US Memorial Day Weekend Market Analysis

Stock-Markets / Financial Markets 2019 May 27, 2019 - 06:47 PM GMTBy: Chris_Vermeulen

The US Memorial Day weekend is set up to become a very interesting time for investors. The EU voting is complete and the change in EU leadership may move the markets a bit. China appears to be playing a waiting game – attempting to hold the US/Trump at bay until after the 2020 US elections. This week is certain to be very interesting for traders/investors.

The US Memorial Day weekend is set up to become a very interesting time for investors. The EU voting is complete and the change in EU leadership may move the markets a bit. China appears to be playing a waiting game – attempting to hold the US/Trump at bay until after the 2020 US elections. This week is certain to be very interesting for traders/investors.

The European stocks moved higher in trading on Monday as the relief from the EU election event and support for auto shares pushed the markets higher. The transition in the EU over the next few months will solidify into a political and social agenda. The EU leadership must acknowledge these future objectives of all parties in order to maintain some level of calm. It is evident that many EU nations are relatively satisfied with the current leadership while others are transitioning into more centrist leadership. The next 4+ years will be full of further transition in the EU.

China is another global issue that is relatively unsettled. We’ve been doing some research with regards to China and the potential future political and economic pathways that may become evident in the near-term future. Our biggest concern is that China has been inflating their economic levels for decades and the true scope of the Chinese economy may be much weaker than everyone expects. If our suspicions are correct and China has been inflating economic levels for many years, then the transition to a consumer/services-driven economy may be dramatically over-inflated and the US/China trade issues could be biting much harder than the Chinese want to admit.

The “Sell in May and go away” market saying may become absolute truth in 2019. Our expectations are still suggesting that an attempt at new market highs may take place before August 2019, but the current market rotation (lower) is setting up a very strong potential for further downside price action at the moment. Our proprietary Fibonacci price modeling system is suggesting the $7294 level in the NQ is key support. Below this level, the NQ could break much lower and potentially target $6850 or lower.

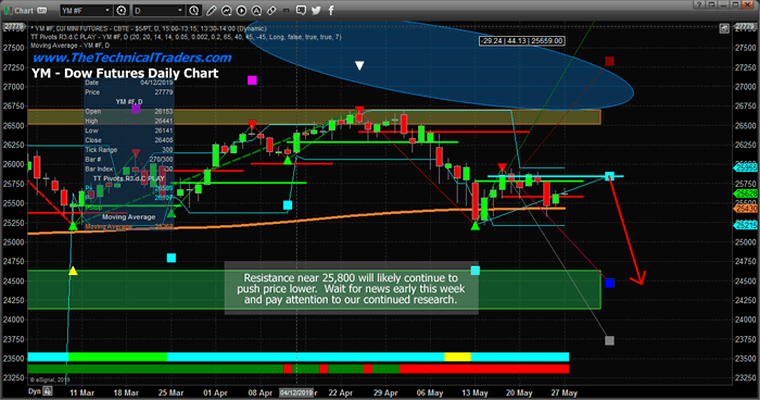

The YM is setting up a similar price pattern with resistance near 25,840. We believe this resistance will push prices lower as we move further into early June. The potential for some type of surprise economic data or Fed/Global market move after this weekend is somewhat higher than expected. There is a lot of shifting taking place throughout the globe and we believe this turbulence will reflect in the US market soon enough.

As of right now, our expectations are that a brief upside price rally will take place over the next 4~7+ days before a continued downside price trend may become evident. Pay attention to the news cycles for key elements that could drive the US stock market lower. We will continue to update you with regards to our proprietary research and expectations. The next 7+ days will likely be nothing but sideways price rotation within a Pennant/Flag formation.

Read our research to understand how this setup coincides with the GOLD price setup and why it is important to understand why July 2019 is so important. Please take a minute to review these recent research posts that focus more on the US Dollar and Gold, and also the July turning point for US Stocks.

4 DAYS LEFT TO GET YOUR FREE SILVER ROUNDS WITH SUBSCRIPTION!

We continue to see money flow into the safe-haven assets like the Utility sector, bonds, and most importantly precious metals. I anticipated this and our XLU utilities ETF taken with members for 4.4% already, and our VIX ETF trade we closed for a 25% last week.

For May I am going to give away and ship out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. You can upgrade to this longer-term subscription or if you are new, join one of these two plans listed below, and you will receive:

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.