Larger Bullish Move in USD/JPY May Just Be Getting Started

Currencies / Japanese Yen Nov 05, 2019 - 10:03 AM GMTBy: MarketsToday

Summary

Summary

- Once current retracement is complete the USD/JPY has a good chance of exceeding last week’s high.

- Pair still in early stages of following through on bullish breakout of a large head and shoulders bottom.

- Upside target zone around $110.51 to $110.70.

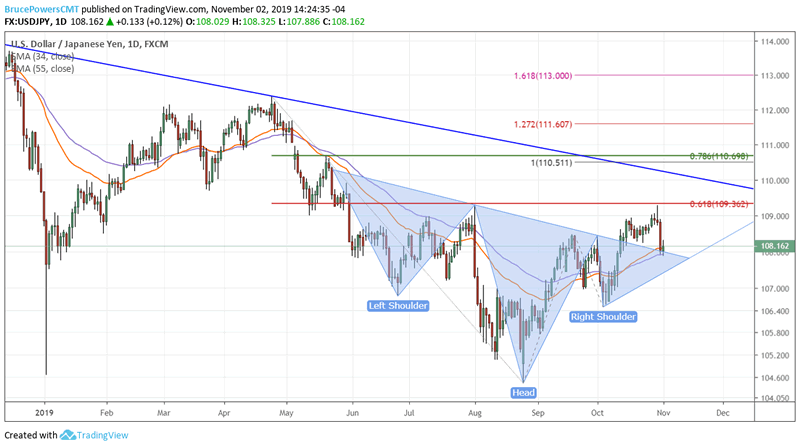

Following an upside breakout of a large head and shoulders bottom pattern several weeks ago, the USD/JPY pulled back to test support of the neckline last week. So far, the area of the neckline has held as support around $107.88. Whether it continues to do so remains to be seen.

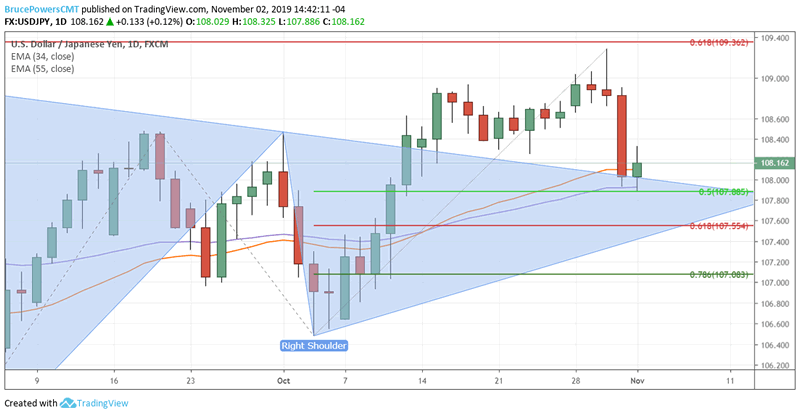

That price area is given greater significance by the fact that it is an exact match with the 50% retracement of the most recent advance off the right shoulder low at $106.48 and the 55-day exponential moving average (ema) (blue line).

This is typical price behavior following a breakout, where price will retrace at least part of its breakout thrust. Initially, the neckline represented resistance, and now potential support. If last week’s low is exceeded to the downside then next watch for signs of support around the 61.8% Fibonacci retracement around $107.55, followed by the 78.6% retracement at $107.08. At the same time, a decisive daily close below the right shoulder indicates a failure of the current head and shoulders bottom pattern structure.

Last week resistance was seen at $109.29, right around the 61.8% Fibonacci retracement of the most recent leg down off the April 2019 swing high of $112.40. Once the current retracement is complete and the bulls return to dominate, the USD/JPY has a good chance of exceeding the recent high and eventually rallying up to the next potential resistance zone from approximately $110.51 to $110.70. That zone consists of the 100% projection of the second leg up off the August bottom (bottom of head) and 78.6% Fibonacci retracement of the prior downtrend, respectively.

Bruce Powers, CMT

Chief Technical Analyst

http://www.marketstoday.net/

© 2019 Copyright Bruce Powers- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.