Why Silver Could Replace The US Dollar

Commodities / Gold and Silver 2018 Aug 20, 2018 - 05:55 PM GMTBy: Hubert_Moolman

Silver used to be a significant part of the monetary base in many countries. You could find it as part of monetary reserves together with gold, as well as coinage in circulation.

Silver used to be a significant part of the monetary base in many countries. You could find it as part of monetary reserves together with gold, as well as coinage in circulation.

Over the years that silver was demonetized (at least from the 1870s to roughly the 1960s), significant amounts of silver coins (official currency coins) were melted down and sold on the markets, together with silver bars (used as reserves). This brought us to today, where the amount of silver that is part of the monetary base is basically immaterial.

This had the effect of enormous downward pressure on silver prices, even unto this day. This will only be reversed when silver is again part of monetary stock or held as a key investment by the masses.

Silver basically has to be used the way the US dollar was/is used (in the US and on an international basis), and other national currencies in their respective countries.

Now, people (especially central banks) are not going to willingly restore silver to being a monetary asset, and neither are the masses going to just go out and buy silver for the fun of it.

Instead, what is likely to happen is a collapse of the current debt-based monetary order will bring people back to using silver as money (out of need), as well as, stack silver like they stack stocks, bonds and other major investment classes, in order to protect against the fallout from the crisis.

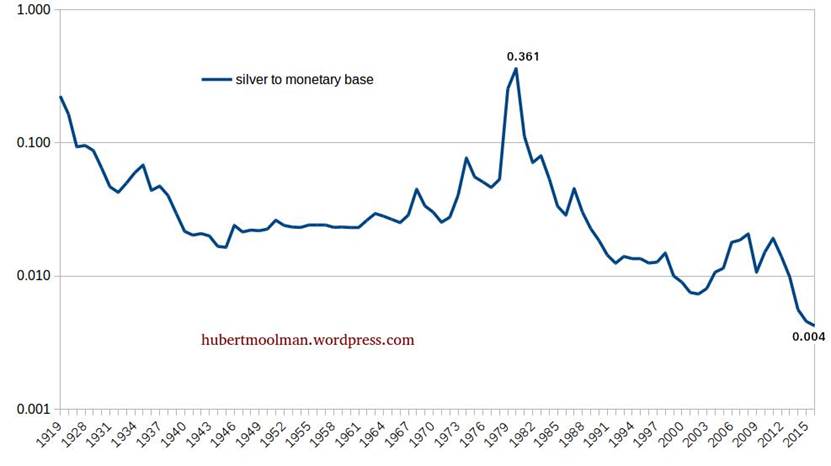

Below, is a chart that shows how the silver price has fallen against the monetary base (in billions of dollars) of the US:

The silver price is at an all time low when measured against the US monetary base. In 1980, the all-time high was 0.361, whereas the ratio is currently at around 0.004. The US monetary base is currently around 3 651 billion dollars (or 3.651 trillion). Therefore, if silver was today at its 1980 value, relative to the monetary base, it would be around $1 318 (3651*0.361).

As high as this value is, it is not the US dollar value silver will be when it reverts to being a significant part of the monetary base, since the 1980 high did not represent silver reverting to being used as money.

In fact the silver’s US dollar value will be far in excess of this, since the US dollar will virtually lose it’s main reason for being.

2nd Phase of the Silver Bull Market

The silver correction since 2011 appears to be forming a similar pattern to the one from 1980 to 2001. I have marked the two patterns (1 to 7) to show how they could be similar. The move from 1 to 5 is typical of a major correction (from top to bottom).

If the comparison is correct, then we appear to be at a bottom for silver (a secondary bottom, since point 5 was the lowest). Higher silver prices over the next few weeks could confirm that silver prices has really turned (from the long correction), and are ready to make great advances during the 2nd phase of the silver bull market.

For more on this and this kind of fractal analysis, you are welcome to subscribe to my premium service. I have also recently completed a Silver Fractal Analysis Report as well as a Gold Fractal Analysis Report. You can also subscribe to this blog (enter email at the top right of this page) to get my regular free gold and silver updates.

Warm regards,

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2018 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.