The Coronavirus Greatest Economic Depression in History?

Economics / Coronavirus Depression Apr 30, 2020 - 07:33 PM GMTBy: Nadeem_Walayat

It looks like the history books will need to be rewritten for if the noises emanating out of every nick and economic cranny are to be believed for the global economy is heading for an economic contraction WORSE than that of the Great Depression! Which will make the Financial Crisis of 2008 look like a walk in the park. And this is not from the usual perma doom merchants who like a broken clock will eventually be right.

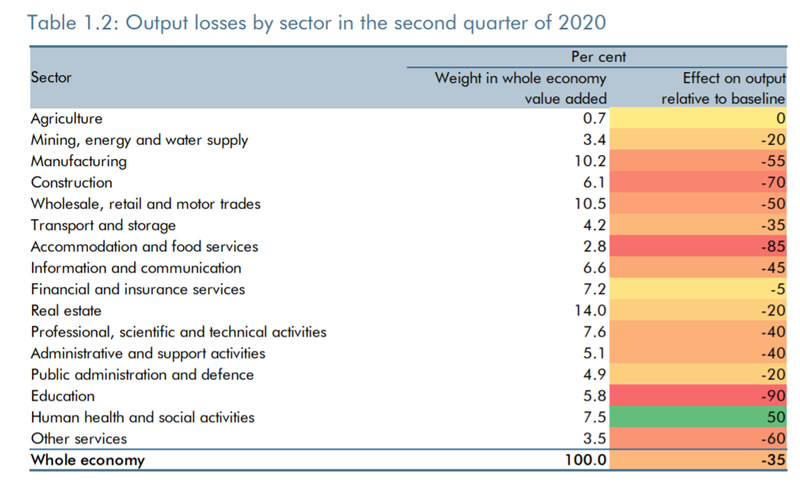

However, even the UK governments Office for State Economic Propaganda (OBR) has warned to expect UK GDP to plunge by an unprecedented 35% in Q2!

Even information technology is set to tumble by 45%! So I guess those profiting from the great shift online will be the US tech giants rather than local tech firms.

Note the whole of this extensive analysis was first been made available to Patrons who support my work: Is the Stock Market Correct to Ignore The Great Coronavirus Economic Depression?

- Rabbits in the Headlights

- Paving the Way for War with China

- The Coronavirus Greatest Economic Depression in History?

- Crude Oil Prices Go NEGATIVE!

- UK Coronavirus Catastrophe Current State

- US Coronavirus Catastrophe Current State

- Stock Market Implications and Forecast

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

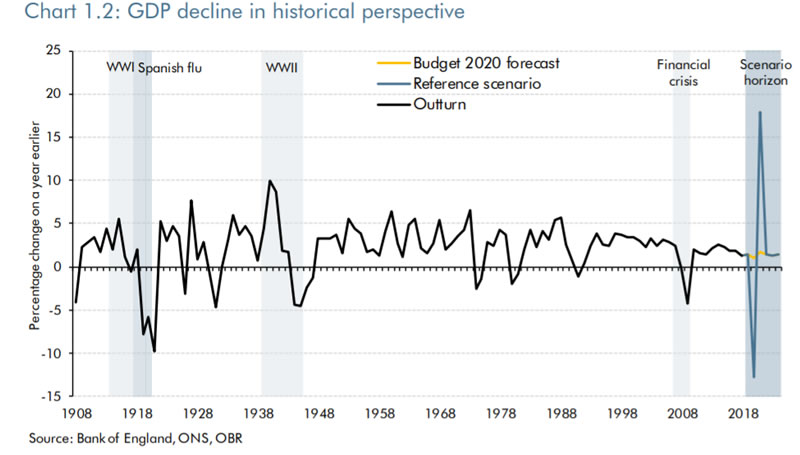

Whilst the expected contraction for the whole of 2020 is set to be at least 13% and possibly as high as 25% depending on when the lockdown ends. Worse than the Financial Crisis, worse than WW2, worse than the Great Depression, worse than WW1 and the Spanish Flu! Albeit with the caveat of a sharp rebound that exceeds the contraction, after all the OBR still is the governments agency for state economic propaganda.

Whilst at the same time the OECD is forecasting a fall in UK GDP of as much as 26% this year!

To be frank the numbers flying around seem unreal, so I have ask myself how can a stocks bull market be sustained if we are about to experience the worst economic collapse in recorded UK economic history of the past 300 years? With likely similar projections for the United States and most other industrialised western nations. This is far removed from the 2% or so drop in GDP that I was expecting going into the Mid March as stocks bottomed.

So it's no wonder that many are resolving to a resumption of the stocks bear markets, sending the likes of the Dow down to under 10k!

However, I would be surprised if the UK economy contracts by more than 6% by the end of this year.

So maybe there is some upside to be discounted by the stock market in all the gloom out there?

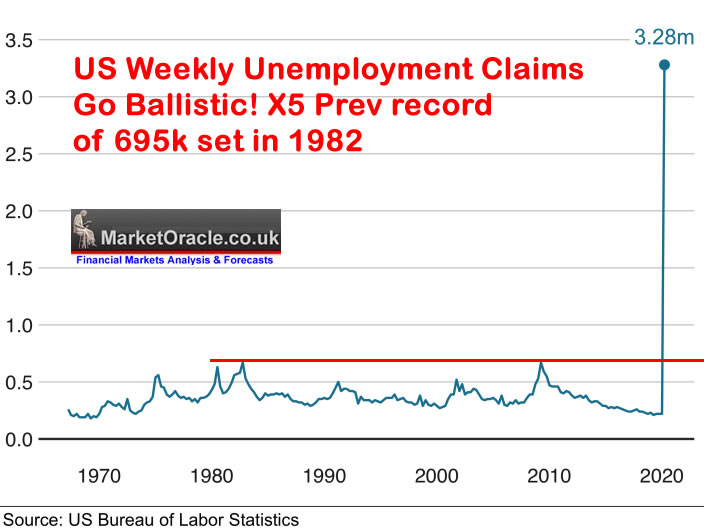

Meanwhile whilst we we were all shocked at the 3 million surge in US unemployment claims 3 weeks ago.

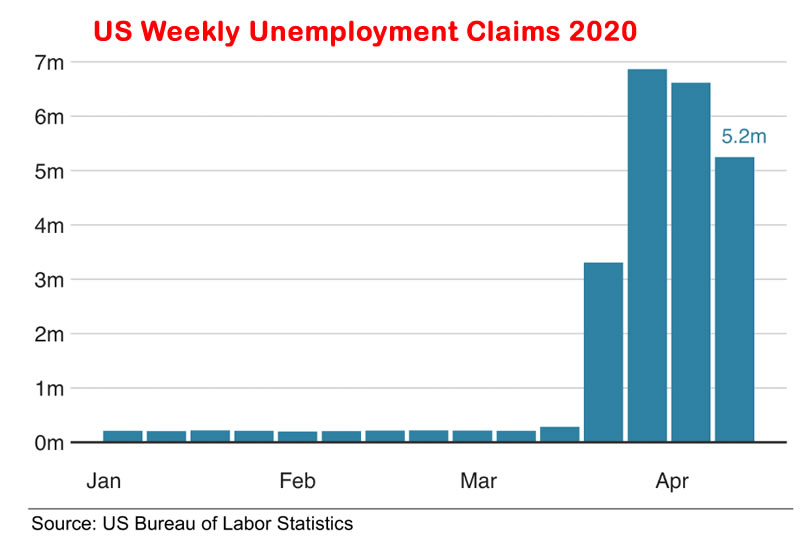

Well this is what the graph now looks like for the week ending 11th April, with likely another 4 million set to lose their jobs in the week ending 18th April.

So it's no wonder that many tens of thousands of americans are starting to protest in the streets demanding that the economy to be reopened given the extent of economic damage being done to the US economy as a consequence of the across the board incompetent response of US government agencies.

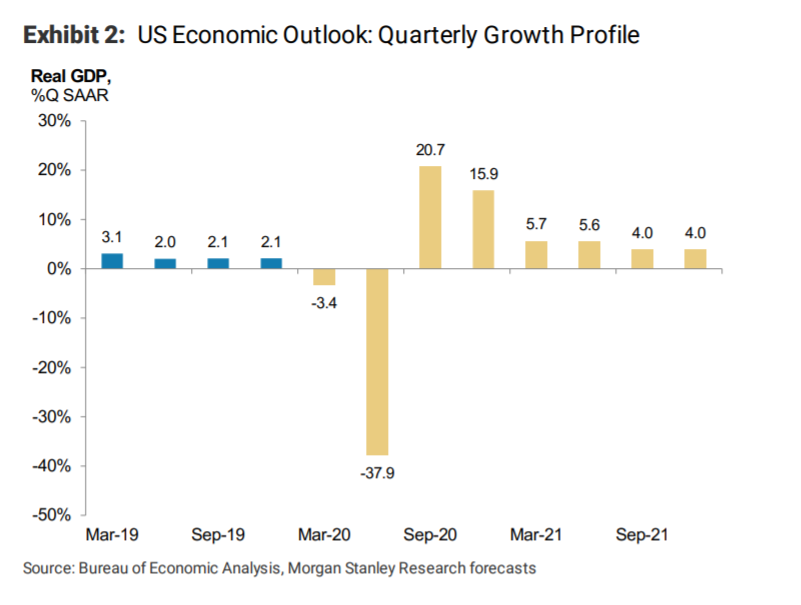

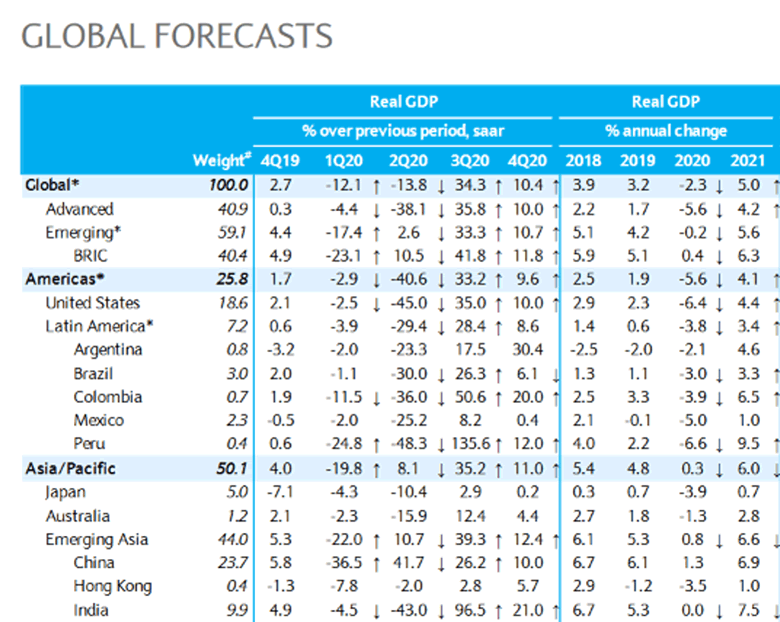

In terms of GDP the doom merchants vary from -6% to -12% for 2020. With most heavy on a Q2 economic collapse of as much as -40%! Though with a sharp rebound of sorts in Q3 and Q4 as this report by Morgan Stanley published 3 weeks ago illustrates.

Whilst here is a more recent report from Barclays Capital.

However, even more so than is the case for the UK, I suspect the US will surprise to the upside. It's as though the academics are not aware that all of the tech giants prospering from the corona lockdown's are housed in the United States! Surely this translates into boom time for silicon valley?

So I am not buying into the extent of the doom and gloom, the UK is not going to contract by 26% and the US by 6-12%, UK maybe 4-5%, US maybe 1.5-2.5%? Hard to say but I doubt we are going to be 1930's level contraction. Therefore my prevailing view remains to view the stock market sell offs as buying opportunities, a view that so far has proven correct.

So maybe the world has become infected with perma doom and gloom and thus economic reality won't pan out to be anywhere near as bad as that which is being forecast today. That or the stock markets are strongly discounting a V shaped recovery as the earlier OBR graph illustrates.

Meanwhile all those who were obsessed over the Fed unwinding it's balance sheet of a few months ago have gone silent, as I have often voiced for the past 10 YEARS that once money printing starts it DOES NOT END, instead expect it accelerate at the time of each subsequent crisis as we are witnessing in this crisis. Just like the AI mega-trend the Inflation mega-trend is EXPONENTIAL!

The rest of this analysis has first been made available to Patrons who support my work: Is the Stock Market Correct to Ignore The Great Coronavirus Economic Depression?

- Rabbits in the Headlights

- Paving the Way for War with China

- The Coronavirus Greatest Economic Depression in History?

- Crude Oil Prices Go NEGATIVE!

- UK Coronavirus Catastrophe Current State

- US Coronavirus Catastrophe Current State

- Stock Market Implications and Forecast

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my latest stock market analysis -

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.