Crude Oil Prices and the 2019 Hurricane Season

Commodities / Crude Oil Jul 10, 2019 - 04:50 PM GMTBy: EWI

In May, the National Oceanic and Atmospheric Administration predicted a near-normal 2019 hurricane season, which runs from June 1 to November 30.

In May, the National Oceanic and Atmospheric Administration predicted a near-normal 2019 hurricane season, which runs from June 1 to November 30.

But, the season got off to an early start with the short-lived sub-tropical storm Andrea on May 20.

On May 31, a financial website mentioned this early start as part of a larger warning to commodity traders (Marketwatch):

Storms in the Atlantic Ocean weren't a major worry for the commodities markets in 2018, but this year's hurricane season, which has seen an early start, may rattle traders'; nerves.

Of course, the presumption is that commodity prices, including oil, react to the impact of hurricanes.

However, you might be surprised to learn that this is simply not the case.

Consider Hurricane Katrina, a historic category 5 hurricane which hit the Gulf states in 2005.

Here's a description from the internet 11 years after Katrina made landfall:

Katrina shut down 95% of crude production and 88% of natural gas output in the Gulf of Mexico … thus having a major effect on oil prices.

The conventional wisdom says that such a disruption in "supply" would cause oil prices to skyrocket.

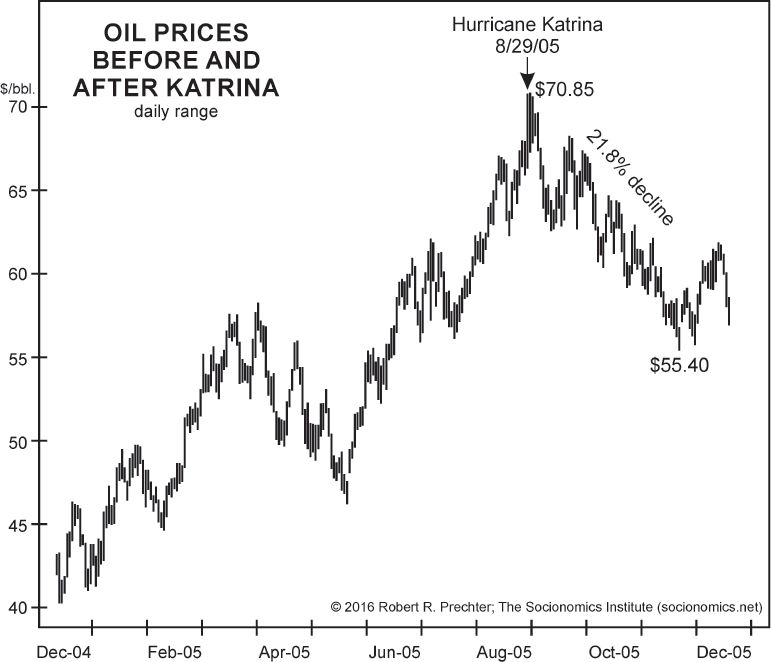

But, this chart and commentary from Robert Prechter's 2017 book, The Socionomic Theory of Finance, reveals what really happened:

The chart shows the day this event occurred: August 29, 2005, right at a top and just before a three-month oil-price slide of over 20%. A record-breaking, surprise disruption in the supply of oil failed to make oil prices zoom. On the chart, it even looks as if somehow the event made prices fall. According to Econ 101 the market's reaction makes no sense. … The historians who described Katrina's "major effect on fuel prices" must have figured that a disaster of such magnitude simply had to have a long term impact on oil prices, so they just said it. Their devotion to exogenous-cause logic obscured their perception of actual history.

Hurricanes are not the only reason for disruptions in the supply of oil. Sometimes disruptions are man-made.

For example, on July 2, a financial website mentioned the "extended OPEC-led production cuts." Again, the conventional wisdom says that prices should jump on this news. Yet, crude was down almost 5% on July 2!

The takeaway is that crude oil is not subject to the economic law of supply and demand, but instead is internally regulated and governed by the Wave Principle.

Elliott Wave International's July Global Market Perspective, which regularly covers the oil market, noted:

You [don't] need to know the news in advance to anticipate the move [in oil's price] -- just the insight that Elliott wave analysis offers.

The bottom line: It's a myth that supply and demand regulate oil prices.

There are several more market myths, which you can read about in the free report, Market Myths Exposed.

This article was syndicated by Elliott Wave International and was originally published under the headline Oil Prices and the 2019 Hurricane Season. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.