Conservatives Launch General Election Campaign with David Cameron NHS Poster

ElectionOracle / UK General Election Jan 05, 2010 - 01:30 AM GMTBy: Nadeem_Walayat

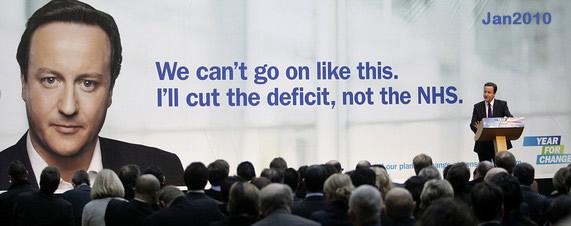

The Conservative party launched their general election campaign with 1000 posters showing David Cameron's face across Britain as below -

The Conservative party launched their general election campaign with 1000 posters showing David Cameron's face across Britain as below -

This was in conjunction with a pledge that the Conservatives would spend more on the NHS than Labour, can this really be true ?

Or is it just election promises that will soon be forgotten in 12 months time when the following will be more probable:

NHS Spending Cuts

The next government will have NO CHOICE but to cut NHS spending, as the Labour party's current plan for cutting the annual budget deficit by £23 billion a year just does not stand up to scrutiny as it would still result in the budget deficit expanding by £510 billion over the next 5 years, i.e. to more than 114% of Public Sector Net Debt which the financial markets would NOT tolerate, i.e. it would result in a series of bond market auction failures, which would be countered with accelerating money printing to monetize the debt which would culminate in an Iceland style currency collapse as foreign investors panic to preserve the value of their capital by selling out of sterling in favour of other currencies.

NHS Spending Out of Control

The Labour government despite tripling the NHS budget / GP Pay over the past 10 years to £120 billion ($198 billion) has resulted in a continuous fall in productivity over the past 6 years or so, and is only now in the final few months of its government for electioneering making announcements to implement reforms necessary to drag the NHS into the 21st century with a view to putting the patient first for the first time since its creation.

The Labour government despite tripling the NHS budget / GP Pay over the past 10 years to £120 billion ($198 billion) has resulted in a continuous fall in productivity over the past 6 years or so, and is only now in the final few months of its government for electioneering making announcements to implement reforms necessary to drag the NHS into the 21st century with a view to putting the patient first for the first time since its creation.

The NHS in its present form is a funding black hole with falling productivity that is sucking in ever increasing amounts of cash in real terms. Real reforms are urgently required otherwise Britain will be heading for a health service crisis as the GDP share of health spending continues to expand from 3.5% in 1948 to 10% today to above 13% by 2020, all without any real improvement in patient healthcare.

Politicians Scared of NHS Voter Army

The reason why politicians are lying about cuts to the NHS budget of at least 4% is because over 1.2 million Brit's ride the NHS gravy train and hence have a vested interest in the continuance of this sacred cow funding black hole that continues to exert a sizeable political force that political parties have little choice but to pander towards to ensure electoral success.

NHS GP Pay Illustrates Out of Control Spending

British MP's were humiliated during May and June across all parties as public outrage and indignation oat the abuse of the MP expenses system with MP's responding with how MP pay has failed to keep pace with that of NHS GP's which is one of the key reasons as to why they had resorted to what amounts to legalised theft from the electorate.

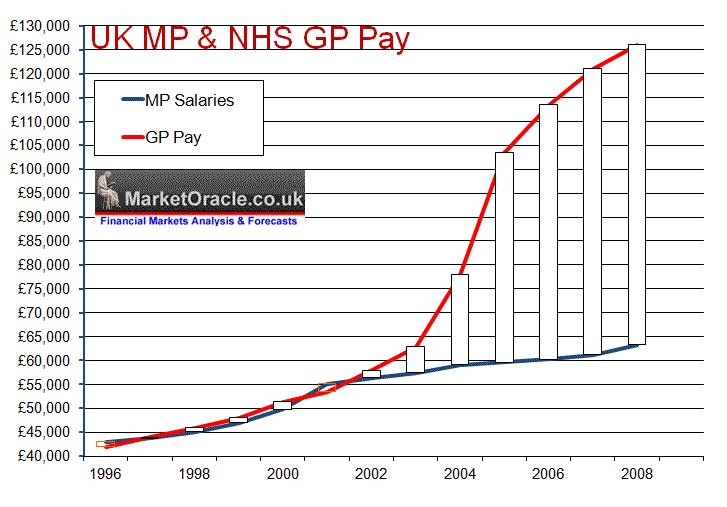

MP - NHS GP Pay Comparison

When Labour came to power in 1997 average MP pay was £43,722 against average NHS GP pay of £44,000, so both were inline with one another at that time. However as the above graph clearly illustrates in 2003 something started to go seriously wrong with GP Pay which took off into the stratosphere as GP's decided to award themselves pay hikes of more than 30% per annum at tax payers expense that has lifted average GP pay to £126,000 per annum against £64,000 for MP's.

How could this happen, unfortunately this was as a consequence of the now infamous GP contracts where to be blunt greedy GP's hoodwinked gullible incompetent Labour government health ministers into signing upto contracts which were meant to deliver greater value for money for the tax payer but were designed to do the opposite and resulted in GP's pay doubling whilst at the same time cutting back on hours worked. This was not only a total fiasco for the nations health and finances but also ignited jealousy amongst MP's that directly led to the adoption of the policy of claiming expenses to the maximum so as to fill the ever widening gap between MP's and NHS GP's, as MP's could NOT get away with awarding themselves pay hikes of 30% per annum without losing their seats at the next general election in response to voter outcry, therefore across the board systematic abuse of expenses started to take place which basically means real average MP pay is currently approx £98,000 per annum.

UK General Election

My analysis of the UK economy reinforced my expectation that the public and mainstream press will be surprised during the next few months as the UK economy bounces back strongly in the first quarter and continues for the whole of 2010. If only Gordon Brown had one more year how things could have turned out so differently than what seems like the inevitable defeat that Labour are heading for. For all of Gordon Browns many faults he has succeeded in delivering an Election Economic Bounce for the Labour party. Which means that I will now have revise my UK election forecast as of June 2009 during January that projected Conservatives on 343 seats, Labour 225 and Lib Dems on 40.

As for the date of the next election, speculation is growing that it could be in March following the recent bounce in the polls, however the election has probably been planned well in advance for May so I don't think minor poll volatility that is gripping the mainstream press is going to impact on the election date.

Source: http://www.marketoracle.co.uk/Article16230.html

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on the housing market and interest rates. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 500 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

David Cameron

18 Jan 10, 18:18 |

Cameron NHS Cuts

A website has copied your poster change idea - Don't worry you won' feel a thing!

|