Precious Metals and Miners Start of New Longer-Term Bullish Trend - P2

Commodities / Gold and Silver 2021 Apr 21, 2021 - 09:22 AM GMTBy: Chris_Vermeulen

This second part of our research article related to the new Bullish price phase in Precious Metals and Miners will continue to explore the potential range and targets for higher price trends.

In the first part of this article, I discussed how precious metals have started moving higher in somewhat of a stealth mode – not really drawing a lot of attention from traders. While other commodities and market sectors continue to rally, Gold and Silver have recently been setting up a new momentum base over the past few weeks. If our research is correct, we may soon see a stronger bullish price rally in precious metals which may drive miners 3x to 5x higher as Miners have greater Alpha than precious metals.

Are The Stars Aligning For A Big Market Shift Focusing On Gold & Silver?

Another key factor is that we’ve recently shifted away from an appreciation cycle phase and into a depreciation cycle phase. This new Depreciation cycle phase suggests the US Dollar may enter a decidedly downward overall trend while the US stock market may continue to move higher with increased volatility and extended price rotation ranges. Additionally, this new Depreciation cycle phase clearly suggests precious metals will begin an upward price trend that may last well into 2027~2028 or longer.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

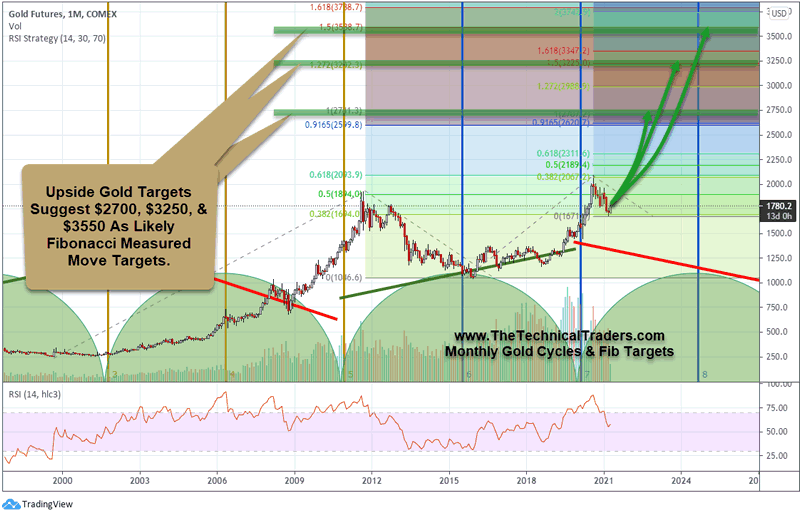

The following Monthly Gold chart highlights the broad Appreciation/Depreciation cycle phases (with the GREEN: Appreciation and RED: Depreciation sloping lines) and also shows two Fibonacci Price Extension ranges (or Measured Moves). Interestingly, the 100% measured move ranges of both Fibonacci anchor points highlight a $2700 target level. Beyond that level, we see $3250 and $3550 as substantial upside target levels. This suggests Gold may rally over 50% from current levels to reach the first target level near $2700 (or higher) over the next 5+ years.

In the shorter term, we need to watch metals, miners, and the US Dollar for signs that this pending longer-term trend is confirming. Currently, Gold and Silver are starting to break a downward/sideways price channel and appear to be starting a new upside price trend. We need to watch for technical confirmation of this breakout as it will likely start a new, broader, price trend based on our cycle research. Keeping that in mind, let’s take a look at some current Daily charts that show why any breakout price trend in metals may present an explosive opportunity for traders.

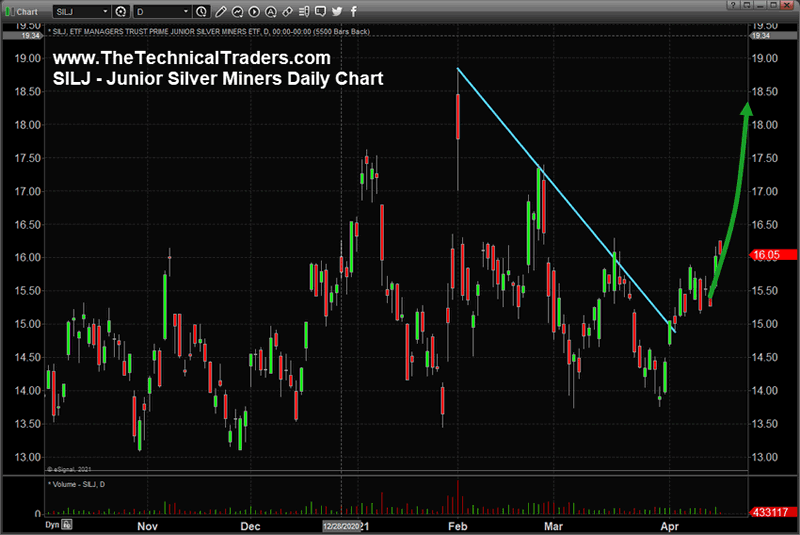

Junior Silver Miners Need To Breakout Above $16.50~$17.00 For Bigger Rally

You can see from this the Silver Junior Miners Daily chart (SILJ) price has recently broken above the downward sloping price channel shown as a CYAN line. This upside price breakout is important, yet we need to see SILJ move above $16.50~$17.00 to really start a broader bullish price trend. Once this level has been breached, which may be very soon, we believe an explosive upside price trend may quickly take SILJ well above $18.50 and beyond.

Silver and Silver miners share one key facet that makes them extremely opportunistic for traders. Typically, when these types of cycle phase trends take hold, Gold will rally substantially higher over time. Yet, Silver, which is often overlooked as a metals hedge instrument, begins to rally faster than Gold in a percentage term. For example, from the bottom in 2015 to the current highs, Gold rallied a little over 101% – whereas Silver rallied over 124%. This happened near the end of the previous Appreciation cycle phase. When and if our expectations become true, Gold will rally 50% to 75% (or more) from current levels and Silver may rally 85% to 175% or more.

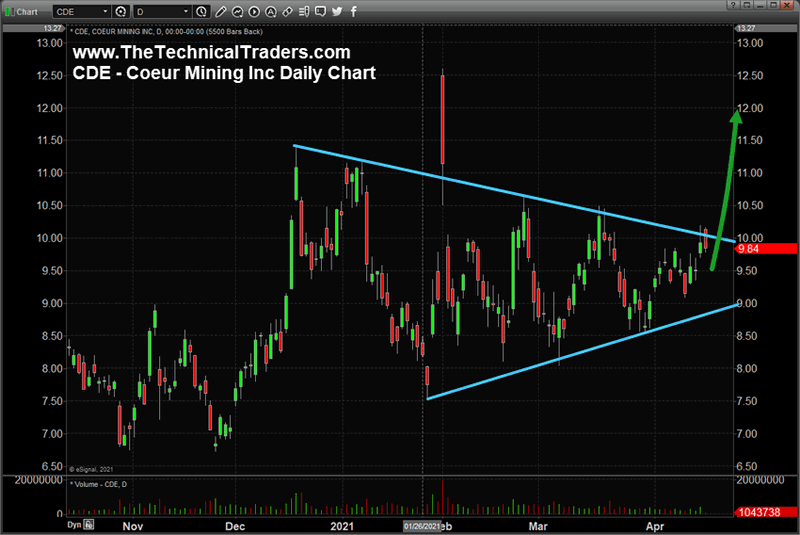

Miners May See An Incredible Breakout Rally If Metals Begin A Big Bullish Cycle

The following Daily Coeur Mining Chart (CDE) highlights the similarities between how the price activity of SILJ and CDE. On the CDE chart, you can see a more defined Pennant/Flag formation that is nearing an Apex. You can also see the bullish breakout event starting to set up on the right side of this chart. If Silver breaks into a bullish trend, pulling SILJ higher as well, CDE will likely break above the $10.50 level and begin to move towards the previous high price level near $12.00 to $12.50 (or higher). This represents a solid 20% to 35% upside price advance for CDE – possibly much higher over time.

In closing, there are two key elements we want readers to focus on. First, the transition into a Depreciation cycle phase, which usually prompts a stronger precious metals price rally and ending in a parabolic price advance. Second, the current setup of Gold and Silver, which have already been moving higher since 2015. This combination suggests the excess phase rally in the US stock market over the past 5+ years has already prompted a move into hedging instruments (Gold & Silver). This is very similar to what happened in 2000 to 2005 – after the DOT COM bubble burst. The real rally in precious metals didn’t start until after 2005~2006 – when Gold rallied over 365% from the $400 price level. Silver rallied over 600% during that same span of time.

It is very likely that many precious metals mining stocks are set up in similar patterns recently. Mostly flagging sideways into Apex formations with some already starting to break out into an upward price trend. We are watching for Gold and Silver to confirm this new upside price trend by attempting to move substantially higher to break previous price peaks. If we can see Gold and Silver continue to move higher while breaking through historical resistance levels (past price peaks), then we would expect this to indicate a broader market trend is setting up and momentum for this move in building.

Remember, this is a 6 to 7+ year cycle related to the new Depreciation cycle phase. Eventually, as the markets transition into this new phase, Gold and Silver will begin a broad rally mode while the US stock market may enter a period of excessive volatility and rotation. The last Depreciation cycle phase took place from 2001 to 2010 (roughly). We are certain many of you remember how the stock market reacted during that market phase?

Don’t miss the opportunities in the broad market sectors over the next 6+ months. Staying ahead of these sector trends is going to be key to developing continued success in these markets. As some sectors fail, others will begin to trend higher. Learn how BAN Trader Pro can help you spot the best trade setups. Learning to profit from these bigger trends and sector rotation will make a big difference between success and failure. If you are not prepared for these sector rotations, then you can sign up now for my FREE webinar that teaches you how to find, enter, and profit from only those sectors that have the most strength and momentum. Staying ahead of sector trends is going to be key to success in volatile markets.

For those who believe in the power of trading on relative strength, market cycles, and momentum but don’t have the time to do the research every day then my BAN Trader Pro newsletter service does all the work for you with daily market reports, research, and trade alerts. More frequent or experienced traders have been killing it trading options, ETFs, and stocks using my BAN Hotlist ranking the hottest ETFs, which is updated daily for my premium subscribers.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.