Election Forecast 2015 - Budget Bribes Fail to Impress Voters, Tory's Lose Seats in Opinion Polls

ElectionOracle / UK General Election Mar 23, 2015 - 04:16 AM GMTBy: Nadeem_Walayat

George Osborne's pre-election bribes budget apparently just did not live upto voter expectations as £3k bunged to first time buyers and £200 to basic rate savers amongst several smaller bribe was just not enough, either that or voters were spooked by the OBR bureaucrats savaging of the budget that implied a roller coaster ride of first severe austerity cuts of £65 billion per year, followed by a pre-election spending spree towards the end of the parliament.

George Osborne's pre-election bribes budget apparently just did not live upto voter expectations as £3k bunged to first time buyers and £200 to basic rate savers amongst several smaller bribe was just not enough, either that or voters were spooked by the OBR bureaucrats savaging of the budget that implied a roller coaster ride of first severe austerity cuts of £65 billion per year, followed by a pre-election spending spree towards the end of the parliament.

OBR: Implication of the Government’s spending policy assumptions is a sharp acceleration in the pace of implied real cuts to day - to - day spending on public services and administration in 2016 - 17 and 2017 - 18, followed by a sharp turnaround in 2019 - 20, as shown in Chart 1.3. As explained below, the implied cuts in 2016 - 17 and 2017 - 18 are a key reason why the Government is on course to achieve its new fiscal mandate to balance the cyclically adjusted current budget in 2017 - 18 with room to spare.

OBR’s chairman, Robert Chote stated: “One important consequence of all of this is that implied public services spending is on a rollercoaster profile through the next parliament, with deeper real cuts in the second and third years than we have seen to date, followed by the sharpest increase for a decade in the fifth.”

George Osborne responded - “That is not actually the approach, as Conservatives, that we will take. We want to take a more balanced approach and we would not put all the cuts in government departments, as the OBR forecast shows.

We would also make savings in the welfare budget and take additional action against tax avoidance, tax evasion, aggressive tax planning. So we would have a more balanced approach.

The cuts in financial departments would be at the same pace as the last couple of weeks and that we are going to have in a couple of weeks’ time as we have the new financial year.”

So it looks like George Osborne blew it, as analysts have been busy number crunching the post budget opinion polls into seats per party forecasts that shows instead of a budget bounce, the Conservatives seats forecasts have actually fallen by approx 10 seats to Labour that puts both parties back virtually neck and neck.

The following is a list of the current state of seats forecasts by various popular mostly mainstream media funded election sites that are set against my own forecast of 28th Feb 2015.

|

Market Oracle | May2015 .com | Electoralcalculus .co.uk | ElectionForecast .co.uk | The Guardian |

28th Feb |

21st Mar | 22nd Mar | 22nd Mar | 18th Mar | |

| Conservative | 296 | 274 | 267 | 286 | 277 |

| Labour | 262 | 271 | 300 | 276 | 269 |

| SNP | 35 | 55 | 46 | 39 | 53 |

| Lib Dem | 30 | 24 | 57 | 26 | 25 |

| UKIP | 5 | 3 | 1 | 1 | 4 |

| Others | 22 | 22 | 22 | 22 | 22 |

The following are individual forecaster trends with brief comments.

May2015.com (New Statesman)

MO 28th Feb |

21st Mar | 12th Mar | 5th Mar | 26th Feb | 10th Feb | |

| Conservative | 296 | 274 | 281 | 255 | 270 | 270 |

| Labour | 262 | 271 | 263 | 283 | 271 | 272 |

| SNP | 35 | 55 | 55 | 55 | 56 | 56 |

| Lib Dem | 30 | 24 | 24 | 26 | 25 | |

| UKIP | 5 | 3 | 4 | 4 | 4 | |

| Others | 22 | 22 |

May2015 seats forecasts are starting to prove highly volatile. perhaps they need to dampen down their calculators settings a little. As of writing they are sitting on the fence by putting both parties virtually neck and neck.

Electoralcalculus.co.uk

MO 28th Feb |

22nd Mar | 14th Mar | 9th Mar | 27th Feb | 30th Jan | |

| Conservative | 296 | 267 | 262 | 267 | 265 | 265 |

| Labour | 262 | 300 | 301 | 298 | 301 | 297 |

| SNP | 35 | 46 | 46 | 55 | 46 | 50 |

| Lib Dem | 30 | 57 | 17 | 15 | 17 | |

| UKIP | 5 | 1 | 1 | 1 | 1 | |

| Others | 22 | 22 |

Are a strange bunch, consistently strong bias towards Labour and trending in the opposite direction of other seat forecasters.

ElectionForecast.co.uk

MO 28th Feb |

22nd Mar | 11th Mar | 25th Feb | 13th Feb | |

| Conservative | 296 | 286 | 295 | 284 | 280 |

| Labour | 262 | 276 | 267 | 279 | 283 |

| SNP | 35 | 39 | 42 | 39 | 37 |

| Lib Dem | 30 | 26 | 24 | 25 | 27 |

| UKIP | 5 | 1 | 1 | 1 | 2 |

| Others | 22 | 22 |

Most closely matches my forecast of 28th Feb 2015.

The Guardian

MO 28th Feb |

18th Mar | 11th Mar | 27th Feb | 28th Jan | |

| Conservative | 296 | 277 | 279 | 276 | 273 |

| Labour | 262 | 269 | 266 | 271 | 273 |

| SNP | 35 | 53 | 52 | 51 | 49 |

| Lib Dem | 30 | 25 | 27 | 27 | 28 |

| UKIP | 5 | 4 | 4 | 3 | 5 |

| Others | 22 | 22 |

Again another mainstream forecaster that is giving an edge to the Conservatives, though here the swing between major parties is a very tight marginal 4 seats, so not far from being sat on the fence.

Analysis

Whilst George Osborne managed to generate a lot of good headlines such as with the Help to Buy ISA. However failure to detail how he would cut public spending by approx £50 billion per year left the Tories open to brutal savaging by the OBR and IFS who grabbed the headlines for several days with warnings of a severe roller coaster ride cuts of £65 billion per year for several years, which is probably a true reflection of what actually would transpire should the Conservatives win an outright majority, as it is not rocket science to realise that governments want to get the pain out of the way during the first 2 or 3 years and then bribe the voters for the last 2 years before the election.

So no budget bounce yet, but maybe when the OBR and IFS headlines subside the voters will forget about the prospects for severe austerity and instead focus on the bribes that they could personally capitalise upon, that and fears of an SNP-Labour catastrophe.

The extremely tight election race means that minor, even inconsequential events and revelations are going to be blown all out of proportions such as todays story of an asian Tory Candidate ***** up attempts at trying to manipulate local Right wing EDL to put on a fake anti-mosque march so that he could come across as Gandi-esk peace maker amongst the electorate. Unfortunately for him, the EDL were plotting their own double cross to entrap and exposure him as illustrated by the mainstream press running with about 30 seconds of footage apparently taken from 27 hours of covert footage. the net effect is that his political career is already over even before it had started and the Tories have egg on their face for a couple of days, leaving the EDL as winners for having out witted an asian Conservative parliamentary candidate.

Conclusion

If the current trend continues then an even tighter hung parliament than 2010 is possible, which is contrary to my view that the Conservatives could win an outright majority on May 7th as per my long standing analysis of seats vs house prices trend trajectory that painted a picture for a likely probable Conservative general election victory. Therefore in my opinion the opinion polls continue to portray an inaccurate picture as probability continues to favour the Tories over Labour to the extent that they could even win the May election.

16 Dec 2013 - UK General Election Forecast 2015, Who Will Win, Coalition, Conservative or Labour?

The updated election seats trend graph illustrates that the Conservatives are virtually ON TRACK to achieve the forecast outcome for an outright election victory on a majority of about 30 seats which NO ONE, and I mean no serious commentators / analysts has or is currently advocating.

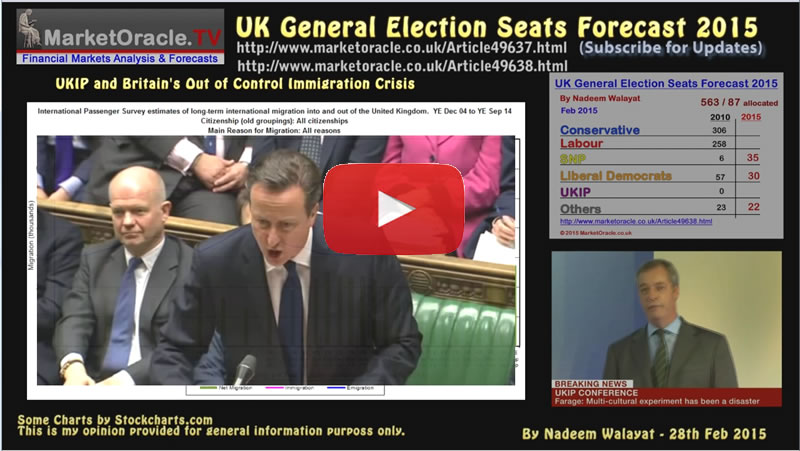

UK General Election Forecast 2015

In terms of what I actually see as the most probable outcome for the general election, I refer to my in-depth analysis that concluded in the following detailed seats per party forecast:

- 28 Feb 2015 - UK General Election 2015 Seats Forecast - Who Will Win?

- 28 Feb 2015 - UK General Election 2015 - Forecasting Seats for SNP, LIb-Dems, UKIP and Others

UK General Election May 2015 Forecast Conclusion

My forecast conclusion is for the Conservatives to win 296 seats at the May 7th general election, Labour 2nd on 262 seats, with the full seats per political party breakdown as follows:

Therefore the most probable outcome is for a continuation of the ConDem Coalition government on 326 seats (296+30) where any shortfall would likely find support from the DUP's 8 seats.

The alternative is for a truly messy Lab-Lib SNP supported chaotic government on 327 seats (262+30+35) which in my opinion would be a truly disastrous outcome for Britain, nearly as bad as if Scotland had voted for independence last September.

Another possibility is that should the Conservatives do better than forecast i.e. secure over 300 seats but still fail to win an overall majority, then they may chose to go it alone with the plan to work towards winning a May 2016 general election.

The bottom line is that the opinion polls do not reflect how people will actually vote on May 7th when they are faced with a stark choice of steady as she goes ConDem government or take a huge gamble on Ed Milliband's Labour party. So in my opinion several millions of voters will chose to play it safe with ConDem which thus is the most probable outcome.

Also available a youtube video version of my forecast:

Ensure you are subscribed to my always free newsletter for in-depth analysis and detailed trend forecast delivered to your email in box.

Source and comments - http://www.marketoracle.co.uk/Article49948.html

By Nadeem Walayat

Copyright © 2005-2015 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.