Before Stock Market Sell-Off, This Indicator Posted Its "Largest 1-Day Jump" in 10 Years

Stock-Markets / Stock Markets 2020 Mar 10, 2020 - 05:11 PM GMTBy: EWI

A revealing perspective on the stock market… and the "unexpected"

Most investors are surprised when a big trend turn occurs in the stock market.

A big reason why is because most market participants tend to linearly extrapolate the current trend into the future. Indeed, instead of getting cautious as a trend persists, they tend to do the opposite and ramp up their expectations. This applies during both down- and uptrends.

Let's first look at an example when the stock market had been in a major downtrend. As you'll recall, the market's last major bottom occurred in March 2009. The then bear market had been going on for 17 months.

Just days before the bottom, these headlines published:

- Dividends Falling -- No Bottom in Sight (Seeking Alpha, Feb. 24, 2009)

- The Dow's Bearing -- 6,000 and Under (CNBC, March 2, 2009)

As you can tell, these headlines reflected expectations that the bear market would persist. Instead, March 2009 marked the "lift off" of the longest bull market in history.

Yes, big trend turns usually happen just when stock market expectations reach extremes.

Now, let's look at expanding bullish expectations, and not just among retail investors.

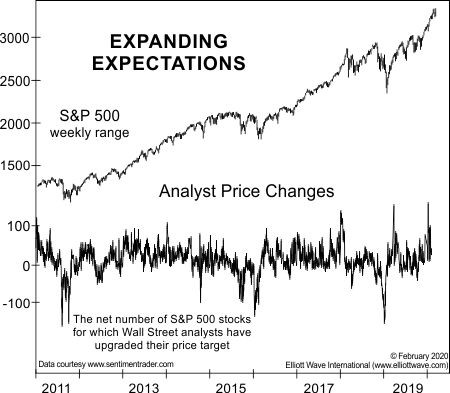

Our February 2020 Elliott Wave Financial Forecast showed this chart and said:

The chart shows a bullish surge within [a] class of investment professionals, research analysts. According to SentimenTrader, analysts upgraded price objectives on a net 169 stocks on January 7, which is the largest one-day jump in the ten-year history of the indicator. So, analysts are chasing the rally, too.

Of course, as we know, those "expanding expectations" were thoroughly dashed.

So, what are mainstream analysts saying now?

Well, here's a March 3 headline from a major financial publication (Investor's Business Daily):

You Just Got A Second Chance At 10 Top Stocks, Analysts Say

In other words, buy the dip.

These analysts may turn out to be right. Then again, we urge you to review what our Elliott wave experts expect next for stocks. See, instead of chasing market "fundamentals" -- which are almost always one step behind, bullish near tops and bearish near bottoms -- Elliott waves let you track the waves of investor psychology, the true driver of stock market trends.

You can get valuable insights into Elliott waves by reading the Wall Street classic book, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter.

You can now access the digital version of this Wall Street classic 100% free. Get access now.

This article was syndicated by Elliott Wave International and was originally published under the headline Before Sell-Off, This Indicator Posted Its "Largest 1-Day Jump" in 10 Years. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.