Saudi Arabia Eyes Total Dominance In Oil And Gas Markets

Commodities / Crude Oil Jul 07, 2020 - 04:49 PM GMTBy: OilPrice_Com

Saudi Arabia’s Energy Minister Prince Abdulaziz claimed last week that the Kingdom will be the world’s biggest hydrocarbon producer “even” in 2050.

“I can assure that Saudi Arabia will not only be the last producer, but Saudi Arabia will produce every molecule of hydrocarbon and it will put it to good use … It will be done in the most environmentally sound and safe way and the most sustainable way,” Abdulaziz said when asked about the oil market outlook in 2050 during a virtual conference convened by Saudi Arabia’s Future Investment Initiative Institute (FII-I).

Abdulaziz added that Saudi Arabia “will be the last and biggest producer of hydrocarbon even then,” referring to 2050.

But is Saudi Arabia’s the world’s leading hydrocarbon producer now? And what is its legitimate prospect for being the largest hydrocarbon producer in 2050?

‘Hydrocarbon’ Explained

To unpack what the prince is claiming, we first must understand the hydrocarbon classification. A hydrocarbon is an organic compound that contains only carbon and hydrogen. This encompasses petroleum, natural gas, and condensates.

Is Saudi Arabia the world’s largest hydrocarbon producer?

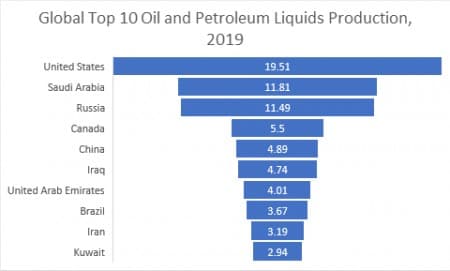

Saudi Arabia’s oil production in 2019, which includes crude oil, all other petroleum liquids, and biofuels--this would include natural gas plant liquids and condensate--was an average of 11.81 million bpd, according to the Energy Information Administration (EIA). At 12% of the world’s total, it’s no wonder why Saudi Arabia holds so much market sway, especially when in cahoots with the rest of the OPEC members.

Russia, too, is right up there, producing an average of 11.49 million bpd, or 11% of the world’s total. This is also no wonder, then, that when you put Russia and Saudi Arabia together to “stabilize” the world’s oil supply to balance it with demand, it creates a crude oil production powerhouse that is unmatched.

But individually speaking, Saudi Arabia is not king of the oil production hill, for its nemesis--the country that sought to undo every production quota OPEC could come up with, is the United States. On its own, the United States produced 19.51 million barrels of oil (and other petroleum liquids) per day, besting both Saudi Arabia and Russia, and controlling 19% of the world’s oil supplies.

The rest of the countries on their own are significantly further down the list, with not one of them producing more than half of third-place Russia. Still, Canada and China--#4 and #5 respectively--are still worth mentioning.

But Saudi Arabia expects to be the largest hydrocarbon producer “still” in 2050. If they are not so now, what are the chances they will be so thirty years from now?

Perhaps out of step with Saudi Arabia’s grand Vision 2030 plan, The Kingdom is still hoping to be top dog for petroleum production decades from now.

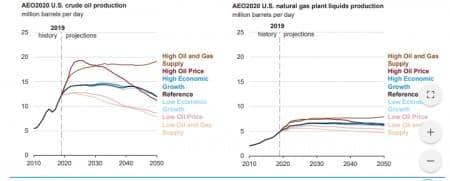

The EIA, in its Annual Energy Outlook 2020, has forecast that global production of crude oil and lease condensate, natural gas plant liquids, dry natural gas, and coal in the United States will reach 90.29 quadrillion Btus in its reference case. For crude oil and lease condensate, the EIA expects that the United States will be on par with where it is today, in its reference case. For natural gas plant liquids production, the EIA anticipates an increase by 2050.

Source: EIA Annual Energy Outlook 2020

The reason for the EIA assuming oil production will level off in 2022 and holding fairly steady through 2045 is the anticipated decline in well productivity, forcing tight oil producers to hunt for oil is less prolific areas.

For Saudi Arabia, its 30-year hydrocarbon plan or abilities are more of an unknown. It has the world’s second-largest crude oil reserves, and it does have plans to add natural gas production in the coming years as it looks to step away from its near-total reliance on crude oil.

For natural gas, Saudi Arabia announced earlier this year that it may actually bring forward its plans to export natural gas by 2030. It did not, however, provide details about this plan, or how it would be implemented.

But its detailless plans may run into some trouble. For starters, while Saudi Arabia has an excess of low-cost associated gas reserves that it could tap, the production of said gas would be limited to the amount of crude it can produce. And crude oil production is periodically--and profoundly so right now--capped by OPEC agreements that keep the Kingdom’s fossil fuel ambitions in check.

But the EIA sees the OPEC countries besting non-OPEC countries on the production front by 2050

By 2050, the EIA sees the production of crude oil, lease condensate, natural gas plant

liquids (NGPLs) and other liquid fuels from 2018 to 2050 reaching 121.5 million barrels per day (b/d) in 2050, or about 21% more than 2018 levels.

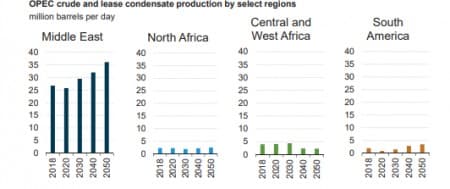

For crude oil and lease condensate, the EIA sees OPEC members increasing production by 9.5 million bpd, and nonOPEC countries increasing their crude oil and lease condensate production by 8 million bpd. This translates into a 27% increase for OPEC countries and a 17% increase for non-OPEC countries, according to the EIA’s International Annual Energy Outlook.

Overall, the EIA expects the OPEC countries to produce 56% of total global production in 2050.

Most of that production increase that OPEC nations (27%) will see will come from the Middle East, which is expected to increase by 35% to 2050.

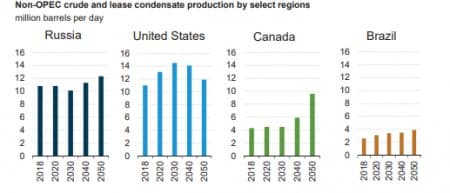

Meanwhile, production in Russia (14%) and Canada (123%) are expected to increase at a quicker rate than the United States (8%) and Brazil (50%).

Using historical production figures courtesy of BP and forecasts published by peakoilbarrel, the top four oil producers remain in their positions through 2050.

Toeing the Saudi Line

Prince Abdulaziz’s chest-puffing seems to be in line with Saudi Arabia’s previous assertions that oil will be alive and well in 2050 despite attempts to spur the world along an energy transition. Even as far back as 2007, Aramco said it could boost reserves to as many as 1 trillion barrels by 2027, adding that it would be 2050 or later before production peaks.

But some of Saudi Arabia’s forecasts of fossil fuel’s future were more sober-minded, even seeing a phasing out of fossil fuels by the middle of this century, Ali al-Naimi, Saudi Arabia’s oil minister at the time said in 2015.

“In Saudi Arabia, we recognize that eventually, one of these days, we are not going to need fossil fuels. I don’t know when, in 2040, 2050 or thereafter,” al-Naimi said, adding that Saudi Arabia was therefore planning on becoming a “global power in solar and wind energy.”

Link to original article: https://oilprice.com/Energy/Crude-Oil/Saudi-Arabia-Eyes-Total-Dominance-In-Oil-And-Gas.html

By By Julianne Geiger

© 2019 Copyright OilPrice.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.