Osborne Budget 2015 New Annuities Pensioner Election Bribe Targets 5 Million Voters

ElectionOracle / UK General Election Mar 15, 2015 - 11:46 AM GMTBy: Nadeem_Walayat

Last years budget announcement of pensions freedom from April 2015, that will allow pension fund holders to cash in all or part of their pension pots for a lump sum rather than being forced to buy an annuity is now being extended just in time for the election to all of the existing 5 million annuity holders from April 2016, who should the Conservatives win the election will also be able to cash in their annuities.

Last years budget announcement of pensions freedom from April 2015, that will allow pension fund holders to cash in all or part of their pension pots for a lump sum rather than being forced to buy an annuity is now being extended just in time for the election to all of the existing 5 million annuity holders from April 2016, who should the Conservatives win the election will also be able to cash in their annuities.

Clearly this is an election bribe aimed at the 5 million pensioner annuity holders that will have huge consequences in the long-term in terms of costs to the tax payer as many retirees will do the sums of how best they can maximise state benefits or be forced by family members into for instance cashing in annuities for home buying deposits etc. The result being that many pension pots will evaporate during the early years of retirement.

In terms of annuity rates then this should result in an increase in interest rates paid for new annuities as now there will be real competition for the insurers to offer better rates for peoples pension pots. Also pensioners need to be increasingly on guard against being scammed out of most of the value of their pension pots as I am sure many cold calling scammers will be soon start deluging the over 60's with scam calls. That and the fact of a flood of second hand annuities hitting the market that will depress the value of second hand annuities so that pensioners could get cash values of typically 80% of that that which they had been expecting and when subject to individual circumstances, which in many cases could be as much as 1/3rd less than expectations.

Another point to consider is the effect of taxation on cashing in annuities as it makes a huge difference where the funds go i.e. if withdrawn as cash then the whole amount is taxable in that tax year, whereas if the funds are converted into a SIPP then the monies can be drawn down across multiple tax years thus resulting in far less tax.

In economic terms, initially for a good number of years pensioners liquidating and their pension pots should act as a significant boost to the economy such as the housing market injected with extra home buying cash. However, fast forward 5-10 years later when many pension pots have been consumed then the state will increasingly be forced to pick up the bill where if all of the existing 5 million annuity holders spent their annuities that could amount to an extra burden on the state of £30 billion pounds per year, and increase in line with new retirees cashing in their pension pots over the subsequent 10 years that could again double the burden on tax payers to £60 billion a year.

Therefore today's announcement sows the seeds of ever expanding future budget deficits, so even if the initial economic boom results in a small budget surplus a few years from now, however this will likely prove to be short lived as the deficit would soon start to mushroom to well over £100 billion again as a consequence of the increasing pressures of an ageing pension-pot-less population.

But of course politicians are not interested in the long-term because their focus is wholly on the next election - May 7th!

In terms of the election probabilities, the latest election bribe will undoubtedly bolster the tory vote which as my earlier analysis concluded increases the chance for an outright Conservative electron victory, especially as many more election bribes will be announced in this weeks budget.

15 Mar 2015 - Election Forecast 2015 - Opinion Polls Trending Towards Conservative Outright Win

Hung Parliament is NOT a Certainty!

If the current trend continues then it is possible that the Conservatives could win an outright majority on May 7th as per my long standing analysis of seats vs house prices trend trajectory that painted a picture for a likely probable Conservative general election victory.

16 Dec 2013 - UK General Election Forecast 2015, Who Will Win, Coalition, Conservative or Labour?

The updated election seats trend graph illustrates that the Conservatives are virtually ON TRACK to achieve the forecast outcome for an outright election victory on a majority of about 30 seats which NO ONE, and I mean no serious commentators / analysts has or is currently advocating.

UK General Election Forecast 2015

In terms of what I actually see as the most probable outcome for the general election, I refer to my in-depth analysis that concluded in the following detailed seats per party forecast:

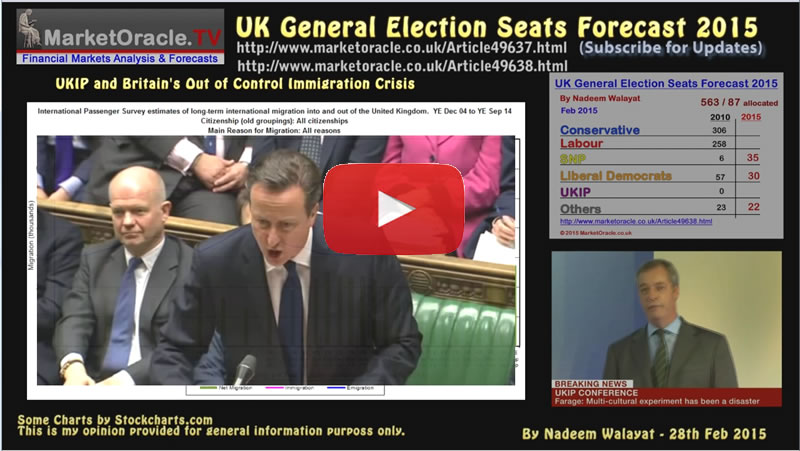

- 28 Feb 2015 - UK General Election 2015 Seats Forecast - Who Will Win?

- 28 Feb 2015 - UK General Election 2015 - Forecasting Seats for SNP, LIb-Dems, UKIP and Others

UK General Election May 2015 Forecast Conclusion

My forecast conclusion is for the Conservatives to win 296 seats at the May 7th general election, Labour 2nd on 262 seats, with the full seats per political party breakdown as follows:

Therefore the most probable outcome is for a continuation of the ConDem Coalition government on 326 seats (296+30) where any shortfall would likely find support from the DUP's 8 seats.

The alternative is for a truly messy Lab-Lib SNP supported chaotic government on 327 seats (262+30+35) which in my opinion would be a truly disastrous outcome for Britain, nearly as bad as if Scotland had voted for independence last September.

Another possibility is that should the Conservatives do better than forecast i.e. secure over 300 seats but still fail to win an overall majority, then they may chose to go it alone with the plan to work towards winning a May 2016 general election.

The bottom line is that the opinion polls do not reflect how people will actually vote on May 7th when they are faced with a stark choice of steady as she goes ConDem government or take a huge gamble on Ed Milliband's Labour party. So in my opinion several millions of voters will chose to play it safe with ConDem which thus is the most probable outcome.

Also available a youtube video version of my forecast:

Ensure you are subscribed to my always free newsletter for in-depth analysis and detailed trend forecast delivered to your email in box.

By Nadeem Walayat

Copyright © 2005-2015 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.