Stock Market Topping - Everything Looks Rosy at the End of a Trend!

Stock-Markets / Financial Markets 2018 May 25, 2018 - 12:27 PM GMTBy: Enda_Glynn

Hello everyone, hope your well.

Hello everyone, hope your well.

A couple of interesting stories dropped today.

And the big picture to keep in mind when viewing these stories is this;

At the end of an economic trend, GOOD NEWS IS EVERYWHERE, AND THE FUTURE ALWAYS LOOKS BRIGHT!

Heres the first one: Trump signs the biggest rollback of bank rules since the financial crisis

The future is bright everyone, we dont need no bank regulation!

Now, these regulations were NOT a cure to all the ill's of the financial industry,

But the deregulation of the banking industry speaks to the confidence that people have in a bright future free from trouble and strife.

A few thoughts on the U.S housing industry.

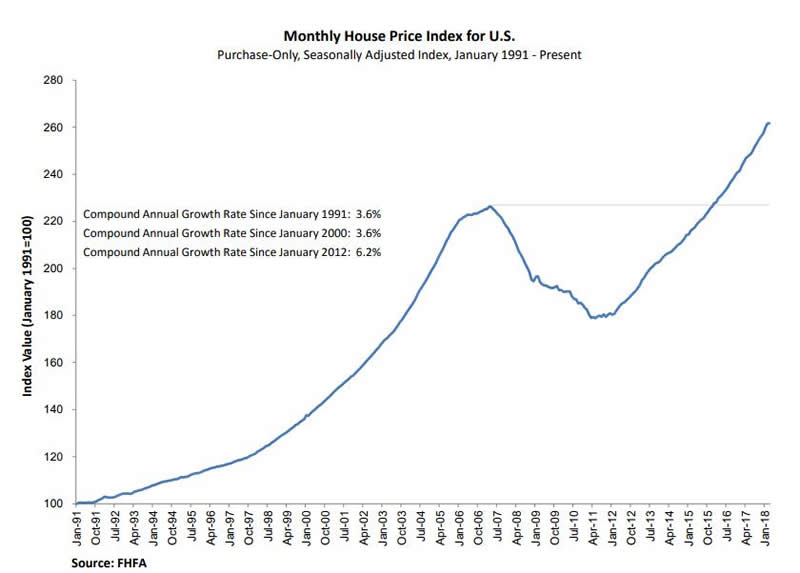

The U.S house price index is sitting at all time highs now 18% higher than the peak in 2007.

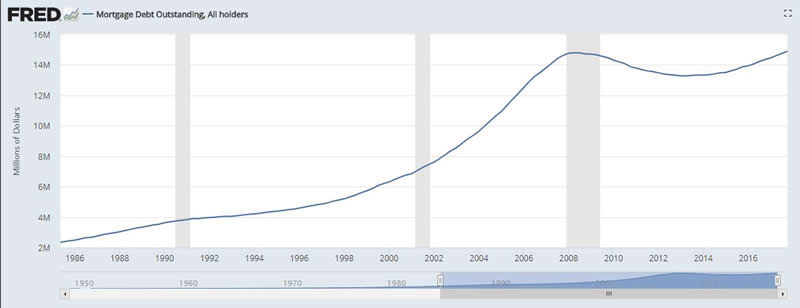

With mortgage debt now topping the the 2008 high.

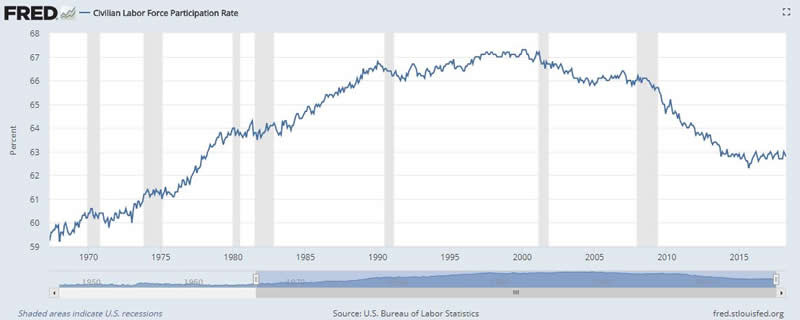

And the labor force participation rate back at levels not seen since 1978?

How does a banking system have a bright future when:

House prices are higher than ever,

Mortgage debt is higher than ever,

And less people are working as a % of the population.

Time to short banking stocks again??

UPCOMING RISK EVENTS:

USD: Core Durable Goods Orders m/m, Fed Chair Powell Speaks, Revised UoM Consumer Sentiment.

EUR: German Ifo Business Climate,

GBP: Second Estimate GDP q/q, BOE Gov Carney Speaks,

JPY: N/A.

My Bias: long term bearish

Wave Structure: Topped in wave [B] black.

Long term wave count: lower in wave [C] black.

EURUSD turned higher today in a corrective looking move,

Wave 'ii' higher was expected,

The short term target at 1.1750 was met, although wave 'ii' may not be complete just yet.

If the price returns lower again and breaks the wave 'i' low at 1.1675,

that will signal that wave 'iii' pink is underway.

Wa ev 'iii' of (iii) should carry the price into the minimum target at 1.1597.

This is where wave (iii) reaches equality with wave (i) brown.

Tomorrow;

1.1829 must hold,

Watch for a decline in wave 'iii' pink to begin.

My Bias: short below parity in wave (5).

Wave Structure: completed wave (4) blue correction higher.

Long term wave count: decline in wave (5) blue, below parity

There are two equally likely scenarios developing in Cable right now.

This could get confusing!

Wave 'iii' may be complete at 1.3304,

and wave 'iv' is now underway in a contracting triangle.

The final high of wave 'iv' must complete below the wave 'i' low in order not to breaks the elliott wave rules.

Or;

the alternate count shown circled in red.

Wave 'iii' is extending in a larger five wave pattern to the downside.

And waves 1 and 2 grey are complete with wave '3' grey expected.

Both wave counts expect further losses before the larger pattern is complete.

The larger wave [i] could break 1.30, if the price reaches the lower trendline.

Tomorrow;

lets see if we get a triangle form in wave 'iv', or a larger extending wave 'iii'.

Either way,

Wave 'iv' must complete below 1.3389.

My Bias: LONG

Wave Structure: rally in wave [C]

Long term wave count: wave [C] is underway, upside to above 136.00

USDJPY dumped again today as expected.

the price has now created five waves down in wave (a) of an abc correction.

Wave (b) of [ii] should begin soon, with a three wave rally into about 110.30.

this is the price region of the previous wave 'iv' brown.

Tomorrow;

Watch for 108.95 to hold and wave (b) green to begin.

My Bias: market topping process completing

Wave Structure: Impulsive 5 wave structure, topping in an all time high, now beginning new bear market.

Long term wave count: topped in wave (5)

The DOW is stuck within a short term correction in wave 'ii' pink.

the price broke to a new low this morning,

But has rebounded again this evening in a possible wave 'c' of 'ii'.

If the price breaks the wave 'a' high at 24889,

then wave 'ii' pink will qualify as an expanded flat.

Wave 'iii' down should begin either tomorrow or Monday.

Teh initial target for wave 'iii' pink lies at 24150,

where wave 'ii' reaches 161.8% of wave 'i' pink.

Tomorrow;

Again, 25086 must remain untouched.

Watch for wave 'ii' pink to complete above 24889 in a possible expanded flat.

WANT TO KNOW the next big move in the Dollar, GOLD and the DOW???

Check out our membership plan over at Bullwaves.org,

You can see into the Elliott wave future every night!

Enda Glynn

http://bullwaves.org

I am an Elliott wave trader,

I have studied and traded using Elliott wave analysis as the backbone of my approach to markets for the last 10 years.

I take a top down approach to market analysis

starting at the daily time frame all the way down to the 30 minute time frame.

© 2018 Copyright Enda Glynn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.