CoronaVirus Stock Market Trend Implications

Stock-Markets / Stock Markets 2020 Mar 25, 2020 - 02:44 PM GMTBy: Nadeem_Walayat

Is the Stock Market discounting the Coronavirus yet?

Well what will be effect on the stock market when we see start to see the numbers of infected virtually doubling every couple of days over the coming week, especially as unlike China the US is not going to hide the numbers of infected.

The markets look at the numbers, they want to see the number of infected stabilising and then DECREASING on a daily basis, and NOT DOUBLING every couple of days!

Therefore this implies we are going to continue to experience a bearish trend trajectory for at least March and likely April, despite Fed panic actions, as it now looks like my estimate of 13,000 US infected by the end of March gave way too much credence to US healthcare and CDC competency, instead both have proven to be seriously lacking i.e. closer in performance to that of Iran than South Korea!

This this analysis was first been made available to Patrons who support my work. Coronavirus Dow Stocks Bear Market - March and April 2020 Trend Forecast

So once more NO the stock market is NOT discounting the Coronavirus yet which means we are likely to see a series of new lows in the stock market as the US is not handling the pandemic in a competent manner which means to expect far higher number of infected and deaths as I have been warning for some weeks.

4th March - Coronavirus Parabolic Pandemic, Bitcoin Price Trend Forecast

So is the stock market discounting what is to come? NO, NOWHERE NEAR! Whilst I will cover the prospects for the stock market in my next analysis as the focus of this analysis is the prospects for the Bitcoin price. However, I do not see any signs for an imminent end to the Coronavirus bear market, instead it looks like it could run on for several months, i.e. it's increasingly looking like it could be May before we see the bottom!

Coronavirus Global Recession 2020

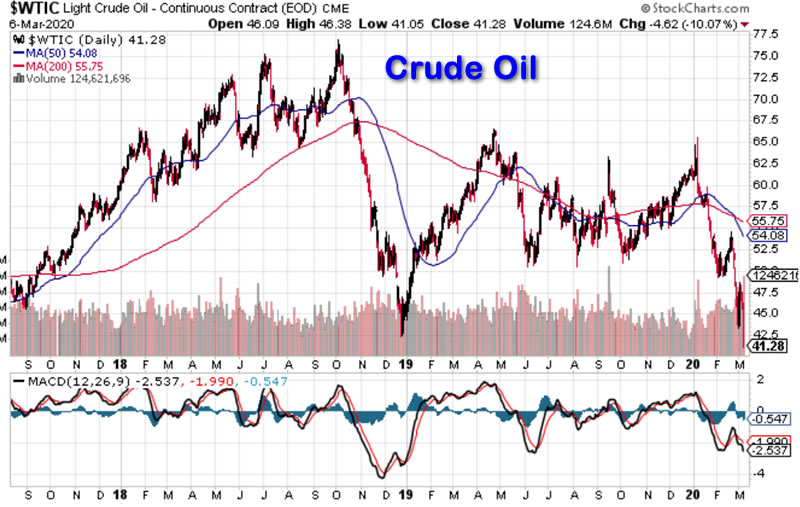

It increasingly looks likely that ALL western nations are heading for an imminent SHARP economic slowdown as consumers change behaviour and supply chains are curtailed. China started the ball rolling for Q1 which will likely continue in Q2 and Q3, with western nations joining China level of economic contraction in Q2. So it's going to be a short sharp economic drop, the signs for which are obvious when we look at what's happened to the crude oil price.

Whilst it is beyond the scope of this article to analyse and forecast the Crude oil price, nevertheless to me it looks like it's going to go a lower than the recent low of $41.

On the plus side we should see a sharp economic rebound maybe starting Q4 as China starts to get production going again towards normal and consumers have adapted to the coronavirus crisis and start to see sunlit uplands that the promise of vaccine in 2021 promises.

So a short sharp economic contraction for 2020 for at least 2 quarters and maybe 3 followed by a sharp V shaped recovery into 2021.

In terms of the stock market trend then whilst the stock market has fallen by about 15% were still only at the very beginnings of this economic contraction with much corporate pain to come over the coming months.

This this analysis was first been made available to Patrons who support my work. Coronavirus Dow Stocks Bear Market - March and April 2020 Trend Forecast

- Stock Market Trend Implications

- Coronavirus Global Recession 2020

- Short-term Trend Analysis

- Long-term Trend Analysis

- ELLIOTT WAVES

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Forecast Conclusion

- Investing in AI to Kill the Coronavirus

- AI Stocks Q1 Buying Levels Current State.

- KIlling the Coronavirus!

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.