The Missing Link for Gold

Commodities / Gold and Silver 2018 May 15, 2018 - 03:16 PM GMTBy: Jordan_Roy_Byrne

Last week we discussed the fundamentals of Gold, which do not appear bullish at the moment. Real rates (and yields) are rising and investment demand for Gold is flat. That in itself is a temporary but big missing link. However, we are referring to the missing link in the context of intermarket analysis. Gold is an asset that performs best when its outperforming its competitors. That’s true of any asset but especially Gold because it traditionally has been a counter-investment or an anti-investment. While Gold is firmly outperforming Bonds and showing strength against global currencies, it remains neutral to weak against global equities.

Last week we discussed the fundamentals of Gold, which do not appear bullish at the moment. Real rates (and yields) are rising and investment demand for Gold is flat. That in itself is a temporary but big missing link. However, we are referring to the missing link in the context of intermarket analysis. Gold is an asset that performs best when its outperforming its competitors. That’s true of any asset but especially Gold because it traditionally has been a counter-investment or an anti-investment. While Gold is firmly outperforming Bonds and showing strength against global currencies, it remains neutral to weak against global equities.

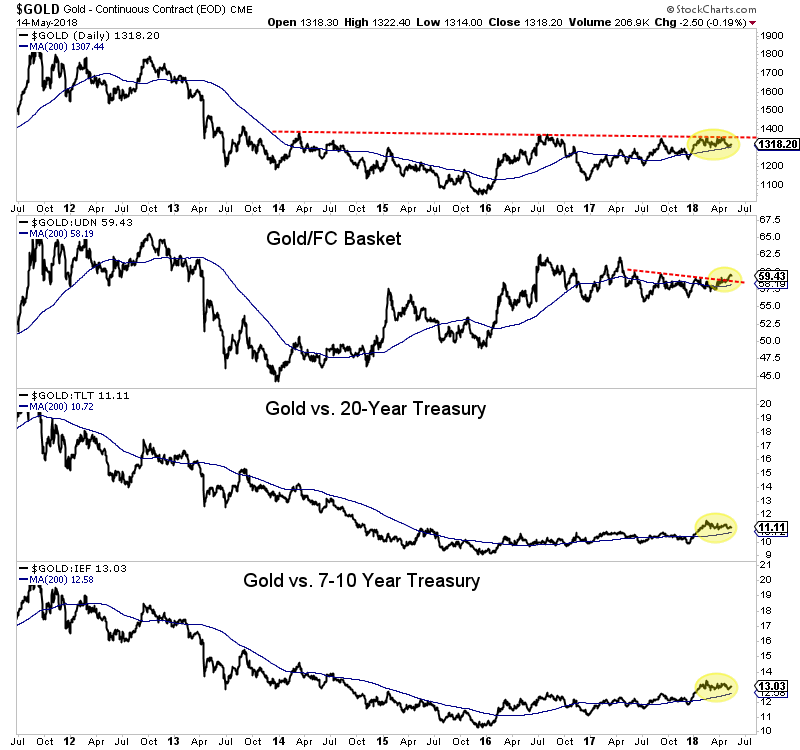

First, let’s take a look at Gold relative to foreign currencies (FC) and Bonds. At its 2016 peak, Gold/FC had already retraced the majority of its bear market. Last week Gold/FC managed to close at an 8-month high even as the US$ index rebounded. Gold has performed even better against Bonds and that includes dividends. A few months ago Gold relative to the major Bond ETFs (TLT and IEF) made a 3-year high. Those ratios remain above rising 200-day moving averages.

Gold vs. foreign currencies, TLT, IEF

It’s important for Gold to outperform foreign currencies because if Gold is only rising because of a weak US Dollar that represents a bear market in the dollar rather than a bull market in Gold.

Gold’s outperformance against Bonds is significant because Bonds represent an enormous capital market and Bonds are in some ways the antithesis of Gold.

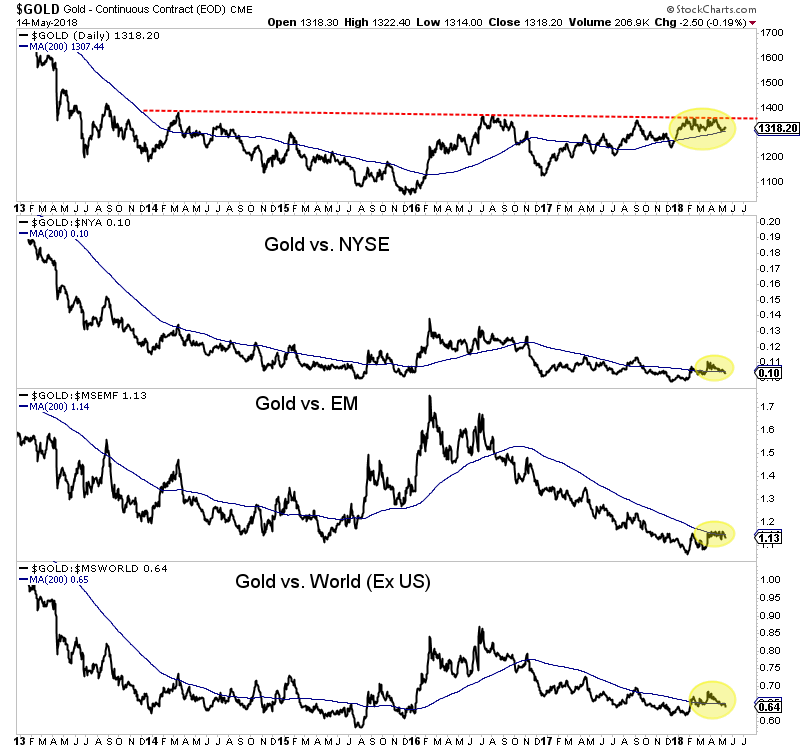

Unfortunately, Gold has not been able to breakout in nominal terms and from an intermarket perspective, that is because of the strength in the stock market. The ratios below show that Gold relative to global equities is trading not too far above the 2015 lows. If these ratios retested their 2015 lows they’d be trading around 10-year lows!

Gold vs. global equities

Gold appears to have lost the 200-day moving average relative to global equity markets but if it can maintain its outperformance against Bonds and foreign currencies then it will be setup for a powerful move when it can break to the upside relative to equities. The negative is that change does not appear imminent but the positive is when it happens Gold should begin a major leg higher. In the meantime, we continue to focus on and accumulate the juniors that have 300% to 500% return potential over the next 12 to 18 months.

To follow our guidance and learn our favorite juniors, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.