Smart Money Accumulating Physical Silver Ahead Of New Basel III Regulations And Price Explosion To $44

Commodities / Gold and Silver 2021 Jun 20, 2021 - 12:33 PM GMTBy: Chris_Vermeulen

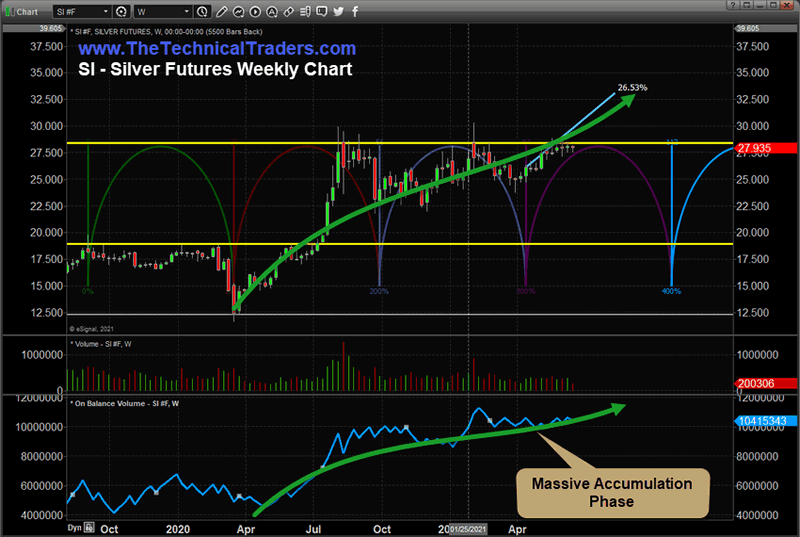

Recently, Gold and Silver have somewhat stalled after a fairly solid upside price trend in April and May 2021. Looking at the longer-term Weekly Silver chart, we believe Silver is ready to pounce with a big move higher.

The second half of 2021 will welcome BASEL III (likely) and a renewed focus by the US Federal Reserve (and Global Central banks) working to contain inflationary aspects of the recovering global economy while also attempting to support continued growth objectives. I believe precious metals, in particular – Silver, have shown a very unique “Accumulation Phase” over the past 12+ months that may lead to a big upside breakout rally when it breaches the $28.50 level.

Silver Waiting For The Opportune Moment To Pounce – Are You Ready?

This Weekly Silver Futures chart highlights the On Balance Volume Accumulation Phase as well as our price cycle analysis suggesting Silver is stalling just below resistance near $28.50. My team and I believe the new upward cycle phase, in addition to the massive Accumulation taking place, suggests that Silver is currently lying in wait – ready to pounce on a big upward price trend once the $28.50 level is breached.

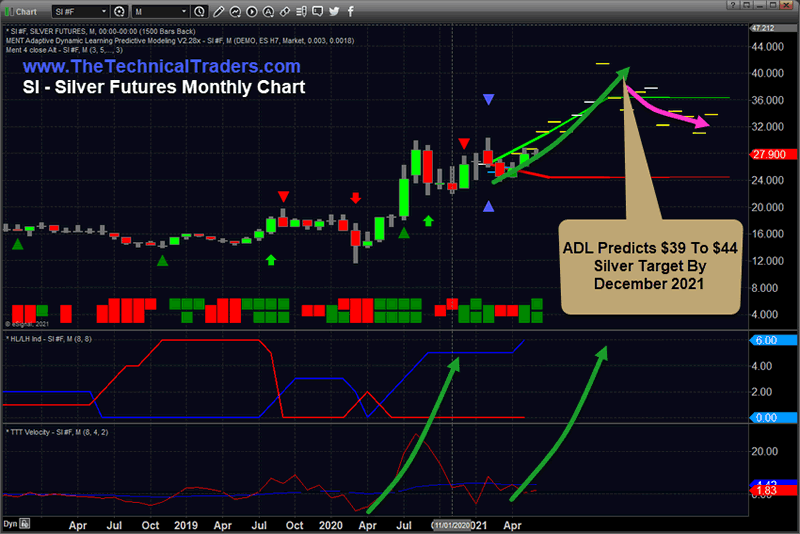

ADL Model Suggests $40 To $44 Upside Target Is Real

Our proprietary Adaptive Dynamic Learning (ADL) Price Modeling system suggests a continued bullish price trend is likely on the Monthly Silver chart, shown below, and that a peak is likely near $40 to $44 near December 2021. This bullish price dynamic is based on the ADL’s ability to map out unique price and technical setups in the past, then align those unique price DNA markers with current price setups.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

What may happen over the course of the next few weeks is that Silver may continue to attempt to consolidate below $28.50 as the markets react to the FOMC announcements and other market facets. Once the markets digest the real factors related to inflationary concerns, what the US Fed and Global Central Banks need to do is to address these concerns, and the future expectations related to forward monetary policies and expectations. Personally, I believe Silver will move above $28.50 sometime in July (or shortly afterward) and begin to move dramatically higher – targeting $40 or higher.

My team and I believe the end of 2021 and nearly all of the next 2 to 3+ years will be full of incredibly big price trends for traders to take advantage of. This setup in Silver suggests we are only starting a multi-year bullish price rally phase in precious metals (very similar to the 2003 to 2007 rally in Gold/Silver). If you have followed precious metals long enough, you understand the biggest moves in Gold and Silver happened after the 2006~07 stock market peak.

That means that we are just starting to see an incredible opportunity in the US stock market and precious metals related to volatility, trends and price rotations. Now is the time you should start preparing for what is to come and learn how to take advantage of these incredible opporutnities.

Want to know how our BAN strategy is identifying and ranking various sectors and ETFs for the best possible opportunities for future profits? Please take a minute to learn about my BAN Trader Pro newsletter service and how it can help you identify and trade better sector setups. My team and I have built this strategy to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the BAN Trader Pro system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.