Stocks Bull Market New 2010 High, Weeks Featured Analysis

Stock-Markets / Financial Markets 2010 Jan 10, 2010 - 08:29 AM GMTBy: Nadeem_Walayat

Britain is again on the brink of economic and social collapse as the country faces its greatest crisis. well since last year, the new crisis is the Salt Crisis! As the country runs out of salt to grit the roads, with government ministers in a state of panic sending their dominions out into the lands supermarkets to buy up stock. The Royal Navy on the high sea's has been sent instructions to intercept salt shipments to other European countries with the army also being placed on high alert as mobs mass outside supermarkets attempting to get hold of the last few packets of salt. Okay so a slight exaggeration but it must be amusing to the peoples of north eastern europe of how a few snow flakes can bring Britain to a shuddering halt in a matter of days.

Britain is again on the brink of economic and social collapse as the country faces its greatest crisis. well since last year, the new crisis is the Salt Crisis! As the country runs out of salt to grit the roads, with government ministers in a state of panic sending their dominions out into the lands supermarkets to buy up stock. The Royal Navy on the high sea's has been sent instructions to intercept salt shipments to other European countries with the army also being placed on high alert as mobs mass outside supermarkets attempting to get hold of the last few packets of salt. Okay so a slight exaggeration but it must be amusing to the peoples of north eastern europe of how a few snow flakes can bring Britain to a shuddering halt in a matter of days.

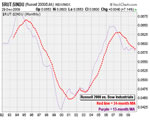

Whilst Britain freezes, the stocks bull market shrugged off bad U.S. jobs data to notch up a new high for the year hitting Dow 10,619 Friday, whilst the bears who missed the bottom continue to hope / pray for a crash / plunge back towards the March bear market lows.

I see a some bearish analysts have started to abandon hope and conclude that the Stock Market must be being manipulated higher. Which is something that I strongly, specifically and unequivocally voiced right at the birth of the stocks stealth bull market way back in March when investors had an opportunity to monetize on one of the greatest bull runs in history in the face of the prevailing bearish mantra of a bear market rally who's demise was always imminent.

The key point to recognise is that economic data, fundamentals and corporate earnings projections are IRRELVENTANT AT IMPORTANT MARKET JUNCTURES. Instead perma-analysts more interested in producing copy for print have a tendency to regurgitate the big media names points of view on the old bear market trend these past 9 months as to why it's end was surely always imminent much as we may read in today's press. Much as Deflationist are about to receive a smack in the face as inflation soars during he first few months of 2010, though because of the 'perma' mindset will continue to argue the deflation case by DISMISSING in your face Inflation data and instead focusing on obscure data sets that no one but the Deflationists pay any real attention to so as to support a delusional point of view.

My current focus is on completing the important UK interest rate in depth analysis and forecast due to be emailed out on the 12th of January (always free newsletter). After which my focus will shift to the inflation mega-trend ebook, UK house prices and then the stock market.

In depth analysis and forecasts completed for 2010 and beyond so far -

31 Dec 2009 - UK Economy GDP Growth Forecast 2010 and 2011, The Stealth Election Boom

UK Strong Economic Recovery 2010 +2.8%, Q1 2011 peak of +3.4% (year on year), 2011 End +2.3%. Q4 2009 +0.6%, Q1 2010 +1.1%. Q2 2010 + 1.3% Election Boom. Q3 2010 +0.9% Q4 2010 +0.6%, NO Double Dip Recession, NO Negative Quarters for 2010 or 2011.

27 Dec 2009 - UK CPI Inflation Forecast 2010, Imminent and Sustained Spike Above 3%

I expect UK inflation as measured by CPI to break above the Bank of England's upper CPI target of 3% very early in the year, and stay above 3% for most of the year only coming back below 3% late 2010 as a consequence of the next governments attempts to bring the unsustainable budget deficit under control.

Your focused analyst freezing his proverbial's off.

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. Twenty Five Financial Market Forecasts and Investment Trends for 2010 |

By: Nadeem_Walayat

Happy New Year!

2009, the year of the stealth stocks bull market has ended and now we enter 2010, the year of the stealth economic boom (above trend growth), despite having been a busy bee these past few weeks

| 2. Demise of The United States of America, An American Tragedy |

By: Darryl_R_Schoon

The demise of a nation is often at the hands of others; and, whereas the usual suspects are its enemies, allies and friends cannot be ruled out.

| 3. Financial Markets Outlook 2010, Wealth Protection and Investment Insurance in Unstable Times |

By: Elite_E_Services

We are not providing the solution, we are asking the question, how to protect wealth in uncertain times? The financial crisis has changed the lives of millions. One of them, Glen Pizzolorusso, used to be a subprime mortgage broker making more than $100,000 a month:

| 4. The Future of the United States, Systemic Fraud, Corruption and Financial Instability |

By: Craig Harris

As we close out 2009 and look forward into 2010 and beyond, this has been a year of near financial catastrophe and monumental change, none of which benefited America or ordinary Americans. Late in 2008 and throughout 2009, events have happened in the US which would have been labeled unfathomable just a few short years ago, and yet already these monumental changes are expected to be filed into the memory hole and Americans are expected to believe nothing has changed.

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

| 5. Signs of Economic Depression |

By: Mike_Stathis

I wanted to remind you not to lose sight of the big picture. It’s advisable to try to make money during an illusion only if you know the reality.

Remember, consumer confidence and investor sentiment can and often creates illusions that can lead to big gains in stock market. But at some point, reality sets in.

| 6. Fed Statements Clear Any Doubts of Gold Hitting $1,700 |

By: Ned_W_Schmidt

We must applaud the leadership of the Federal Reserve. That group is certainly attempting to be more efficient. Why wait till later in the year? Do it early, and get it done. Make a speech filled with what may go down as the height of economic drivel on the 2nd day of January, rather than later in the year. Maybe Chairman Bernanke thought if he spouted economic nonsense early in the year, most would forget his blundering leadership by year end.

| 7. The Gates of Financial and Economic Hell Have Opened |

By: Bob_Clark

The abyss is widening, many have already fallen in. The Fat Boys at Goldman say they are doing God's work, do they really believe that. Maybe they know dark secrets we are not privy to. What does God's work entail? Stopping fear and panic? Holding up asset prices and presenting the illusion of a stable, recovering economy? If they fail, then hell will follow.

| 8. 2010 Gathering Giant Economic and Financial Storm Clouds |

By: Jim_Willie_CB

The year 2008 bore my mark as the year the system broke. A public article addressed the issues, laid out before the breakdown occurred in September of that year. The consequences for the many failures, the desperate nationalizations, the hasty scrambles to put financial sewage under USGovt ownership, the realization of TARP as a vast slush fund for illegitimate bank rescues, the official monetization plans put forth to prevent bond implosions, and much more occurred in the year 2009 as a recognized aftermath. Here we are in 2010 and the threats must again be laid out.

| Subscription |

You're receiving this Email because you've registered with our website.

How to Subscribe

Click here to register and get our FREE Newsletter

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2010 MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions. ( Market Oracle Ltd , Registered in England and Wales, Company no 6387055.

Registered office: 226 Darnall Road, Sheffield S9 5AN , UK )

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.