Vote Labour Get SNP Catastrophe - General Election 2015 Forecast - Grand Coalition Possible

ElectionOracle / UK General Election Mar 08, 2015 - 05:47 AM GMTBy: Nadeem_Walayat

Poll after poll indicates that the Labour party faces a blood bath in Scotland that could result in the loss of as many as 40 of its 41 Scottish seats and thus making a Labour majority government impossible, that coupled with the Liberal Democrats national meltdown could result in the SNP increasing their seats tally from the current 6 to as many as 57 thus replacing the Liberal Democrats as Britain's third largest party.

Poll after poll indicates that the Labour party faces a blood bath in Scotland that could result in the loss of as many as 40 of its 41 Scottish seats and thus making a Labour majority government impossible, that coupled with the Liberal Democrats national meltdown could result in the SNP increasing their seats tally from the current 6 to as many as 57 thus replacing the Liberal Democrats as Britain's third largest party.

Journalists, politicians and think tank pundits have been busy war gaming the various possible permutations if which parties could come together to form a 326+ seat majority government on the release of each days opinion polls, which tend to be instantly analysed by a plethora of mainstream media backed election 2015 websites such as May2015.com (New Statesmen)

May2015.Com - Latest Polls analysis as of 5th March 2015.- Labour 283 seats

- Conservative 255 seats

- Lib Dems 27 seats

- UKIP 7 seats

- SNP 55 seats

- Others 23 seats

Election Gaming for 326 Seat Majority

- Labour 283 + Lib Dem 27 = 310 seats - FAIL

- Conservative 255 + Lib Dem 27 + DUP 8 = 290 Seats - FAIL

- Labour 283 + SNP 55 = 338 Seats - SUCCESS

The number crunching results are the political equivalent of the UK being nuked, and that without Trident! Which would be immediately scrapped as a pre-condition for SNP support and with it some 10,000 Scottish jobs.

The current polls and resulting seats projections if became manifest would result in the direst of outcomes for the UK in terms of a Labour Coalition with an effective Syrizia-esk I.S. entity north of the border whose primary objective is just as fanatically as that of the other I.S. we often hear much about in the media i.e. to DESTROY the United Kingdom.

Which having failed to do so last September at the ballot box, now I.S. has its eyes on destroying the UK from within the carcass of an inept Milliband led Labour-SNP Government.

The people of Britain should be under no illusion of what to expect from an Labour-SNP Government as I have iterated many times overt the past year and more recently some 3 weeks ago -

16 Feb 2015 - SNP-Syriza Labour Coalition Government Election Catastrophe, Debt Binge Before Breakup -

SNP-Syriza Bankrupting Britain All the Way to Independence

However, Britain's SNP Syriza-esk party are not done with the UK for their latest baldrick-esk cunning plan is to go into an unofficial Coalition with a Labour government by means of Syriza style taking as many as 30 of Labour's Scottish seats bringing their total to about 35 out of 59 and and thus ensuring that Labour in May 2015 would have zero chance of securing an outright election victory and probably even failing to become the largest party.

The SNP following the script of their euro-zone Syriza brethren will take their scottish majority to hold a minority Labour government to ransom as SNP-Syriza sees the UK purely as a cash cow to milk to the fullest extent possible as illustrated by their publicised agenda to ramp up UK government borrowing by an EXTRA £180 billion as illustrated by demands being made by the SNP leader, Nicola Sturgeon.

“I would certainly hope if there was a Labour government and it was dependent on SNP support - which is the most popular preferred outcome of people in Scotland - then I would hope we could persuade and influence a Labour government to take a more moderate approach to deficit reduction.”

“Debt and deficit would still be falling as a percentage of GDP over these years but we would free up something in the region of £180 billion over the UK to invest in growing the economy”.

However, as my warnings in the run up to the last 2010 General election warned that politician promises of debt and borrowing can be taken with a huge lump of salt as the likely outcome would be for one of many times greater level of borrowing, probably exceeding an EXTRA £500 billion, much as the Tories promises of bringing down the deficit and debt never materialised, and so the SNP's real agenda will be to literally suck the financial blood out of the UK before it went bust, disintegrating under the weight of an unserviceable debt mountain and a currency in collapse, primed for a new DEBT FREE Scottish Currency to be released onto the public as the SNP will have ensured that little or no share of UK debt & liabilities would be honoured.

29th June 2010 - UK ConLib Government to Use INFLATION Stealth Tax to Erode Value of Public Debt

Therefore it is difficult to see how the government will be able to achieve its stated budget reduction target of getting the annual deficit down to just £20 billion by 2015-16. Whilst the government is expected to trend close to target for the next 3 years, however thereafter the governments (OFBR) and my deficit forecasts diverge as the coalition governments primary focus will be towards getting re-elected in May 2015. In all likelihood this means that total debt will be over £100 billion higher than that which the government is forecasting as illustrated by the annual budget deficits forecast graph below-

Whilst the ConLib's deficit reduction targets represent an improvement under the Labour governments target that would have resulted in extra borrowing of £478 billion over the next 4 years if the Labour government managed to stick to its targets. However the ConLib government will still expand total debt by £414 billion over the next 4 years, and £471 billion over the next 6 years to reach £1,242 billion, so hardly an earth shattering improvement.

The following updated graph for UK public sector net debt clearly shows that the Coalition government has hit a deficit cutting road block because instead of the deficit falling to around £38 billion for 2014-15, the government will be lucky if the deficit comes in at under £100 billion. Furthermore the trend for persistently high deficits is expected to continue beyond the May 2015 general election as the Coalition government has ramped up deficit spending to buy votes, the net effect of which would be for a total additional debt of over £130 billion beyond the Coalition governments expectations to be added to Britain's debt mountain.

Therefore to imagine a Labour - SNP supported government is going to be able to stick to its debt promises is delusional because the often hyped of economic austerity Con-Dem Coalition are themselves looking set to borrow an extra £130 billion over that which they promised they would. Which means the £180 billion of extra SNP led borrowing could easily double to £360 billion of EXRA borrowing which implies that the current debt total of £1.5 trillion could easily soar to £2.5 trillion by the end of the next parliament, double the £500 billion of Coalition debt added to Britain's debt mountain that makes a mockery of politicians when they make claims that the deficit will be cut and debt repaid.

The only answer / solution that all governments have remains one of stealth default by means of high real inflation hence the Inflation Mega-trend. Inflation is a REQUIREMENT for the Debt Based Economy, this is how governments keep putting off the day of reckoning by attempting to inflate the debt away with printed money and then borrowing more money to service the debt interest which is why virtually all money in an economy is debt money that will NEVER be repaid.

When George Osbourne and David Cameron are stating that they are paying down Britain's debt, they are LYING! The same goes for Ed Milliband if he states that he will cut Britain's debt. NO GOVERNMENT DEBT IS BEING REPAID OR WILL EVER BE REPAID! Instead the truth is that the WHOLE of the economic growth (in real terms) since the May 2010 General Election and continuing into the May 2015 General Election will be wholly as a consequence of some £550 billion of additional DEBT. Again this is a very important point to note that ALL of the economic growth of this parliament is DEBT based, ALL of it, including the current election boom, the debt accrued over the 5 year term will equate to total real terms increase in GDP - virtually pound for pound which is why there is a cost of living crisis because printing money (debt) does not increase productivity, all it does is inflate the money supply.

You should realise by now that the constant drivel about the threats and risks of debt deflation are nothing more than propaganda so as to allow policies such as quantitative easing (money printing) to be more palatable to the general population so as to ensure that the Inflation Mega-trend continues, and all that an Labour-SNP pseudo coalition promises is an even greater magnitude to the cost of living crisis for Britains (England's) hard working tax payers as their productive capacity is funneled as election bribes towards Labour - SNP voting regions and the 8 million or so vested interests sat on their lard asses on benefits for life.

SNP and the Economics of the Oil Price Collapse

Those that may still delude themselves that under a socialist banner an SNP Labour government could be workable much as the Lib Dems and Conservatives have turned out to be, need to take into account not only the not so hidden agenda for the disintegration of the United Kingdom but that where economics are concerned the SNP are completely clueless as illustrated by Scotland's largest tax and revenue earning industry, North Sea Oil that is currently in a state of collapse.

Just as spectacular as the collapse in the oil price has been the collapse in the SNP's Economic Baldrick-esk Master Plan for an Independent Scotland that was wholly based on reaping huge rewards from North Sea oil exports where SNP propaganda had convinced many Scots to Vote to effectively commit economic and social suicide by voting Yes in last Septembers referendum that came close to achieving the catastrophe on the basis of propaganda implying upwards of £7 billion in North Sea oil tax revenues that would be raised to finance Scotland's budgetary black hole, which in the fever pitch of the campaign had reached the heights of £11 billion so as to exaggerate the degree to which Scotland could prosper and fill the void left by the withdrawal of the English subsidy that currently amounts to £9 billion per year.

Even the Governor of the Bank of England did not mince his words by warning "the Scottish economy was heading for a “negative shock”.

A Grand Coalition to Save the Union

An post election coalition permutation that is not even being seriously considered today would be one of keeping the highly destructive nationalists out of power at all costs even to the extent of Labour and Conservatives thinking the unthinkable by forming a grand coalition or more likely arrangement!

Yes such a government would be chaotic and probably not last no more than a couple of years, but still it would be better than the destruction to the UK that the SNP would wrought. So Labour and Conservative MP's could as they did last September in Scotland swallow their ideological differences in defence of the union.

Yes at this point in time such an outcome is highly improbable, nearly as improbable as a Con-Lib coalition was in 2010, but the important point is that it is POSSIBLE!

Such an outcome would likely send the SNP fanatics into a frenzy of making frothing at the mouth demands of this, that and the other, but all the politicians at Westminister would need to do is turn the volume off for the SNP's MP's tally would be near worthless against the overwhelming 550+ MP tally of the Con Lab government.

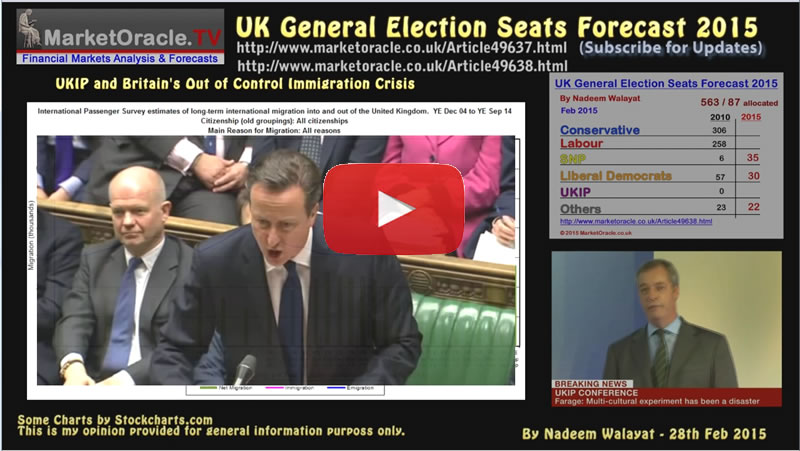

UK General Election Forecast 2015

Leaving aside the flip-flopping likes of May2015.com, that only a week ago were putting both parties virtually neck and neck. In terms of what I actually see as the most probable outcome for the general election, I refer to my recent in-depth analysis that concluded in the following detailed seats per party forecast:

- 28 Feb 2015 - UK General Election 2015 Seats Forecast - Who Will Win?

- 28 Feb 2015 - UK General Election 2015 - Forecasting Seats for SNP, LIb-Dems, UKIP and Others

UK General Election May 2015 Forecast Conclusion

My forecast conclusion is for the Conservatives to win 296 seats at the May 7th general election, Labour 2nd on 262 seats, with the full seats per political party breakdown as follows:

Therefore the most probable outcome is for a continuation of the ConDem Coalition government on 326 seats (296+30) where any shortfall would likely find support from the DUP's 8 seats.

The alternative is for a truly messy Lab-Lib SNP supported chaotic government on 327 seats (262+30+35) which in my opinion would be a truly disastrous outcome for Britain, nearly as bad as if Scotland had voted for independence last September.

Another possibility is that should the Conservatives do better than forecast i.e. secure over 300 seats but still fail to win an overall majority, then they may chose to go it alone with the plan to work towards winning a May 2016 general election.

The bottom line is that the opinion polls do not reflect how people will actually vote on May 7th when they are faced with a stark choice of steady as she goes ConDem government or take a huge gamble on Ed Milliband's Labour party. So in my opinion several millions of voters will chose to play it safe with ConDem which thus is the most probable outcome.

Also available a youtube video version of my forecast:

In terms of that which I consider the most probable, a vote for Labour is a vote for a Lab-SNP catastrophe in the event of which would only be avoided by means of an Con-Lab grand coalition of sorts or a very weak minority government just lingering on for a year or so with little power to get much through Westminister.

Therefore the only logical answer is for those in Scotland that oppose continuing SNP Independence fanaticism despite losing the referendum by a clear margin, to vote tactically for either Labour, Conservative or even Liberal Democrat, whomever has the electoral advantage against the SNP in an particular seat so as to limit the number of SNP seats to a far less destructive 30-35.

Source and Comments: http://www.marketoracle.co.uk/Article49738.html

By Nadeem Walayat

Copyright © 2005-2015 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.