The Ghost of Crude Oil Futures (Part 2)

Commodities / Crude Oil Jan 02, 2009 - 11:49 AM GMTBy: Oxbury_Research

Happy New Year. Welcome is the psychological reset of the scorecard to our portfolios. Most investors are eager to pretend that the new year will begin with a clean slate, with fresh money and no losses glaring at them from half-opened portfolio statements.

Happy New Year. Welcome is the psychological reset of the scorecard to our portfolios. Most investors are eager to pretend that the new year will begin with a clean slate, with fresh money and no losses glaring at them from half-opened portfolio statements.

The daunting truth is that, for the most part, investors large and small have experienced devastating losses this past year. Remarkably, this actually bodes well for new investors (as well as the market in general) because although little has actually changed from December 31 st to January 1 st , psychologically there is more optimism due to the sheer desire for something to go right for a change. And, as I have stated countless times before, psychology means more to actual market direction than earnings ever will.

Alas, my focus this week will be a continued analysis of the crude oil market in terms of price barriers, the possibility of messing with a balanced market, and what kind of ride we're in for ahead. All the same, this “fresh start” psychology will play a role in the future of oil… well, futures.

Taking a fresh look after a rotten year

As previously mentioned, many investors will be peering into the market in January as if they had not been watching it in despair over the past fourteen months. Doing so will reveal the lunacy that occurred in the short-term oil bubble and the ensuing collapse.

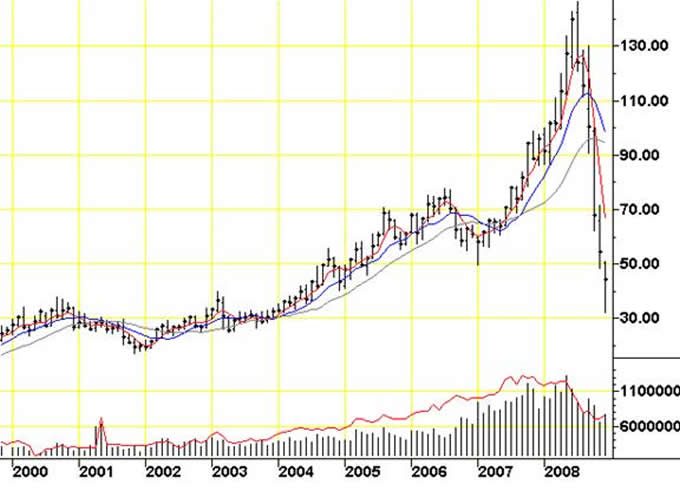

Let's look at the prices crude oil has trespassed over the past nine or ten years:

As you can see, leading up to 2007-2008, there were major support/resistance levels created around $30, $50, $60, and just over $70. During the run up in the past couple of years, it tore through new highs, peaking at $147. It then proceeded to collapse in six months, crashing through every price level as if it did not exist at all.

We all know that, during times of extreme duress, markets tend to overshoot prices in either direction. This has a rubber band effect that can be difficult to gauge. That being said, I propose that we concede that the run oil made to $147 per barrel only six months ago was part of a panic bubble, feeding off of fear and speculation, greed on the part of oil companies, and uncertainty regarding our foreign policies and predicaments. Afterwards, the falling knife (or more accurately, running chainsaw) had not found a landing spot until it touched just above $30 per barrel only weeks ago.

Ladies and gentlemen, demand may have subsided to some degree. But the fact remains that from a technical perspective, there has essentially been no bounce to speak of since this landslide began.

Hordes of investors are going to be looking at this information and realizing that the screaming oil prices of 2007-2008 have been followed by just as much insanity as it overshoots to the downside. Short covering, re-positioning, and speculation alone should trampoline these prices back to the $50s at least in the near term (by “near term”, I am referring to a time period of a couple of months).

I am not selling my position yet.

What if we were wrong about demand?

Matthew Simmons, who I quoted in last week's article in his recent interview with Fortune , believes that demand has not fallen to the extent that prices are reflecting. Furthermore, he states that $40 oil (much less $30 oil) is so devastating to oil-based economies, that OPEC will actually continue to make supply cuts as necessary. On top of this, companies in the oil and gas industry are cutting production (and hence supply) for the very same reason.

Here is the problem: there is no way of collecting precise, reliable demand data in such a short period of time. So, we are essentially guessing in terms of where we think demand actually is and how this should affect prices.

What happens if we're wrong?

Is this not so conceivable? Damn near everyone, including myself, has been wrong at some point in the past year. Are we so arrogant that we believe we can correctly determine the short- and long-term oil demands of both individuals and businesses throughout the world to the point where we can determine an accurate price? I doubt it.

So, if the markets do not have a great deal of flexibility in them, and we are cutting supply in a market that is actually relatively balanced , we have a supply/demand disaster in the making. It is entirely possible that excess supply is merely a perception, partially due to the record-breaking drop in oil prices, in which case we are depleting an already (historically speaking) low stash of oil.

This will send prices higher, and this will not occur slowly.

A final word on the future of oil

Regardless of what is happening in Iraq , Gaza , Russia , or the Moon for that matter, a couple of simple facts remain.

Number one, that there are far too many cars on the road for the world to suddenly relinquish its thirst for oil. At my local Jiffy Lube, I was unable to procure a cold fusion converter for my car for $99.99, along with a lifetime supply of hydrogen.

Secondly, it does not rain oil. Aliens do not deliver oil every other February, and crude is not able to be converted from old tires or grass clippings. There is a finite supply of this resource, and that will not likely change. Furthermore, it does not get cheaper to reach what oil we have left as time dwindles on.

We are no longer at the point of speculation, we are at the point of common sense. Perhaps there's not enough common sense left in the world to make me correct on this issue, but I'm betting a lot of my own money that I am.

Next week, part 2 – price barriers, the possibility and horror of cutting into a balanced market, and where this is all going.

Cutting into a balanced market… or making too many production cuts could snap the price of oil back up to levels unknown.

What happens when demand “comes back”?

Well, if you think the oil companies are jumping for joy as the price of their product falls through the floor, I don't know what to tell you.

Moreover, if you think that they're going to do us any favors by increasing production (and hence supply) if the price creeps up, you're equally crazy.

Disclosure: no positions

John K. Whitehall

Analyst, Oxbury Research

John has a solid decade of experience in the financial markets: from developing and implementing long-term investment strategies for high net worth clientele to intraday trading of equities, Exchange-Traded Funds, options and currencies.

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2008 Copyright Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.