UK House Prices Momentum Forecast 2019

Housing-Market / UK Housing Dec 18, 2018 - 04:20 PM GMTBy: Nadeem_Walayat

This analysis of UK house prices continues from Part 1 (UK House Prices 2019 No Deal BrExit 30% Crash Warning!) and was first made available to Patrons who support my work. So to get immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for as little as just $3 per month. https://www.patreon.com/Nadeem_Walayat.

UK House Prices Forecast Current State

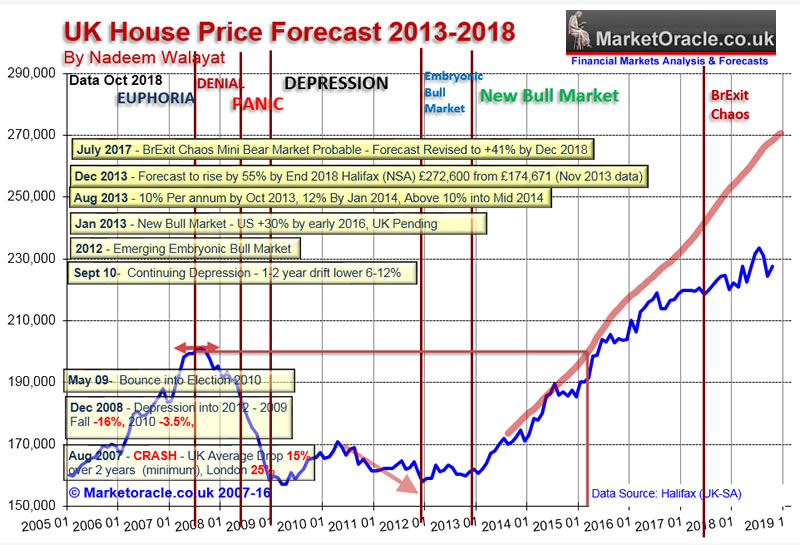

The most recent UK average house prices data for October 2018 (£227,702) is currently showing a 15% deviation against my original forecast trend trajectory which implies to expect a 14% reduction in terms of the long-term trend forecast for a +55% rise in average UK house prices by the end of 2018 i.e. a +41% rise. This is inline with my revised forecast expectations as of July 2017 (UK House Prices Momentum Crash Threatens Mini Bear Market 2017).

UK House Prices Momentum Forecast 2019

UK house price momentum steadily fell from Mid 2016 after having chugging along nicely at 10% per annum for a good 3 years, then falling to a low of +0.5%. Following which the pattern has been one of surges towards 5% resolving in house prices revisiting near 0%, followed by the next surge higher which appears to be the current trajectory.

This pattern is highly revealing for it suggests the government and the Bank of England's hidden hand at work towards preventing UK house prices from going NEGATIVE on an annualised basis. As negative house prices, i.e. a bear market would trigger a further loss of confidence and likely be accompanied with an economic recession.

Therefore despite the chaos of BrExit, it is CLEAR that the Government and the Bank of England are determined to do their damndest towards preventing the UK economy from tipping over into a BrExit recession, towards which keeping UK house prices positive on an annualised basis is one of their primary mechanisms towards avoiding a BrExit recession.

UK House Prices 2019

Current UK house prices momentum coupled with the government and central banks hidden hand suggests to expect average UK house price inflation of about 3% for at least the first half of 2019 and likely for the whole of the year. Where the current trajectory is for UK house prices to peak at about 4% to coincide with BrExit day 29th March 2019 before dipping back towards zero over the subsequent months. Compare this to the likes of Bank of England Governor Mark Carney warning just a few weeks ago that UK house prices could fall by as much as 35% in a No deal BrExit! Regardless of what happens in terms of a deal or No deal BrExit a 35% drop is NOT going to happen! Most probable for 2019 is an average gain of about 3%, which I will fine tune further over the next few weeks.

Of course with so much BrExit chaos in the air then economic volatility will be high for much of 2019, with ever widening swings as the government effectively prints money to inflate UK house prices as being one of the primary mechanisms towards fighting off a recession which implies any dips below ZERO will be followed by even more intense counter measures to inflate asset prices.

The bottom line is that a 5 year house prices forecast is pushing the envelope too far in terms terms of forecasting reliability, as previously my UK house price forecasts tended to range for between 2 and 3 years. Hence why some 18 months ago I effectively revised my forecast expectations down to a +41% rise by December 2018.

So the key lesson learned for my forthcoming UK house prices multi-trend forecast that I aim to complete before the end of December 2018 is that 2 years forward as the optimum forecast period whilst 3 years should be seen as the absolute maximum.

Therefore expect at least 5 more pieces of housing market related analysis over the coming weeks covering population growth, house building, inflation, interest rates, affordability, London and regional prices in the countdown to my next multi-year trend forecast with momentum suggesting to expect a weak bull market during 2019, barely keeping pace with even CPI inflation (2.2%) let alone RPI (3.3%).

To get immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for as little as just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Your analyst,

Nadeem Walayat

Copyright © 2005-2018 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.