Russia: How Financial "Complacency" Morphed into "Crisis"

Stock-Markets / Russia Jun 08, 2020 - 12:18 PM GMTBy: EWI

It's been a tough year for Russia financially.

Of course, there's been the big collapse in oil prices, plus -- just like many other global stock indexes -- Russian stocks are well off their highs.

That's quite in contrast to 2019, when the RTSI index, a U.S. dollar-based index of 50 Russian companies, climbed 29%.

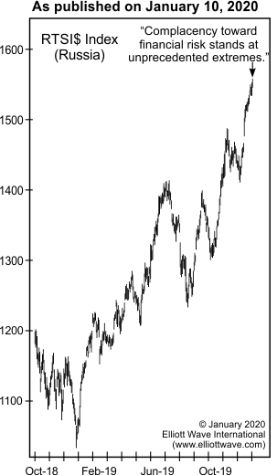

Shortly after registering that performance, Elliott Wave International's January Global Market Perspective, a monthly publication which covers 40-plus worldwide markets, showed this chart and said:

Complacency toward financial risk stands at unprecedented extremes.

Our global analyst's comment suggested that a change of trend was afoot, given that extremes in financial markets are akin to a rubber band that is stretched to the breaking point.

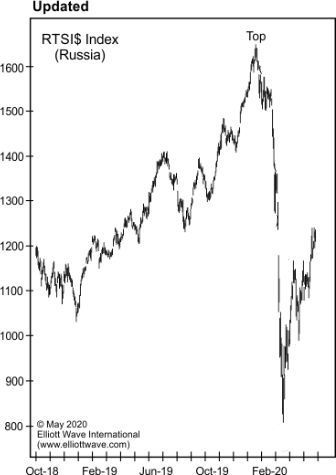

Well, here's an update on the RTSI from the just-published June Global Market Perspective. An EWI global analyst notes:

The RTSI index ... did worse than Europe's broader indexes, losing more than half of its value from February to March. The stunning crash was followed by [a] rally that has since retraced about 50% of the decline.

In addition to stock prices being well off their highs, Russia's economic output will contract at 6% this year and the jobless number is expected to double.

Plus, in April, the government projected that the budget deficit will hit 4% of GDP.

As the June Global Market Perspective also notes:

Russia's last financial crisis in 2014-15 also came on the heels of a decline in oil prices, and the crisis culminated on December 15, 2014, when the ruble suddenly plummeted against the euro and dollar. ... Russia is entering its current crisis from a much weaker financial position.

So, does this mean that the rally in Russian stocks is nearly over, or might the RTSI index climb the proverbial "wall of worry"?

Well, a March 27 Barron's headline suggests that investors will eventually be rewarded:

Russia's Stocks Are a Buy Only for Very Patient Investors

Elliott Wave International's global analysts provide their own perspective on the big financial picture, yet they are also focused on what's next for Russia financially and economically -- as well as many other worldwide markets.

Indeed, EWI has recently published the valuable, free resource: 5 Global Insights You Need to Watch.

You see, EWI's top 5 global experts share their latest forecasts for cryptocurrencies, crude oil, interest rates, deflation, and the futures of the European Union.

The result is a 5-video series (plus, two quick reads) -- all in just 13 minutes.

And -- you get it free with a fast Club EWI signup. Club EWI membership is also free.

Follow this link to get started: 5 Global Insights You Need to Watch.

This article was syndicated by Elliott Wave International and was originally published under the headline Russia: How Financial "Complacency" Morphed into "Crisis". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.