Financial Markets 2010 Scenario's Building

Stock-Markets / Financial Markets 2010 Dec 19, 2009 - 02:55 AM GMTBy: Nadeem_Walayat

My focus over the coming week is in completing the UK inflation analysis and forecast that is at the core of what happens to subsequent market trends as it directly feeds into interest rates, house prices, economy and stocks. Last years analysis and concluding forecasts for RPI and CPI proved remarkably accurate (30 Dec 2008 - UK CPI Inflation, RPI Deflation Forecast 2009) and hence the inflation road map resulted in the generation of many accurate projections for subsequent trends throughout 2009 and especially for UK savers that if they followed my cue of fixing savings at above 5% for 1 - 2 years would not have been burned by the subsequent crash in UK interest rates to pittance of as low as 0.1% on savings accounts, shame on you HBOS.

My focus over the coming week is in completing the UK inflation analysis and forecast that is at the core of what happens to subsequent market trends as it directly feeds into interest rates, house prices, economy and stocks. Last years analysis and concluding forecasts for RPI and CPI proved remarkably accurate (30 Dec 2008 - UK CPI Inflation, RPI Deflation Forecast 2009) and hence the inflation road map resulted in the generation of many accurate projections for subsequent trends throughout 2009 and especially for UK savers that if they followed my cue of fixing savings at above 5% for 1 - 2 years would not have been burned by the subsequent crash in UK interest rates to pittance of as low as 0.1% on savings accounts, shame on you HBOS.

I get plenty of emails asking what should savers do now? Bear with me for a couple more weeks as I continue to assemble all of the pieces of the 2010 finance outlook puzzle.

Given that 2010 looks set to be just as uncertain and volatile as 2009 has been, I have gone the extra mile this year by starting the analysis in early November that will culminate into a ebook containing many projected trends that I will make available for free at the end of this month.

Labour Busts the Countries Monthly Budget Deficit Record with a £20 billion black hole for November 2009, not so long ago £20 billion would be the deficit for a whole year! More on this later today.

COP15 COP OUT - Global Warming action a case of too little to late to make ANY difference, which ironically means we may freeze in Europe! All I can do as an analyst is to focus on how to monetize on the global warming mega-trend.

The U.S. Dollar rallied strongly during the week finally achieving the buy trigger of 77.00 which now targets USD 84. The dollar trigger has been a long time coming with the original analysis dating back to August 2009, and updated on 2nd November 2009. The subsequent price action that saw the dollar break below 75 does call on an in depth analysis as the break was a sign of weakness. .

Robert Prechter says - Investors bought into the "stocks for the long run case" and got killed, prompting a record outpour into muni bond funds. But is this any safer? Read More

Which analysts should you pay greater attention to during 2010 ?

The answer is those that provided the most accurate analysis for 2009 have a greater probability of being right during 2010. In this regard, please do continue to vote for past articles (900+ votes to date) to help evaluate analysts, the following google searches will help get you started.

- Forecasts 2009

- Stock Market 2009

- Gold 2009

- Economy 2009

- Housing Market 2009

- U.S. Dollar 2009

- Investing 2009

Articles published between Sept 08 and Sept 09 will be counted, see voting guide here

Source:http://www.marketoracle.co.uk/Article15926.html

Your 2010 Scenario's Building Analyst wishing you all a Merry Christmas.

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. Global Financial Crisis, No Bailout Will Stop It |

By: Mac_Slavo

Sometimes, a bailout is not enough.

When Dubai World black swanned global investors last month with what amounts to be a reported $80 Billion in debt liabilities, it sent shivers down the spine of many a financial manager and stock trader. For those who were paying attention, Dubai’s troubled assets were no surprise, it was simply a matter of time. Oft repeated by contrarian analysts and investors like Dr. Doom Marc Faber, Gerald Celente, Jim Rogers, and Karl Denninger, the mathematical certainty of the economic crisis would play out - eventually.

| 2. The Inflation Mega-trend and the Illusion of Price Deflation |

By: Nadeem_Walayat

This analysis seeks to get to the heart of the matter to answer the question - Have we experienced Deflation and IF we have are we still in Deflation Now ?

| 3. A New World War for a New World Order, The Origins of World War III |

By: Andrew_G_Marshall

In Parts 1 and 2 of this series, I have analyzed US and NATO geopolitical strategy since the fall of the Soviet Union, in expanding the American empire and preventing the rise of new powers, containing Russia and China. This Part examines the implications of this strategy in recent years; following the emergence of a New Cold War

| 4. Where is the Stock Market Santa Rally? |

By: Howard_Katz

Dems want to raise the debt ceiling now rather than face a backlash in 2010.

In a bold but risky year-end strategy, Democrats are preparing to raise the federal debt ceiling by as much as $1.8 trillion before New Year’s rather than have to face the issue again prior to the 2010 elections.

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

| 5. Silver Rising Bearish Wedge Price Pattern |

By: Clive_Maund

A bizarre anomaly of gold's recent strong runup was the unusually poor performance of silver, which normally outpaces gold noticably during the middle and later stages of an uptrend. It did not gain any serious traction and is already back below its September peak. The fact that it did not even manage to break out to new highs is taken as a non-confirmation of gold's move, as is the failure of the PM stock indices to make new highs, and is viewed as bearish for the sector over the intermediate-term, meaning the coming 2 to 6 months.

| 6. Financial, Economic and Climate Crisis Ushering In Brave New World 2009 |

By: James_Quinn

O wonder!

How many goodly creatures are there here! How beauteous mankind is! O brave new world! That has such people in't! - William Shakespeare – The Tempest

“Most human beings have an almost infinite capacity for taking things for granted. That men do not learn very much from the lessons of history is the most important of all the lessons of history.”- Aldous Huxley

| 7. Obama Calls for More Leverage and More Debt On Path Towards Financial Ruin |

By: Bob_Chapman

Congressional appropriators agreed Tuesday night to give civilian federal employees a 2 percent pay increase -- which includes a locality pay increase President Obama didn't want.

Government workers will get a 1.5 percent nationwide increase in base pay and a 0.5 percent average increase in locality pay. The final agreement goes against the wishes of Obama, who called for a flat 2 percent jump and no locality increase.

| 8. Sovereign Government Debt Defaults Come Full Circle |

By: Jim_Willie_CB

The continuation of the bank dominoes took 14 months, but it occurred. The initial destructive impact craters were carved in the United States and England. To be sure, major damage was done to assets in Spain and Greece and other smaller nations in the last year, but their banks had remained insulated. The discredit and death of the central bank franchise system showed first clear evidence in September 2008 on Wall Street.

| Subscription |

How to Subscribe

Click here to register and get our FREE Newsletter

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2009MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions. ( Market Oracle Ltd , Registered in England and Wales, Company no 6387055.

Registered office: 226 Darnall Road, Sheffield S9 5AN , UK )

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Philip Townsend

20 Dec 09, 05:15 |

Inflation 2010

Hey Nadeem,

As always enjoy reading your stuff. Before you go projecting inflation in 2010, I suggest you take a look at the reconstructed US M6 graph circulating at present. With less than 70% capacity utilisation and 18% unemployment, IMHO, deflation remains the more important concern. I would put mony, in fact HAVE put money, on there being no increase in the Fed Funds rate in 2010.

Keep up the great work and thanks,

Philip |

|

John Bingham

22 Dec 09, 02:16 |

Inflation v deflation

Nadeem interested in your answer to In order to get comfortable with an inflation arguments I think people need some comprehension of how all the extra £ gets into the hands of consumers in order that it can chase goods and services. We saw it happen with wage spirals in the 70's and credit expansion on the back of securitisation over the past decade. But what now. Wages are contracting, credit is contracting unemployment is rising |

|

d

22 Dec 09, 05:56 |

Re inflation 2010

I agree 100% with Phillip on rates and inflation. Rising inflation will not be a concern in 2010. |

|

Nadeem_Walayat

22 Dec 09, 09:20 |

inflation / deflation

John I call it an inflation mega-trend because prices are on a perpeptual upward trend. The purpose of the analysis will NOT be to support a DEFLATION / INFLATION argument but rather conclude in an accurate projection for UK RPI and CPI, which will follow in a week or so Best, |

|

Roy

23 Dec 09, 12:20 |

US Mortgage Resets

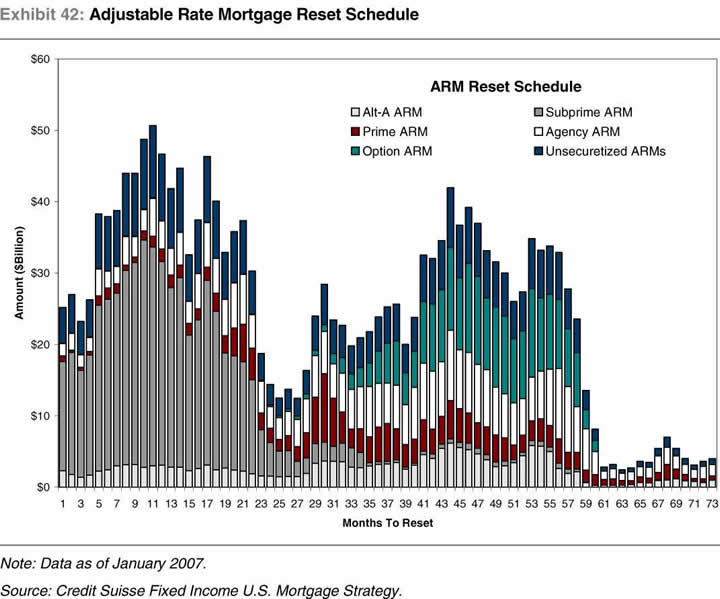

Nadeem, not much press about this lately? What about this and what will it do to stock prices? Aren’t we in for a HUGE second wave down in the markets? Banks have changed mark to market accounting and generally have avoided this issue. Interest rates are increasing, WITHOUT the Fed raising rates! Resets ahead, Foreclosures abound. Even without the interest increases, the principal payment increases with kill the ability to pay. Next time you are on CNBC, I support you to tell Joe Kernan what you think, but he is nothing but a talking head who has not concept of what he is talking about relative to LONG term views. He lives for the next day, just as all CNBC newscasters do. http://seekingalpha.com/article/179329-the-forthcoming-prime-mortgage-meltdown

|

|

Nadeem_Walayat

23 Dec 09, 12:21 |

US Housing

My focus is the UK housing market. I last looked at US housing in mid 2008 - http://www.marketoracle.co.uk/Article5257.html Perhaps time for an update. Nadeem Walayat, |