, that is only partially true.

*The traditional version of “sell in May and go away” means that you should sell from May to October, not May to September. But since October is a seasonally bullish month, we adjusted this to only include May to September. The stock market goes up on average from May-October.

But as you can clearly see from the above chart, the stock market is not particularly bearish from May – September. It’s merely less bullish (i.e. the odds of the market going down vs. up are equivalent). That’s why “sell in May and go away” is not a good trading strategy.

And keep in mind that the above seasonality chart only looks at the S&P 500. It doesn’t include the S&P 500’s dividends (which the Total Return Index does). So while the S&P may be flat from May – September, a stock market investor would have still earned positive returns via the dividends that companies issue.

The point is, sell in May and go away is not consistently bearish for the stock market. It’s irrelevant – the equivalent of a 50-50 coin flip.

Here’s the stock market’s performance during the past 10 years from each calendar year’s May-September. You can see that May-September is not consistently bearish for stocks. Some very strong rallies happened during this supposedly “bearish” seasonality.

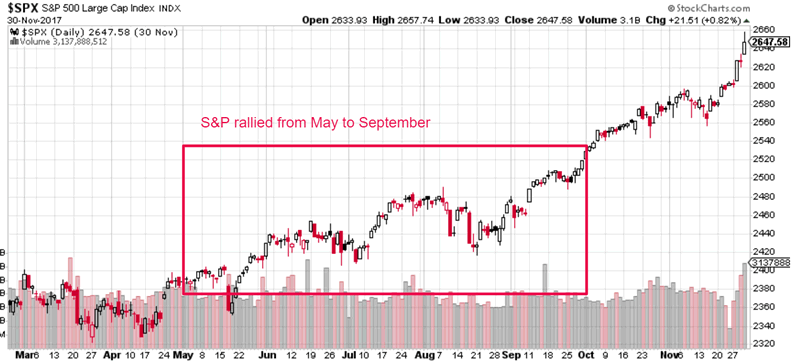

2017

The S&P rallied 5.6% from May – September 2017.

Chart courtesy StockCharts.com

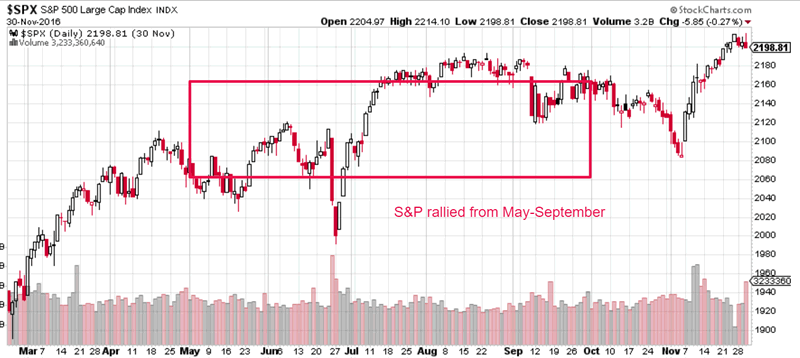

2016

The S&P rallied 4.4% from May-September 2016

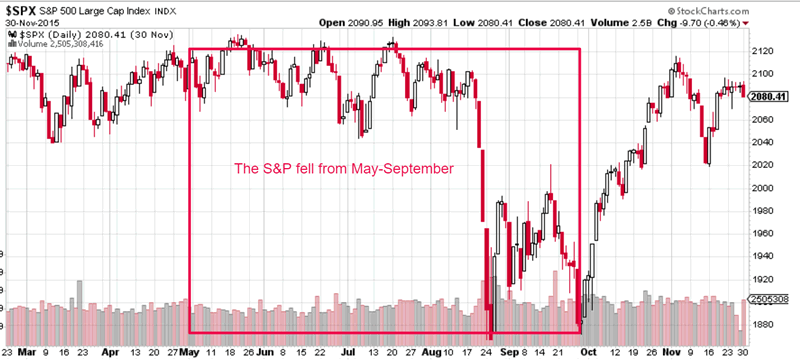

2015

The S&P fell -7.9% from May-September 2015

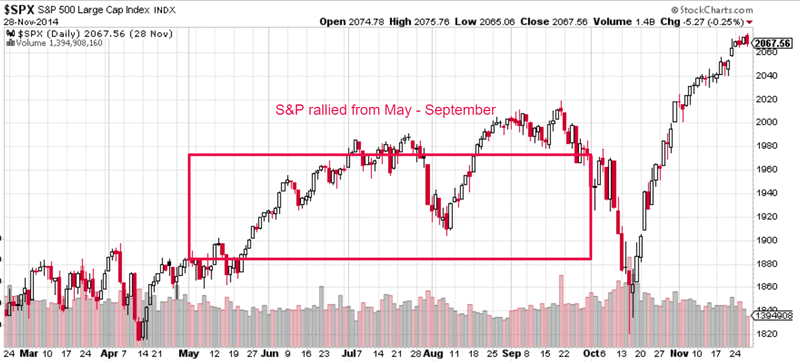

2014

The S&P rallied 4.7% from May-September 2014

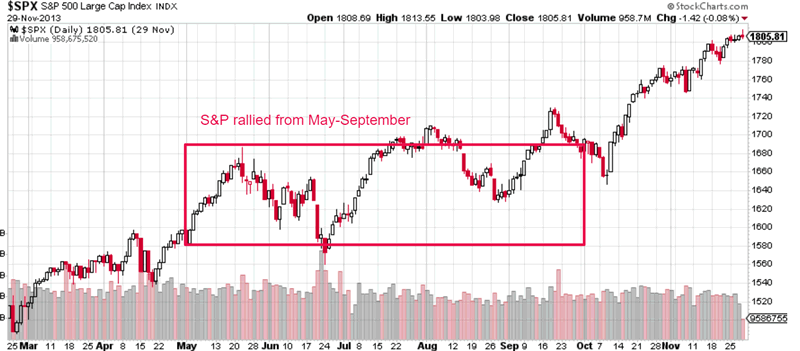

2013

The S&P rallied 5.2% from May-September 2013

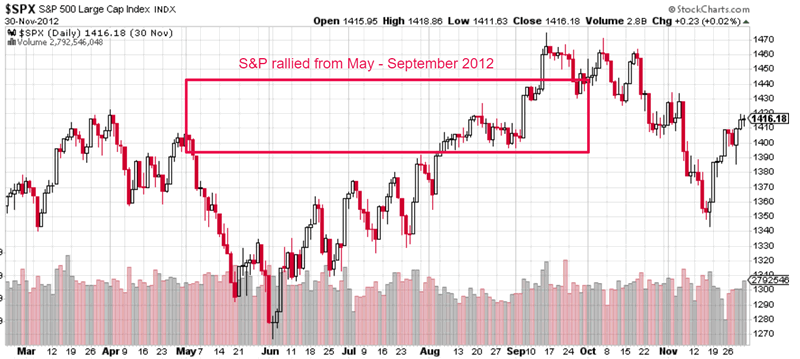

2012

The S&P rallied 2.4% from May – September 2012

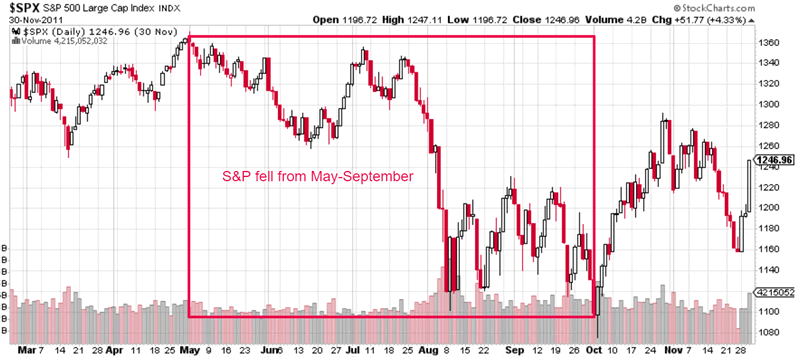

2011

The S&P fell -16.8% from May-September 2011

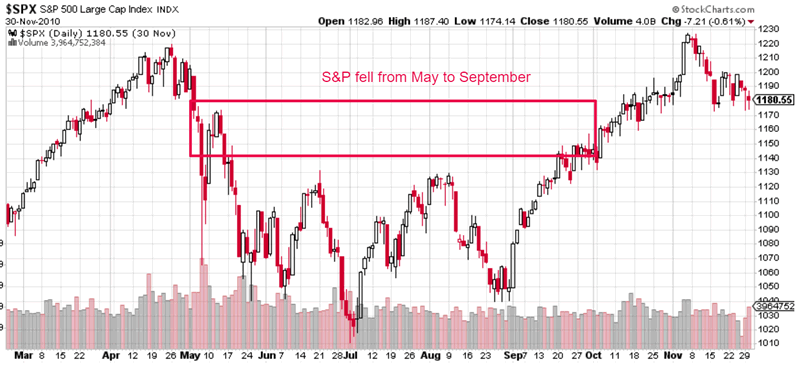

2010

The S&P fell -3.3% from May-September 2010

2009

The S&P rallied 20.5% from May – September.

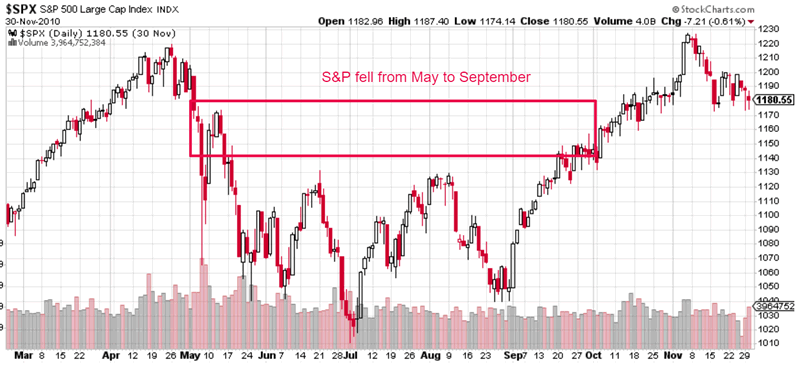

2008

The S&P fell -17.3% from May-September 2008.

Conclusion

As you can see, May-September is not consistently bearish for the stock market. The stock market has gone up 6 times and gone down 4 times from May-September. The average % change is -0.25%, which is hardly any different from 0%. When you factor in the dividends, investors actually made money from May-September.

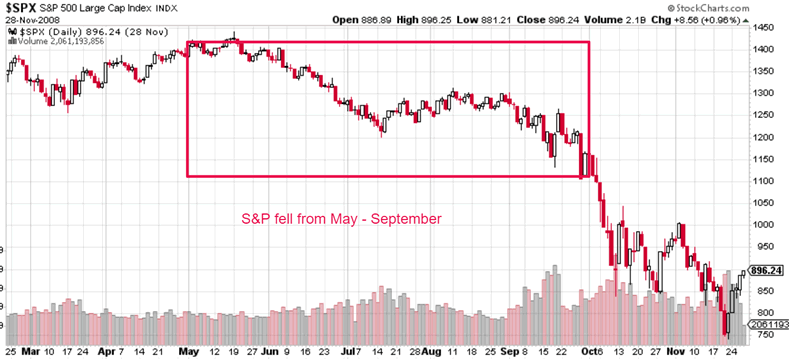

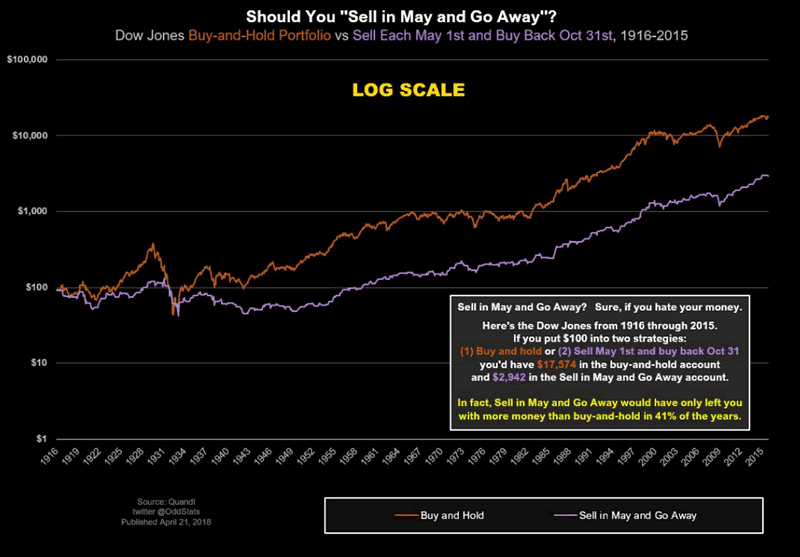

This holds true if you use the Dow Jones Industrial Average over the past 100 years. If you use the traditional version of “sell in May and go away” (i.e. sell from May-October), you would actually be WORSE OFF than someone who just buys and holds forever. The Dow goes down 41% of the time from May-October (i.e. it goes up 59% of the time).

Moreover, there are clearly periods when buy and hold beats Sell in May. Look at the chart from 1931 – 1943. Buy and hold was up (made higher lows), while “Sell in May” kept on making new lows.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Troy_Bombardia Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.