DJIA Stock Market Technical Trend Analysis

Stock-Markets / Stock Markets 2020 May 19, 2020 - 06:05 PM GMTBy: Nadeem_Walayat

Dow Short-term Analysis

The uptrend off the March 23rd low appears to be tiring, running out of steam, as evidenced by the MACD that is showing early signs of starting to roll over after having unwound ALL of it's earlier over sold state. So as I warned last week the Dow does appear to want to go lower rather than higher in the immediate future.

Dow Long-term Trend Analysis

The Chinese Coronavirus catastrophe had sent the Dow trading to a near 4 year low of 18,213 on 23rd March 2020, a huge waterfall drop of 38.5% the magnitude of which no one saw coming because it was driven by sheer PANIC in the wake of moronic Governments mishandling of the pandemic that was several orders of magnitude worse than it should have turned out to be.

The Dow's dropped by a huge 38.5%, though not unprecedented, however the subsequently 33% rally to the recent high of 24,300 that many analysts mistakenly auto-refer to as a 'bear market rally' IS unprecedented. So even if the Dow is some 5000 points away from it's all time high, the market is clearly stating that the corona drop was TEMPORARY as my analysis suggested going INTO the late March low that the corona bear market would likely prove to be TEMPORARY, and probably hit bottom late March.

TREND ANALYSIS - The Dow has now retraced more than 50% of the Corona bear market, with the last high being made on the 17th of April and thus showing signs of running out of steam.

RESISTANCE : There is heavy overhead resistance art 24,700 and then 25,300 with the 61.8% retracement level at 25,250.

SUPPORT : Immediate support is at 23,300 with more significant levels at 21,700 and 20,800. With the percentages ranging from 20,500 to 21,250 and 21,900.

TRENDLINES - Short-term nearby trendline support is at 23,900 that will likely easily break. So weak trendline support.

MACD - MACD has unwound all of its oversold state which means that the Dow is ripe for a down leg.

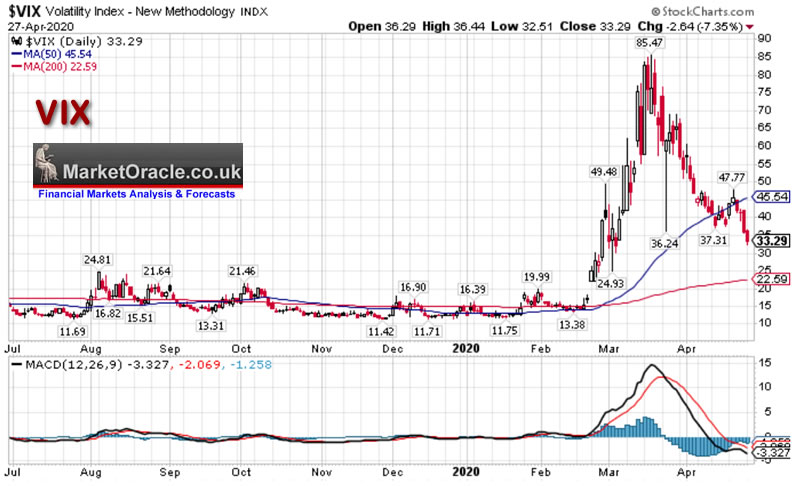

VIX

The 86 high coincided with the Mid March stock market bottom since which time there has been a steady decline in volatility accompanying the steady rise in the stock market.

The VIX's MACD is oversold which at least suggests a corrective rise in volatility to first target 48 and then 60 that should act to contain stock market weakness without revisiting the panic levels of March 2020. However, a move beyond 60 would increasingly imply the Dow looking set to target the 18,200 bear market low, which at this point is a low probability event.

The whole of this extensive analysis was first made available to Patrons who support my work: Dow Stock Market Trend Forecast for May 2020

- Preliminary Stock Market Analysis

- Fed QE4EVER

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- VIX Analysis

- ELLIOTT WAVES

- Dow Stock Market Forecast Conclusion

- AI Stocks Buying Levels Q2

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.