U.S. Fed Opts to Inflate Treasury Bond Bubble

Interest-Rates / US Bonds Dec 17, 2008 - 01:19 PM GMTBy: Gary_Dorsch

Beware - “Quantitative Easing” is Hallucinogenic - American bankers are so fearful of a replay of the 1930's Great Depression, they've finally reached the point of "No-return," – lending $30-billion to Uncle Sam at a rock-bottom interest rate of zero-percent. Demand was so great at the last auction, the Treasury could have sold four-times as many T-bills. If short-term T-bill rates go negative, frightened bankers would effectively be paying the US Treasury for the privilege of lending money to it! But remember, "The Fed can guarantee cash benefits as far out, and at whatever size you like, but we cannot guarantee their purchasing power," former Fed chief, "Easy" Al Greenspan told Congress on Feb 15, 2005.

Beware - “Quantitative Easing” is Hallucinogenic - American bankers are so fearful of a replay of the 1930's Great Depression, they've finally reached the point of "No-return," – lending $30-billion to Uncle Sam at a rock-bottom interest rate of zero-percent. Demand was so great at the last auction, the Treasury could have sold four-times as many T-bills. If short-term T-bill rates go negative, frightened bankers would effectively be paying the US Treasury for the privilege of lending money to it! But remember, "The Fed can guarantee cash benefits as far out, and at whatever size you like, but we cannot guarantee their purchasing power," former Fed chief, "Easy" Al Greenspan told Congress on Feb 15, 2005.

The last time short-term T-bill rates went negative was during the Great Depression, when frightened bankers were effectively paying the US Treasury for the privilege of lending money to it! As for short-sellers of US Treasury bond futures, betting on a major top in a delusional market, John Maynard Keynes would say, “Markets can stay irrational longer than you can stay solvent.”

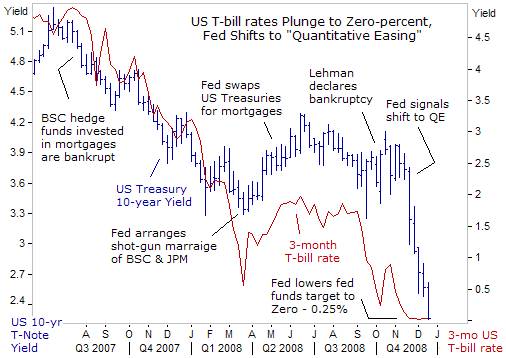

There is a massive paranoia in the marketplace, a “safety-at-any-cost mentality,” that has knocked the 30-year Treasury yield to 2.63%, the lowest in history, and 10-year yields have plunged to 2.15%, the lowest since 1962. The same sophisticated bankers that bought toxic sub-prime mortgages, and “off-balance sheet” items, such as collateralized debt obligations, structured investment vehicles, and credit default swaps, are now locking in Treasury yields at historic lows.

However, most Americans are playing it a bit safer. Money market funds invested in T-bills have surged 150% over the past year, to $726 billion. Overall, US-money market fund assets have climbed for an 11 th straight week to a record $3.72-trillion, and nearly half of US money market mutual funds posted no returns as T-bills dipped to zero-percent. The nightmare scenario has arrived after the US stock market lost roughly $8-trillion of its value during a brutal 14-month bear market, and Zillow.com estimates that US-home values also lost $2-trillion this year.

Most remarkably, bond prices are soaring, and interest rates are plunging, even as the US Treasury expects to auction a record $2-trillion or more of new debt in fiscal 2009. Previously, the largest annual budget deficit in US-history was $450-billion set last year. The wildly bullish behavior of the Treasury market goes a long way to bolstering the argument, that it's the demand side of the equation which is most influential in determining interest rates, rather than the supply side.

Most remarkably, bond prices are soaring, and interest rates are plunging, even as the US Treasury expects to auction a record $2-trillion or more of new debt in fiscal 2009. Previously, the largest annual budget deficit in US-history was $450-billion set last year. The wildly bullish behavior of the Treasury market goes a long way to bolstering the argument, that it's the demand side of the equation which is most influential in determining interest rates, rather than the supply side.

The US Treasury plans to sell $2-trillion or more of freshly printed IOU's at ultra-low interest rates, while the Fed plans to churn-out unlimited amounts of US-dollars from its electronic printing press to buy the debt. It's an age-old process known as “monetization,” and the late Milton Friedman warned, “Money is too important to be left to central bankers. You essentially have a group of unelected people who have enormous power to affect the economy. I've always been in favor of replacing the Fed with a laptop computer, to calculate the monetary base and expand it annually, through war, peace, feast and famine by a predictable 2%,” he said.

But American households are reeling from the worst credit crunch since the 1930's, and every day continues to deliver more dismal news. The number of US workers filing new claims for unemployment benefits jumped to 573,000 last week, the highest since November 1982. US payrolls have shrunk by 1.9-million so far this year, and other government measures of the labor market that provide a more realistic estimate show unemployment to be well over 10 percent.

More than 1-million US-homes have been lost to foreclosure since the housing crisis broke in August of 2007, and Realty Trac predicts that another 1-million homeowners could be forced out of their homes next year. Sales at US retailers fell for a fifth straight month in November, the longest decline in 16-years, and new building permits, declined 15.6% last month to a 616,000 pace, the lowest on record .

Taken together with a record back-to back decline in consumer prices, these reports suggest an economy lurching into the deepest and longest recession since the Great Depression of the 1930's. And in China , the other key locomotive of the global economy, there is also grim picture of a collapse in manufacturing, and tens of millions of job losses next year. On Dec 15 th , the IMF slashed its forecast for Chinese growth to 5% for 2009, or less than half of its growth rate this year.

China 's major export markets in Europe, Japan , and the US , are effectively in recession. Emerging economies can not sustain China 's export growth as they have also been hit hard by the global credit crunch. Indeed, Chinese exports were 2.2% lower in November than a year earlier, and industrial output plunged 8.2%, after expanding at a steady annualized rate of roughly 18% over the past three years.

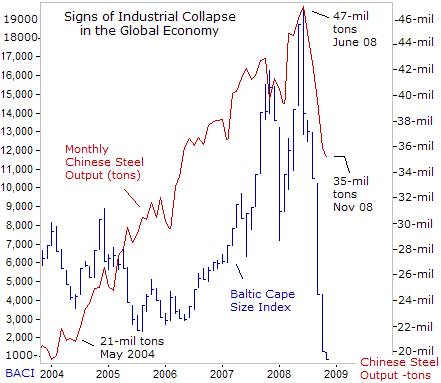

Chinese steel production fell to 35.2-millions tons in November, or 25% below its all-time high set in June. Some 70-million tons of iron ore are still stockpiled in 22-Chinese ports, due to the collapse of the global commodities trade, translating into a complete meltdown in the Baltic Cape-Size Index. As well as being hit by plunging sales, Chinese steel mills have faced a 40% fall in global steel prices since July.

It's from the ashes of the global stock markets, which have lost $32-trillion of wealth over the past 14-months, that the IMF called on G-20 central banks to slash their interest rates towards zero-percent, and begin printing trillions in paper currency, in order to rescue the world economy from another 1930's style Great Depression.

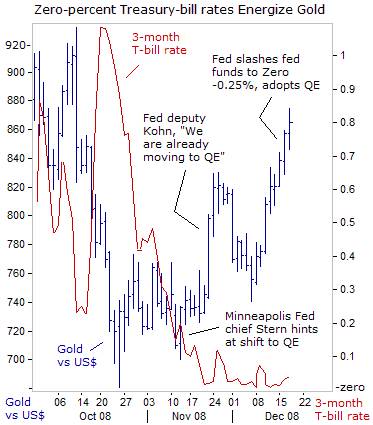

Traders are now playing a game of chicken with the Fed, purchasing ten and thirty year bonds at lower yields, aiming to eventually dump the IOU's onto the Fed's balance sheet at even higher prices. Yields on the US Treasury's 10-year note have plummeted by 180-basis points, since the Fed signaled it was ready to dig deeper into its tool-box, after cutting the fed funds rate as far as possible, and injecting the most hallucinogenic drug ever - “Quantitative Easing” (QE).

Japanese Bond Trader Experience with QE

The Bank of Japan was the only major central bank in modern times to experiment with the “Quantitative Easing,” drug, - a strategy of injecting more cash into the banking system than is needed to peg the overnight interest rate near zero-percent. “Our QE strategy contained two elements, one was to provide massive liquidity into the market, the second, was a promise to maintain zero interest rates until the consumer inflation rate became positive on a sustainable basis,” BoJ chief Masaaki Shirakawa told the Financial Times on Dec 14 th .

However, “while the “QE strategy was effective in stabilizing financial markets, it had limited impact in remedying stagnation, because banks wouldn't lend and companies wouldn't borrow,” Shirakawa added. Instead, Japanese banks flush with cash, simply parked the excess yen into government bonds, or lent trillions of yen to overseas borrowers, who were engaged in the infamous “yen carry” trade. Ultimately, Japan 's ultra-low interest rates inflated asset and commodity bubbles worldwide.

The Bank of Japan's QE policy was introduced in March 2001, but it was not certain whether it would succeed, it was experimental. In a nutshell, QE meant shifting the central bank's target of money market operations from interest rates to a quantitative indicator, - the balance of yen held by the BoJ in the banking system. At its peak, the BoJ injected 31.2-trillion of excess yen into the banks, or 6-7 times more than required to meet their basic reserves requirements.

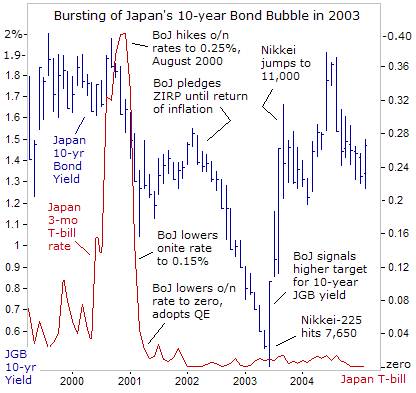

The BoJ's shift to a Zero–Interest-Rate-Policy (ZIRP) in March 2001, initially guided Japan 's 10-year bond yields 50-basis points lower towards 1.25-percent. However, the BoJ stated in January 2002, that it would continue ZIRP until the “year-on-year rate of change in the CPI was zero or higher on a sustainable basis.” The BOJ also decided to increase its monthly purchases of JGB's.

When it became clear the BoJ would keep QE in place until deflation was eradicated, leaving its money spigots wide-open, long-term interest rates dropped again. Ten-year Japanese government bond (JGB) yields plummeted to an all-time low of 0.43% in May 2003, which also coincided with a “flight to safety,” as the Nikkei-225 index extended a 34% loss to 7,650-points, a 20-year low.

However, on June 16 th , 2003, BoJ chief Toshihiko Fukui decided to burst the JGB bubble, by suggesting that yields had fallen too-low. “Now, we are implementing measures aimed at creating situations which will drive up long-term interest rates. It's a very important to avoid turmoil in financial markets, as Japan has a huge amount of outstanding government bond sales, and it will become very important to have a policy to manage government bond issuance,” he warned.

The Spanish philosopher George Santayana once remarked that, “Intelligence is quickness in seeing things as they are.” And the ability to correctly decipher BOJ riddles is a critical skill for JGB traders. One week later, Fukui was more explicit, “long-term yields are at very low levels. There is a small chance that they can rise,” he warned. Tokyo traders understood Fukui 's remarks as a signal to dump their JGB's. Three-months later, the 10-year JGB yield had tripled to 1.50%. The surge in JGB yields also coincided with the Nikkei-225 climbing above 10,000.

Since the bursting of the JGB bubble in mid-2003, the Bank of Japan and the Ministry of Finance have skillfully locked the 10-year benchmark JBG yield within a tight range between 1.25% and 2.00%. Yield starved Japanese investors plowed more than $6.2-trillion of their savings into higher yielding bonds overseas, which in turn, helped to keep interest rates artificially low, even during inflation booms.

Fed Targets Zero to 0.25% Interest rate,

The Bernanke Fed can't wait to experiment with QE, by printing unlimited amounts of US-dollars out of thin air, and monetizing the US Treasury's debt. On Dec 16 th , the Fed shocked the market by adopting a target for the fed funds rate, within a range of zero to 0.25%, an all-time low, and said it would employ “all available tools” to dispel a year-long recession. “The Fed is sending a message that it will print money to an unlimited extent until it starts to see the economy expanding,” remarked William Poole, former president of the St. Louis Fed.

However, “Quantitative Easing” is a very dangerous hallucinogenic drug, and quoting Santayana again, “Those who do not learn from history are doomed to repeat it.” Fed chief Ben “Bubbles” Bernanke, who strongly endorsed “Easy” Al Greenspan's ultra-low interest rate policy earlier this decade, which was designed to inflate the commodity, housing, and sub-prime debt bubbles, is now fueling a massive Treasury market bubble, and legions of speculators are taking collective leave of their senses and succumbing to delusions of zero-percent 10-year yields.

However, “Quantitative Easing” is a very dangerous hallucinogenic drug, and quoting Santayana again, “Those who do not learn from history are doomed to repeat it.” Fed chief Ben “Bubbles” Bernanke, who strongly endorsed “Easy” Al Greenspan's ultra-low interest rate policy earlier this decade, which was designed to inflate the commodity, housing, and sub-prime debt bubbles, is now fueling a massive Treasury market bubble, and legions of speculators are taking collective leave of their senses and succumbing to delusions of zero-percent 10-year yields.

If left unchecked, “Bubble-mania” engenders a massive, largely uncorrected rise in valuations that discounts not just the present and near-future, but also a distorted view of the far-horizon. The Fed's bold shift to QE seems designed to head-off the possibility of a deflationary depression. However, “ if inflation targeting creates the presumption that the central bank can look at consumer price inflation alone, then it might have the unintended effect of creating a bubble,” warned BoJ chief Shirakawa.

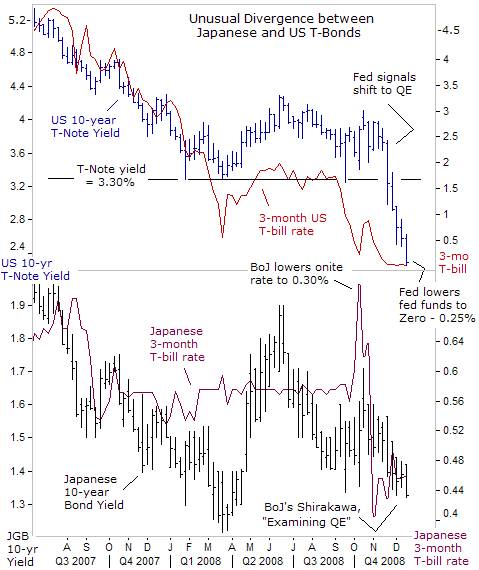

Japanese bond traders still carry the scars from the bursting of the JGB bubble in 2003, and so, far haven't gotten caught-up in “irrational exuberance” of the US Treasury bond market. “Wisdom comes by disillusionment,” said Santayana. JGB traders are anxiously waiting to see how the BoJ's reacts to the Fed's dangerous experiment with QE, and whether it will boost its purchases of long-term JGB's from the current 1.2-trillion yen ($13.2-billion) per month.

The BoJ has put a floor under the 10-year JGB yield at 1.25% for the past five-years, but BoJ chief Shirakawa is under heavy pressure from Tokyo warlords, to resume full-scale QE. “ We acknowledge the Bank of Japan's independence. But as stipulated under law, the BoJ and the government keep in close contact with each other in guiding economic policy,” said Finance chief Shoichi Nakagawa on Dec 16 th . “I hope the BoJ reaches an appropriate conclusion, bearing in mind Japan 's economic and liquidity conditions,” he warned.

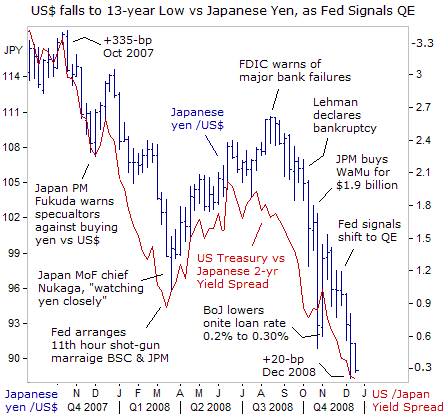

The yield on the US Treasury's 2-year note has collapsed to 20-basis points above Japanese yields, the smallest gap since 1992, which in turn, has crushed the US$ versus the Japanese yen, to a 13-year low of 88-yen. Japan is heavily dependent on exports, particularly to the US and Europe, and a major factor sinking Japan 's Nikkei-225 index is the strength of the yen against all major currencies including the Euro and US-dollar. Falling exports have already led to a contraction in the Japanese economy in the second a third quarter, and the worst is yet to come.

On Dec 16 th , BoJ chief Shirakawa said he is “examining quantitative easing,” and is increasingly concerned about a deepening recession. “In addition to falling exports due to a slowdown in overseas economies, corporate profits, household finances and job conditions are worsening, and it is taking a toll on domestic private demand. Output, employment and consumption data were all severe,” Shirakawa told parliament, sending JGB futures higher.

As the Fed floods the global money markets with another big tidal wave of US-dollars in the months ahead, the BoJ might return to QE, to cushion the slide of the dollar. The BoJ might buy commercial paper, increase its monthly purchases of Japanese government bonds, or expand the types of collateral it accepts when making loans, the Nikkei business newspaper reported on Dec 15 th .

Swiss National Bank hinting at Shift to QE

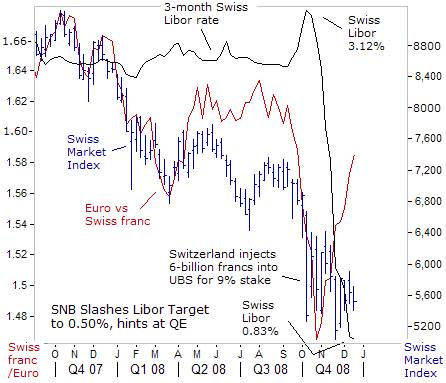

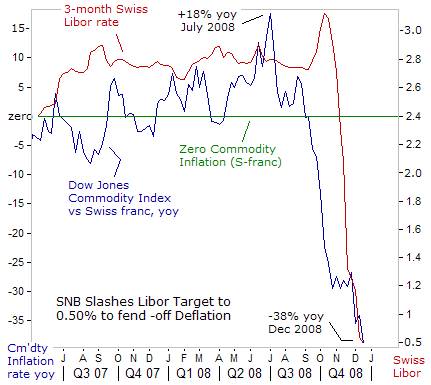

The Swiss National Bank, (SNB) might become a QE junkie, after it slashed the 3-month Libor target rate by 225-basis points to 0.50%, over the past two-months. “The global economic slowdown, the decline in the price of oil and the appreciation of the Swiss franc (vs the Euro) are reinforcing the expected drop in inflation. Relaxation of monetary policy provides an impetus to economic activity, and will not jeopardize the return to price stability,” the SNB explained.

The usually tight-fisted SNB grew alarmed by the Euro's rapid decline against the Swiss franc in October. Exports of goods and services account for 57% of Switzerland 's economic output, and half its exports are shipped to the Euro-zone. And now, Switzerland 's biggest customers in the Euro-zone and the US are contracting simultaneously for the first time since World War II. Similarly, the sharp slide of the Euro vs the Swiss franc erodes earnings for big exporters such as Nestle and Novartis, which in turn, undermines the Swiss Market Index, (SMI).

The usually tight-fisted SNB grew alarmed by the Euro's rapid decline against the Swiss franc in October. Exports of goods and services account for 57% of Switzerland 's economic output, and half its exports are shipped to the Euro-zone. And now, Switzerland 's biggest customers in the Euro-zone and the US are contracting simultaneously for the first time since World War II. Similarly, the sharp slide of the Euro vs the Swiss franc erodes earnings for big exporters such as Nestle and Novartis, which in turn, undermines the Swiss Market Index, (SMI).

Switzerland 's love of secrecy, neutrality and low inflation, has long made it a leading offshore money manager worldwide. About 40% of all global cross-border asset management for private customers has been carried out in Switzerland . However, recent events have tarnished Switzerland 's squeaky-clean image, and raising doubts about its pre-eminent position in banking and other financial services.

Outside observers were stunned to see Switzerland 's largest financial institutions caught by reckless gambles in the same risky instruments that brought down so many US banks and brokers. On October 16 th , the Swiss government had to step-in with a massive bailout, which put $60-billion of UBS's risky assets into a fund backed by the central bank, reversing an earlier government position.

UBS reported 49-billion Swiss francs of deposit outflows in the third-quarter, and clients learned of its involvement in tax haven products to wealthy clients from Germany and the United States . Credit Suisse, the country's second largest bank, is cutting 5,000-jobs or about 10% of its workforce after losing about 3-billion francs in October and November. Zurich-based Swiss Re, reported 3-billion Swiss francs of write-downs, leading to a Q'3 loss of 304-million francs, amid a 289-million franc mark-to-market loss on credit default swaps (CDS). And as of October 31 st , Swiss mutual fund assets under management fell to 532-billion Swiss francs, declining steadily from 705-billion Swiss francs a year earlier.

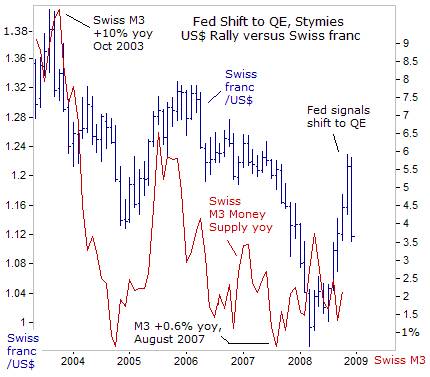

The Swiss franc's link to gold, dating from the 1920's, was abolished in May 2000, under a referendum to the Swiss Constitution. So in order to keep the Swiss franc attractive, the SNB maintains a tight fisted monetary policy, and in recent years, limited the growth rate of the Swiss M3 money supply to around +2%, the tightest money policy on earth. Yet despite the SNB's tight money policy, the US-dollar managed to climb 20% against the Swiss franc since mid-July to 1.22 chf, while investors withdrew large sums from Swiss banks.

The possible reasons for the US-dollar's rally since mid-July are vague, such as unwinding of “yen carry” trades, or short covering by foreign insurers in the $55-trillion credit default swap market. However, the Fed's advanced warnings to the media in November, of a shift to the radical QE policy, also signaled a return to a familiar sleight of hand - a “cheap dollar” policy.

The SNB cut its Libor target 50-basis points to 0.50% on Dec 11 th , and said it will do anything to prevent deflation from striking the Swiss economy, even if rates reach zero. “We could engage in quantitative easing, and we could intervene in foreign exchange markets, or we could buy-up bonds, and try to influence long-term interest rates. All these options are open and we're not limited in any way in choosing from among these instruments,” warned SNB member Thomas Jordan.

The Swiss franc extended losses versus the Euro after the SNB rate cut to 0.50%, and the threat of adopting QE, hitting 1.5765 per Euro, from the record 1.43 hit on Oct 27 th . But buying Swiss government bonds might not be effective in easing monetary conditions, since the amount of outstanding government bonds, roughly 92.4-billion Swiss francs, is very small relative to the money markets.

A more effective approach could be direct intervention in the foreign exchange market to weaken the Swiss franc, with money created by the SNB's electronic printing press. That might boost the sluggish money supply, which combined with sharply lower commodity prices, when measured in Swiss francs, threatens to inflict the Swiss economy with the dreaded disease of deflation.

Gold – the True Antidote for QE

The news headlines read: “Stocks surge as Fed pledges broad Economic support,” as a surprised Wall Street bolted sharply higher, after the Fed said it will use “all available tools” to jump-start the economy. “Weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time,” the Fed added. The initial knee-jerk reaction sent the Dow Jones Industrials surging 360-points higher, to close at 8,924, and the number of stocks advancing outnumbered those declining by 5-to-1 on the New York Stock Exchange.

The news headlines read: “Stocks surge as Fed pledges broad Economic support,” as a surprised Wall Street bolted sharply higher, after the Fed said it will use “all available tools” to jump-start the economy. “Weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time,” the Fed added. The initial knee-jerk reaction sent the Dow Jones Industrials surging 360-points higher, to close at 8,924, and the number of stocks advancing outnumbered those declining by 5-to-1 on the New York Stock Exchange.

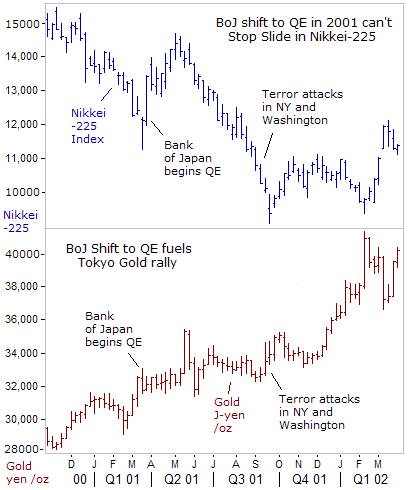

But QE is a dangerous drug, - it produces changes in perception, thought, and feeling, ranging from distortions of what is sensed (illusions) to sensing objects where none exist (hallucinations). QE can transmit false perceptions about the health of the economy and the direction of the stock market. Looking back at history, on March 19, 2001, when the BoJ formally announced its adoption of QE, it gave an instant jolt to the Nikkei-225 Index, surging 10% higher in a single week to 13,200, and extended to a 22% gain to 14,400.

However, after two-months, the QE drug soon wore-off, and the Nikkei-225 reverted back to its bearish trend, tumbling 45% to the 9,500-level. Nearly a year QE after the BoJ adopted the QE framework, the Nikkei-225 was still languishing 5% lower, but the Tokyo gold market was enjoying the ride of a genuine bull market, climbing 30% higher to 40,000-yen per ounce. In 2002, Japanese investors bought 65-tons of gold, a quarter more than in 2001, amid worries about Japanese bank deposits.

Even today, the Nikkei-225 is hovering near 8,600, or 28% lower than in March 2001, when the BoJ unveiled its QE approach. The BoJ is apprehensive about getting hooked on QE again, but it might have no choice but to adopt unorthodox measures to prevent the US-dollar from sliding into a free-fall against the yen. Japanese investors understand though, that the only true anti-dote for QE, the hallucinogenic drug administered by central banks, is the “yellow metal.”

The essence of these quantitative measures amounts to monetizing debt,” admitted Richmond Fed chief Jeffrey Lacker. “As a result, we have to be very careful about withdrawing (the narcotic) before it sparks a run-up in inflation,' he said. Yet with “Bubbles” Bernanke in charge of the electronic printing press, traders are betting the Fed will keep interest rates pegged at zero percent long after inflation has returned to the economy. The gold market has already left the train station.

As the momentous year of 2008 winds down to a conclusion, traders can reflect upon the inflationary boom in commodities in the first half of the year, and the stunning deflationary bust in the second half. What took the “Commodity Super Cycle” more than six years to build-up was wiped out in just a matter of a few months. The time span of normal cycles has been compressed from a few years to a few months. How to navigate through the treacherous commodity and global financial markets in 2009 will be a key focus of the upcoming Dec 19 th edition of Global Money Trends.

This article is just the Tip of the Iceberg of what's available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2008 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.