Dow Stock Market Trend Analysis and Forecast

Stock-Markets / Stock Markets 2020 May 20, 2020 - 05:16 PM GMTBy: Nadeem_Walayat

My last analysis focused on the unfolding economic consequences of the corona catastrophe that really should never have happened. Instead due to gross incompetence and negligence of our governments we are rapidly descending down a black hole the depths of which we can only guess at, as economic contraction numbers for Q2 range from -20% to -40% for the UK and the US. For worse than anyone could have imagined even a few weeks ago as the gauge of possibilities were mostly centered around the Financial Crisis of 2008. Where this crisis apparently looks set to be many times worse! ALL courtesy of the headless chickens in charge with their mad scientists advising them.

23rd April 2020 - Is the Stock Market Correct to Ignore The Great Coronavirus Economic Depression?

- Rabbits in the Headlights

- Paving the Way for War with China

- The Coronavirus Greatest Economic Depression in History?

- Crude Oil Prices Go NEGATIVE!

- UK Coronavirus Catastrophe Current State

- US Coronavirus Catastrophe Current State

- Stock Market Implications and Forecast

Thus going into this analysis my preliminary expectations were for the Dow to trend lower towards 20k by Mid May.

The whole of this extensive analysis was first made available to Patrons who support my work: Dow Stock Market Trend Forecast for May 2020

- Preliminary Stock Market Analysis

- Fed QE4EVER

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- VIX Analysis

- ELLIOTT WAVES

- Dow Stock Market Forecast Conclusion

- AI Stocks Buying Levels Q2

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Furthermore my analysis and commentary since early March concluded in expectations for the coronavirus stocks bear market to bottom during late March and so far the stock market has confirmed this expectation, even more so with each passing week that has witnessed a massive near unprecedented rally the likes of which I cannot recall in 35 years trading experience.

Which means to continue to hold true then regardless of how bad the economic news turns out to be or how even more incompetent the governments handing of the Coronavirus pandemic, the Dow should still NOT break it's late March bear market low. Furthermore given the power of the stocks rally to date, then it should not trade down to anywhere near the bear market low of 18,213.

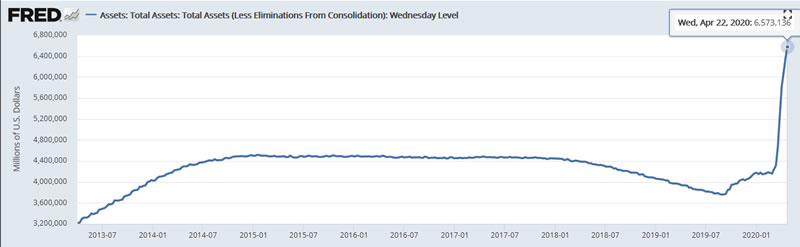

Quantitative INFLATION - Fed QE4EVER

Once money printing starts it never ends! Instead what happens is any unwinding of central bank balance sheets tends to be temporary in advance of the next crisis which tends to send balance sheets through the roof. This has been my consistent message for the past 10 years since Quantitative INFLATION began in 2008! And so the corona crisis has seen the Fed once more flood the markets with liquidity buying up all sorts of assess left right and centre from junk bonds, to stocks of bankrupt corporations to of course government bonds, and when the buying is done the Fed will likely have DOUBLED it's balance sheet from $4.2 trillion a couple of months ago to approaching $9 trillion!

This is why the perma bears are not going to get their Dow Bear collapse dreams come true, despite GDP collapsing by as much as 40% in Q2!

And INFLATION IS THE PRICE PAID! Which means if you are smart you can LEVERAGE yourself to INFLATION by investing in assets such as AI Stocks. Whilst Governments pay people for NOT working will ALSO cause CONSUMER price Inflation even if the official statistics won't measure it, but people WILL experience it in their weekly grocery shops and online purchases. For instance my monitoring of prices on Amazon.co.uk already resolves in a 10% to 20% jump in prices!

Whilst other online retailers show 10% plus price hikes, so if you are looking to buy hardware online then do your research as you can still find retailers that have yet to hike their prices as a consequence of central bank rampant the money printing. With typical super market prices for weekly shops up about 5%! Again which won't be reflected in the official inflation indices as the Bank of England looks set to monetize virtually the whole of the £273 billion projected corona deficit so far, that could easily double to more than £500 billion by the end of 2020.

And I am sure similar price hikes are taking place in the United States given that the US will likely soon double up on it's recent $2 trillion corona bailout.

DJIA Stock Market Technical Trend Analysis

Dow Short-term Analysis

The uptrend off the March 23rd low appears to be tiring, running out of steam, as evidenced by the MACD that is showing early signs of starting to roll over after having unwound ALL of it's earlier over sold state. So as I warned last week the Dow does appear to want to go lower rather than higher in the immediate future.

Dow Long-term Trend Analysis

The Chinese Coronavirus catastrophe had sent the Dow trading to a near 4 year low of 18,213 on 23rd March 2020, a huge waterfall drop of 38.5% the magnitude of which no one saw coming because it was driven by sheer PANIC in the wake of moronic Governments mishandling of the pandemic that was several orders of magnitude worse than it should have turned out to be.

The Dow's dropped by a huge 38.5%, though not unprecedented, however the subsequently 33% rally to the recent high of 24,300 that many analysts mistakenly auto-refer to as a 'bear market rally' IS unprecedented. So even if the Dow is some 5000 points away from it's all time high, the market is clearly stating that the corona drop was TEMPORARY as my analysis suggested going INTO the late March low that the corona bear market would likely prove to be TEMPORARY, and probably hit bottom late March.

TREND ANALYSIS - The Dow has now retraced more than 50% of the Corona bear market, with the last high being made on the 17th of April and thus showing signs of running out of steam.

RESISTANCE : There is heavy overhead resistance art 24,700 and then 25,300 with the 61.8% retracement level at 25,250.

SUPPORT : Immediate support is at 23,300 with more significant levels at 21,700 and 20,800. With the percentages ranging from 20,500 to 21,250 and 21,900.

TRENDLINES - Short-term nearby trendline support is at 23,900 that will likely easily break. So weak trendline support.

MACD - MACD has unwound all of its oversold state which means that the Dow is ripe for a down leg.

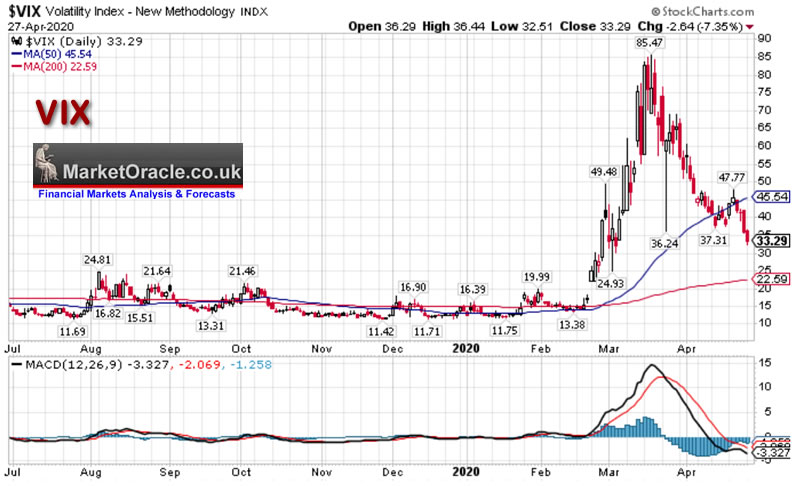

VIX

The 86 high coincided with the Mid March stock market bottom since which time there has been a steady decline in volatility accompanying the steady rise in the stock market.

The VIX's MACD is oversold which at least suggests a corrective rise in volatility to first target 48 and then 60 that should act to contain stock market weakness without revisiting the panic levels of March 2020. However, a move beyond 60 would increasingly imply the Dow looking set to target the 18,200 bear market low, which at this point is a low probability event.

ELLIOTT WAVES

My elliott wave count for an ABC pattern has remained consistent since early February, even if the magnitude of the stock markets moves have gone far beyond what anyone could have imagined as my EWT update of early March illustrates. Which implies that we are currently in Wave B ahead of a Wave C decline.

My updated Elliott Wave chart illustrates the finer wave count that continues to resolve in expectations for a Wave C decline. Though according to EW theory Wave C should normally trade LOWER than Wave B, so implies that the Dow should trade below it's March 18,200 low and comprise 5 waves down i.e. be an impulse down wave. In fact Wave C's are supposed to be of similar length to Wave A and at a minimum be the same length as Wave B.

So before EWers comment, yes I am once more making a break with the tenants of EWT by having Wave C significantly shorter than Wave B. So we shall see if orthodox wave theory proves more accurate than my own more skeptical interpretation of this technical tool.

Formulating a Stock Market Trend Forecast

As was the focus of my previous analysis, the corona and economic fundamentals suggest it is going to be highly improbable that this current stock market rally can continue for much longer, perhaps no more than a couple of days before the market succumbs to selling.

I can imagine most people looking at the Charts of what happened in March and then reading the mainstream media gloom and doom reporting of the likes of an expected 40% drop in US Q2 GDP, unemployment soaring by an unprecedented rate that approached 7 million jobs lost in ONE week, more than TEN times the number of jobs that were being lost at the height of the financial crisis. Will thus find it relatively easy to make the argument in favour of expectations for a re-run of March sell off during May i.e. another waterfall decline taking the Dow to fresh bear market lows, which if it were to repeat would see the Dow fall to 15,000!

However against this we have the tech sector that if not mostly immune to the corona catastrophe is profiting to great extent as the world accelerates it's move online. That and central bankers dusting down their Weimar republic printing money handbooks.

Whilst the technical picture is coming across as being more benign, in that whilst stocks are likely to head lower than higher, however the decline will likely prove milder than the what the fundamentals and some technical tools such as EWT suggest.

Whilst it should not be forgotten that the Dow is currently in an uptrend that has yet to terminate, so it could carry higher for a several more days before turning lower with resistance at around 25,000.

So how low could the Dow trade during the forthcoming correction, technical support ranges from 20,500 to 21,700. Given that this correction is likely to more orderly means the Dow may not decline by much, let alone getting anywhere near Dow 18,200 which I am sure many who failed to BUY during March hope for it to revisit for another bite at the tech cherries, which unfortunately for them may not transpire.

Therefore it is highly probable that the low during the next correction will be ABOVE 20,500. In terms of duration it should be similar to the advance since the March low, so about 5 weeks in duration which would take us into late May which I am sure many in hindsight will repeat the mantra of "Sell in May and Go Away" probably after the decline has already happened.

Dow Stock Market Forecast Conclusion

Therefore my forecast conclusion is that once the current rally has ended, likely within the next few days then for the Dow to target a relatively orderly decline to 21,000 by late May as illustrated by my trend forecast graph..

Following which it is highly probable that the Dow will enter a trend towards new bull market highs i.e. above the levels where this new bull market ends it's current rally off of the March 23rd low for which the most recent high was 24,300.

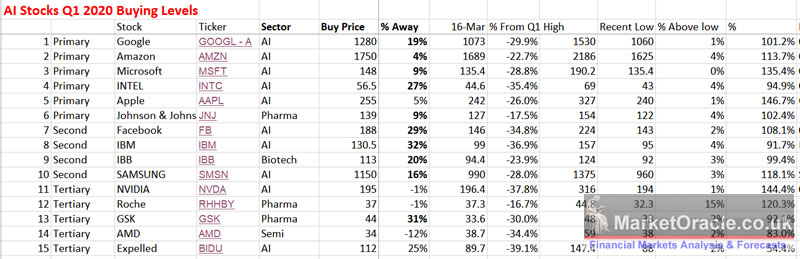

AI Buying Levels Q2

My intention had been to include updated AI stocks buying levels with this article. However, doing so would have delayed posting this analysis by a further day or 2. So I now aim to follow with the updated AI buying levels within the next couple of days.

However, if you have taken one message away from my articles during the coronavirus crisis then it should be that this Corona crisis stocks bear market is presenting investors with the MEGA BUYING OPPORUTNTY in AI Stocks! For instance in my analysis of 16h March ( US and UK Coronavirus Containment Incompetence Resulting Catastrophic Trend Trajectories) I wrote:

Remember that whilst the current spread of the Coronavirus may be exponential, so is the AI mega-trend. And who do you think is going to profit from the current crisis? Amazon, Google, Facebook, that's who! i.e. the coronavirus is reinforcing the importance of the virtual world.

All of the stocks except AMD have now moved below their Q1 buying levels, and many stocks by a significant degree! The most notable biggest bargains of the bunch are Google, Intel, Facebook and IBM, especially when compared against their Q1 highs.

The recent panic sell off also acts as an important indicator of underlying relative strength of Apple and Amazon. One would have imagined that these two stocks having greater exposure to the real world than the virtual world would have faired worse then the likes of Google, i.e. being disruptive to Apples production of iphones and Amazon's supply chains. But no, so far they are showing that the market is already starting to discount recovery for these two stocks. And if one thinks about it then it makes sense that China will lead the V shaped economic bounce back by a couple of months ahead of the West, and thus improve the prospects for Apple and Amazons supply chain.

That and so many people choosing not to risk catching Coronavirus will increasingly put greater demands on Amazon for all sorts of goods and services.

So to once more iterate my central message NOT TO BLOW THIS MEGA BUYING OPPORTUNTY towards which you will likely get another bite of the AI cherry of sorts during the coming anticipated correction.

Though looking at where the AI stocks are currently trading such as Amazon, we'll your not going to see this stock trade at below $1700 again! That ship has long since sailed! $2376 is 9% ABOVE it's PRE CORONA All time high! And UP 45% from where it was trading Mid March!

More in my next analysis: AI Mega-trend Stocks Buying Levels Q2 2020

- Stock Market Trend Forecast Summary

- Britain's FAKE Coronavirus Death Statistics Exposed

- Implied Case Fatality Rate

- United States Coronavirus Trend Trajectory Update

- Perceiving Coronavirus as a Disruptive Technology

- The AI Mega-trend

- When to Sell Your AI Stocks

- AI Mega-trend Stocks Buying Levels Q2

- Preliminary Stock Market Analysis

- Fed QE4EVER

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- VIX Analysis

- ELLIOTT WAVES

- Dow Stock Market Forecast Conclusion

- AI Stocks Buying Levels Q2

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.