A Big Stock Market Shock is About to Start

Stock-Markets / Stock Markets 2018 May 01, 2018 - 10:35 AM GMTBy: Submissions

Martin C writes: In the latest week, the busiest for first-quarter reports, several companies warned about or cited higher costs. Shares of all three companies declined even though their quarterly earnings were mostly strong. Investors will be alert for more signs of rising costs next week, which brings results from several big consumer names like Kellogg and market-cap leader Apple. Also on tap will be a Federal Reserve meeting, the April jobs report and data on wages and inflation. In the face of it, the earnings for the first quarter of this year that companies have been announcing are superb and far ahead of the most optimistic expectations. The S&P 500 companies in the US are on course for an almost unfathomably good year-on-year increase of 24.6 per cent, according to Thomson Reuters. A month ago, brokers were braced for an increase of 18.5 per cent. The first quarter was the first reporting period since U.S. President Donald Trump in March imposed a duty on imports of steel and aluminum. Prices for those and other commodities have risen sharply, with U.S. crude oil up 7.5 percent in the first quarter.

Martin C writes: In the latest week, the busiest for first-quarter reports, several companies warned about or cited higher costs. Shares of all three companies declined even though their quarterly earnings were mostly strong. Investors will be alert for more signs of rising costs next week, which brings results from several big consumer names like Kellogg and market-cap leader Apple. Also on tap will be a Federal Reserve meeting, the April jobs report and data on wages and inflation. In the face of it, the earnings for the first quarter of this year that companies have been announcing are superb and far ahead of the most optimistic expectations. The S&P 500 companies in the US are on course for an almost unfathomably good year-on-year increase of 24.6 per cent, according to Thomson Reuters. A month ago, brokers were braced for an increase of 18.5 per cent. The first quarter was the first reporting period since U.S. President Donald Trump in March imposed a duty on imports of steel and aluminum. Prices for those and other commodities have risen sharply, with U.S. crude oil up 7.5 percent in the first quarter.

However the earnings are in complete contrarion to actual economy as we see below. The US debt has stayed at high levels while the latest GDP numbers is weak in its details. Lets prepare our selves for a buzy trading week.

US Debt: High!

The Debt to GDP ratio has stayed high at 105.4%. This is one of the most historically high debt that US has carried for such a long period of time. It severely restricts the US ability to dig out of a hole if the economy craters again. It is a vey delicate situation.

US GDP: Weak in details

The GDP came in at an annualized 2.3 percent on quarter in the first quarter of 2018, below 2.9 percent in the previous period but beating market expectations of 2 percent. Personal consumption expenditure (PCE) contributed 0.73 percentage points to growth (2.75 percentage points in the previous period) and rose 1.1 percent (4 percent in the previous period). Services (2.1 percent compared to 2.3 percent in the previous period) and nondurables (0.1 percent compared to 4.8 percent) slowed and spending on durable goods shrank 3.3 percent, following a 13.7 percent rise in the previous quarter. Fixed investment added 0.76 percentage points to growth (1.31 percentage points in the previous period) and increased 4.6 percent (8.2 percent in the previous period). Investment slowed for equipment (4.7 percent compared to 11.6 percent) and stalled for residential (12.8 percent in the previous period). On the other hand, it rose faster for structures (12.3 percent compared to 6.3 percent) and intellectual property products (3.6 percent compared to 0.8 percent). Private inventories added 0.43 percentage points to growth after subtracting 0.53 percent in the previous period. Meanwhile, both exports (4.8 percent compared to 7 percent) and imports (2.6 percent compared to 14.1 percent) eased. As a result, the impact from trade was 0.2 percent, better than -1.16 percent in the previous period. Government spending and investment added 0.2 percentage points to growth (0.51 percentage points in the previous period). It increased 1.2 percent, compared to 3 percent.

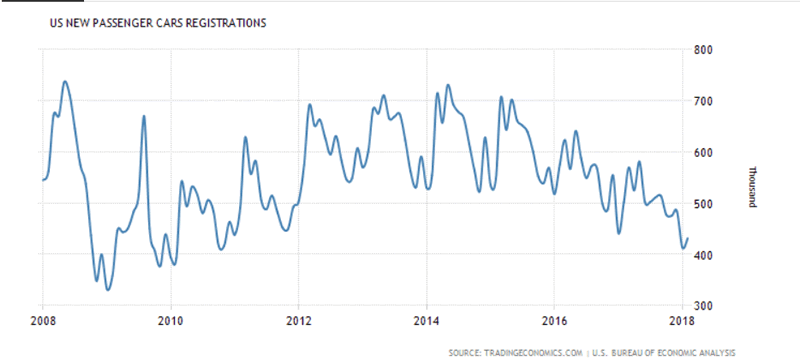

Passenger car registration: 10 year lows

Passenger car registrations is often a keenly watched indicator because it gives the pulse of the economy. The trend shows the clear weakness in consumption across the US. While the last reading was a sligCar Registrations in the United States increased to 431.32 Thousand in February from 413.33 Thousand in January of 2018. Car Registrations in the United States averaged 698.18 Thousand from 1975 until 2018,

reaching an all time high of 1149 Thousand in September of 1986 and a record low of 331.50 Thousand in January of 2009.

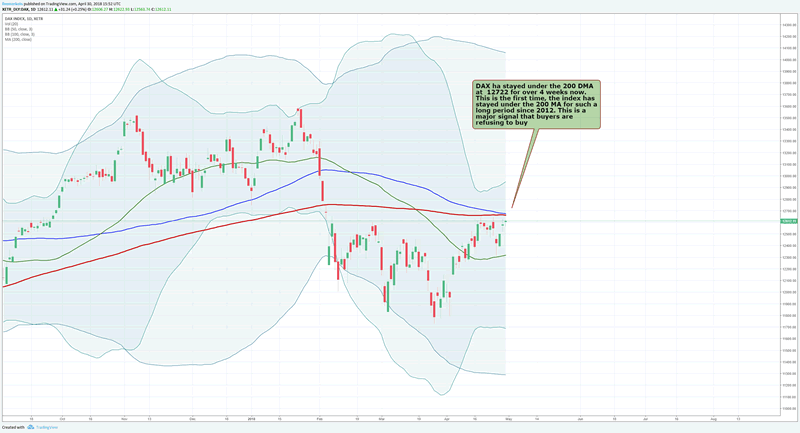

DAX: A major warning

The DAX is under the 200 DMA for over 4 weeks. No recovery attempted. This clearly is suggesting market is not done with the correction. There is more coming. We see a potential drop of 5% at the minimum and possibly well over 10% as well.

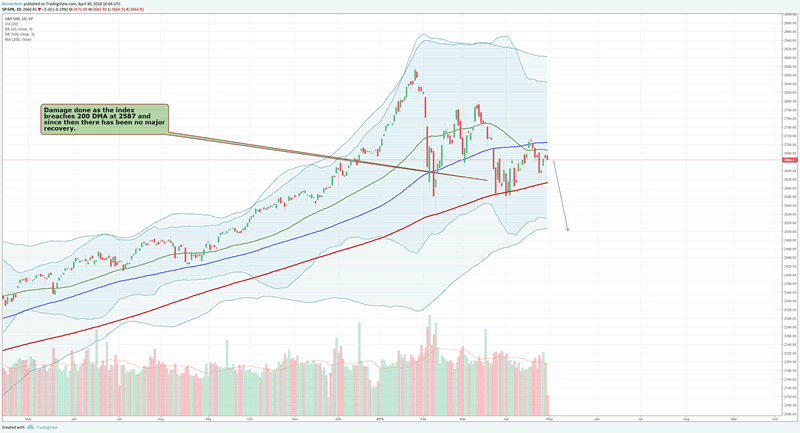

The US large cap index has breached the 200 DMA at 2587 and the recovery has been limited under the 50 DMA. The index has again fallen under 2670 levels. We see fast paced correction.

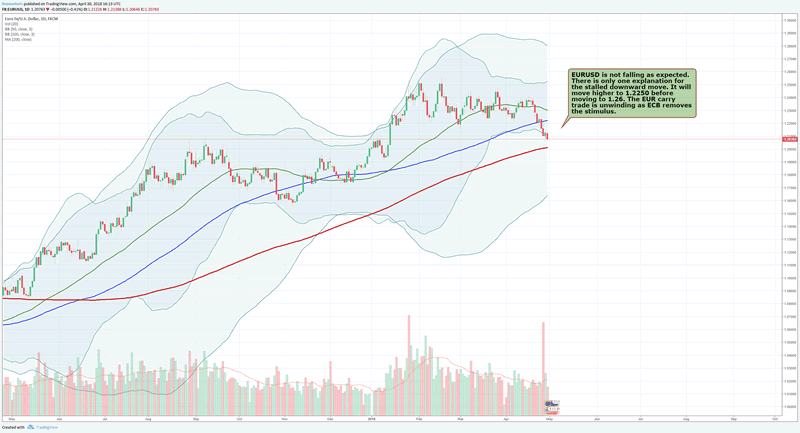

EURUSD: Stalled downward move?

EURUSD is not falling as expected. There is only one explanation for the stalled downward move. It will move higher to 1.2250 before moving to 1.26. The EUR carry trade is unwinding as ECB removes the stimulus.

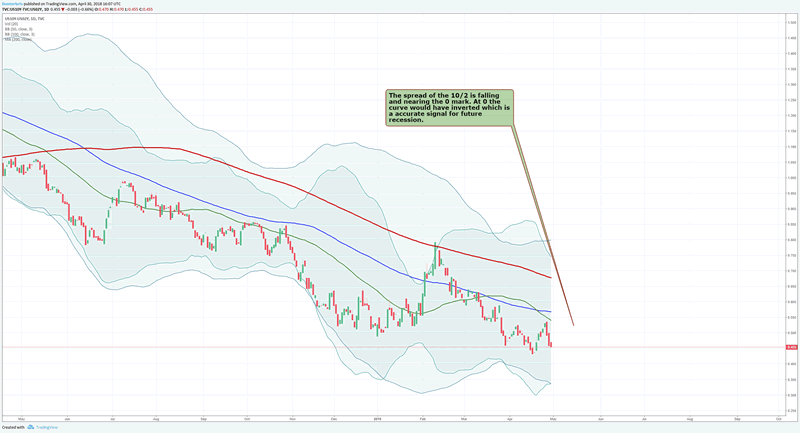

Spread: Recession ahead?

The spread of the 10/2 is falling and nearing the 0 mark. At 0 the curve would have inverted which is a accurate signal for future recession.

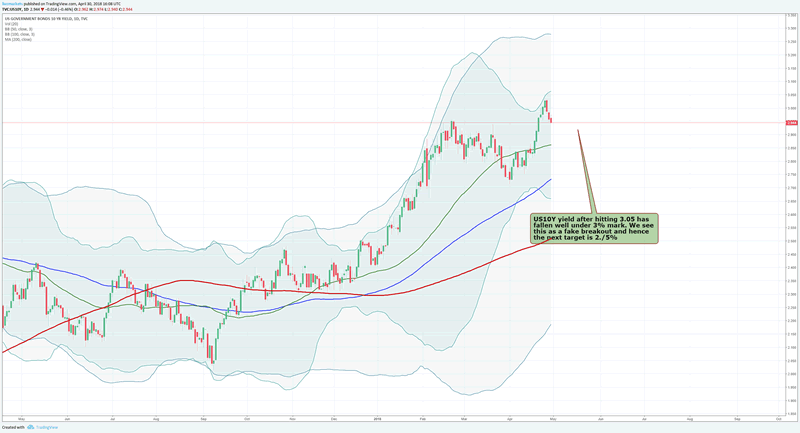

US 10Y yield: Fake breakout

US10Y yield after hitting 3.05 has fallen well under 3% mark. We see this as a fake breakout and hence the next target is 2./5%

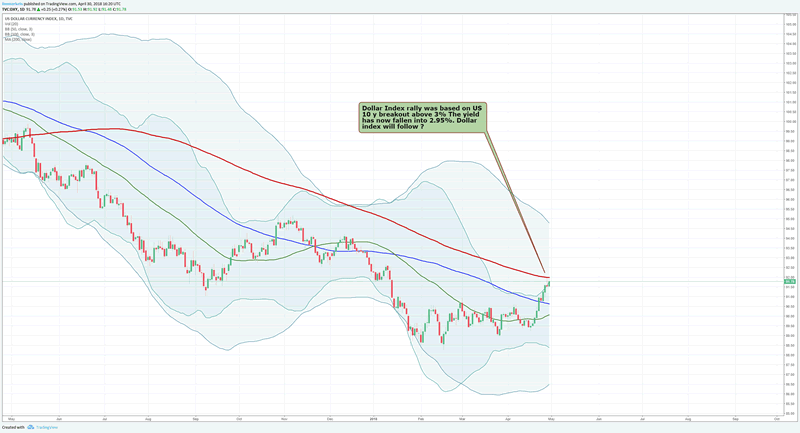

Dollar Index: Following the 10 year yield?

Dollar Index rally was based on US 10 y breakout above 3% The yield has now fallen into 2.95%. Dollar index will follow ?

Summary: The economy in the US has suddenly plateued off. This is exactly what has happened in the EU. However the US has very little wiggle room as the debt stands at 105% of GDP. They cannot allow 10 y to go higher nor can they do more stimulus. Things are getting tightr for US. If the market senses the danger ahead as economy cratters and the fiscal situation worsens, it is the end of the bull run as we know it.

By Martin C

About Livemarkets.live

Livemarkets.live runs a highly successful trading and investment management program along with high quality premium research. Our automated trading system has run since 2009. Every single month has made positive returns. Clients with MT4 terminal can take advantage of this system. Please contacts us at investment@livemarkets.live

© 2018 Martin C- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.