Stock Market Rally Built On?

News_Letter / Financial Markets 2009 Sep 19, 2009 - 10:38 PM GMTBy: NewsLetter

The Market Oracle Newsletter

September 19th, 2009 Issue #76 Vol. 3

The Market Oracle Newsletter

September 19th, 2009 Issue #76 Vol. 3

Stock Market Rally Built On?Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By:Graham_Summers In case you have not heard the news, China has announced that it will be instructing its state-owned enterprises to potentially default on their derivatives contracts. As I have written extensively in the past, the derivatives market is a massive time bomb just waiting to go off. China’s latest move may be the match that lights the fuse.

By: Madison_Avenue_R Long Term: Madison Avenue Research Group's outlook for gold and silver is bullish. Our sentiments echo Peter Barnes, CEO of Silver Wheaton whom in a BNN interview on September 8, 2009 said "Over the next two or three years silver is going through USD$30/oz”. Barnes believes weakness in the US dollars will drive precious metal prices and excessive monetization will have a significant inflationary effect at some stage saying "it is only a matter of when".

By: Nadeem_Walayat During the last few days the mainstream media has been obsessed by Lehman's as though it caused the financial crisis, when all Lehman's was one crack in the credit crisis dam that was destined to burst following the August 2007 interbank market freeze when the game was up on the U.S. mortgage backed securities valuations that bank staff had inflated so as to bank huge bonuses on fictitious profits. Peaks.

By: Hans_F_Sennholz Early 1955 finds the American public swamped by forecasts of prosperity and boom. Economic advisers to governments, corporations, universities, labor unions and other groups seem to have resolved in unison to assure the people that a depression like that of the 1930s has been banned forever from the American scene. "Americans need not fear a depression," they say. "Our government will carefully watch our economy and interfere when the need arises."

By: Submissions "Seriousness of the Crisis Cannot be Exaggerated, Closest Comparison is the Collapse of the Soviet Union" George Soros

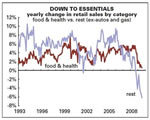

By: Bob_Chapman Almost all important, pertinent data reflects continued weakness in the economy, especially retail sales and unemployment.

By: John_Mauldin Just as water is formed by the basic elements hydrogen and oxygen, deflation has its own fundamental components. Last week we started exploring those elements, and this week we continue. I feel that the most fundamental of decisions we face in building investment portfolios is correctly deciding whether we are faced with inflation or deflation in our future. (And I tell you later on when to worry about inflation.) Most investments behave quite differently depending on whether we are in a deflationary or inflationary environment. Get this answer wrong and it could rise up to bite you.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.