Analysis Topic: Commodity Markets - Metals, Softs & Oils

The analysis published under this topic are as follows.Friday, January 16, 2009

Silver and the Minimum Wage / Commodities / Gold & Silver 2009

By: David_Morgan

Many of us who write about the precious metals field have put out their 2009 forecasts and predictions for the New Year. This writer is no exception, but it seemed to me that it might be nice to look at my mission statement and determine if I could compose a simple story that might engage the reader to think about the current dire state of affairs in the economy and how an honest “money” system might help on an individual basis.Read full article... Read full article...

Friday, January 16, 2009

Crude Oil Record Contango Situation Causing Producers to Hoard Supplies / Commodities / Crude Oil

By: Mike_Shedlock

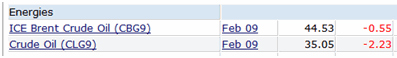

West Texas Intermediate Crude ( WTIC ) typically trades at a premium to Brent Crude (North Sea). Lately the pattern has reversed and now the WTIC discount to Brent is staggering as the following chart of the February contract captured on Thursday shows.

West Texas Intermediate Crude ( WTIC ) typically trades at a premium to Brent Crude (North Sea). Lately the pattern has reversed and now the WTIC discount to Brent is staggering as the following chart of the February contract captured on Thursday shows.

Read full article... Read full article...

Friday, January 16, 2009

Gold Rallies with Stocks as $1.3 trillion of "Aid" Caps the U.S. Dollar / Commodities / Gold & Silver 2009

By: Adrian_Ash

SPOT GOLD BULLION rose further from yesterday's 5-week low early Friday in London, bouncing together with world stock markets after Washington pumped more than $1.3 trillion into the US financial and economic systems.This fresh flood of money – promised in a series of announcements – put a floor beneath Wall Street stocks, commodity prices and foreign currencies, sparking a rally in all asset classes bar government bonds.

Read full article... Read full article...

Thursday, January 15, 2009

Bear Market in Crude Oil / Commodities / Crude Oil

By: David_Shvartsman

Crude oil was off as much as 10 percent during Thursday's trading on the NYMEX, before closing the session 5 percent lower at $35.40. Reuters has the story ." Oil prices fell more than 10 percent on Thursday to a one-month low as thickening economic gloom added to expectations that world energy demand would keep shrinking.

Read full article... Read full article...

Thursday, January 15, 2009

Will Gold Skyrocket to New Highs? / Commodities / Gold & Silver 2009

By: Money_and_Markets

Larry Edelson writes: In my August 2 and September 6, 2007 , Money and Markets columns, with gold trading at $664 and $694, respectively, I told you to increase your core gold holdings.

Larry Edelson writes: In my August 2 and September 6, 2007 , Money and Markets columns, with gold trading at $664 and $694, respectively, I told you to increase your core gold holdings.

Since then, gold has risen to $855, a gain of as much as 28.7%. Assuming you had invested equal amounts on the aforementioned dates, your gold positions have gained an impressive 25.9%.

Read full article... Read full article...

Thursday, January 15, 2009

The Pump is Primed, Crude Oil Set To Go Higher / Commodities / Crude Oil

By: Mac_Slavo

Off over $100 since its high in mid-2008, oil seems set to be set for some upward movement. Internationally renound commodities investor Jim Rogers was recently quoted on his forecast:

Off over $100 since its high in mid-2008, oil seems set to be set for some upward movement. Internationally renound commodities investor Jim Rogers was recently quoted on his forecast:

We're going to see US$200 oil at some point, it may be by 2013. It's a sad fact but the world is running out of known oil. Oil will make a big comeback

Read full article... Read full article...

Thursday, January 15, 2009

Gold Unmoved by ECB Interest Rate Cut / Commodities / Gold & Silver 2009

By: Adrian_Ash

THE PRICE OF WHOLESALE GOLD BULLION was left little changed by the widely-anticipated cut to Eurozone interest rates Thursday, trading at $809 an ounce in London – and down more than 5% for the week so far – as global stock markets plunged yet again.The European Central Bank (ECB) lopped 0.5% off its key interest rate, taking it back to the record low of 2.0% hit during the last global "Deflation Scare" of 2001-2004.

Read full article... Read full article...

Thursday, January 15, 2009

Gold Trades Flat Ahead of ECB Interest Rate Decision / Commodities / Gold & Silver 2009

By: Mark_OByrne

Gold is marginally higher today but has fallen to one month lows as markets await the ECB interest rate decision. The ECB is expected to cut by 0.5% today and that has put the euro and gold under pressure as the dollar has strengthened in recent days.Read full article... Read full article...

Thursday, January 15, 2009

Trading Gold Using Gold Stocks as an Leading indicator / Commodities / Gold & Silver 2009

By: Chris_Vermeulen

I find from time and time that gold stocks tend to lead the price of gold during extreme times and as I mentioned in last weeks report the HUI index has warned us up to 7 days in advance, before gold made sizable drop. Well this week is a perfect example in my opinion.

I find from time and time that gold stocks tend to lead the price of gold during extreme times and as I mentioned in last weeks report the HUI index has warned us up to 7 days in advance, before gold made sizable drop. Well this week is a perfect example in my opinion.

The charts below show how gold stocks became bearish much quicker than the price of gold indicating we should see lower gold prices soon. This time the HUI index gave us 5 days advance warning that gold will eventually drop quickly to catch up and the chart below show this.

Read full article... Read full article...

Wednesday, January 14, 2009

Gold Spot to Futures Price Gap Portends for Price Boom / Commodities / Gold & Silver 2009

By: John_Browne

Most consider the New York market ‘spot’ price for an accurate indication of the true price. However, investors now buying buy physical or ‘fabricated’ gold, are paying a premium of between $20 and $30 per ounce. When these gaps existed in the past, major increases in the price of gold were imminent.

Most consider the New York market ‘spot’ price for an accurate indication of the true price. However, investors now buying buy physical or ‘fabricated’ gold, are paying a premium of between $20 and $30 per ounce. When these gaps existed in the past, major increases in the price of gold were imminent. Read full article... Read full article...

Wednesday, January 14, 2009

The "Truth" About the Gold Market Today / Commodities / Gold & Silver 2009

By: Adrian_Ash

Just what is the link between retail gold coin prices and the apparent manipulation of gold futures & options...?

Just what is the link between retail gold coin prices and the apparent manipulation of gold futures & options...? YOU MAY HAVE SEEN some rather wild commentary of late concerning gold and silver prices. I can't vouch for the silver market – small, tight and still dependent on fast-falling industrial demand though it is. But as regards Gold Bullion , this sensational "analysis" mistakes the key basics of how the gold market actually works.

Read full article... Read full article...

Wednesday, January 14, 2009

Making Money in Troubled Times, Precious Metals Investing / Commodities / Gold & Silver 2009

By: Nick_Barisheff

Keynote Speech Presented by Nick Barisheff at the Empire Club's 15th Annual Investment Outlook Luncheon -

Thursday January 8, 2009. Today's topic at this 15th Annual Investment Outlook is “Making Money in Troubled Times”. This may be quite a challenge in 2009 if investors continue to do what they've always done. However, there is always a bull market somewhere and making money in troubled times is possible if you correctly identify the dominant trends and adjust your portfolios accordingly.

Keynote Speech Presented by Nick Barisheff at the Empire Club's 15th Annual Investment Outlook Luncheon -

Thursday January 8, 2009. Today's topic at this 15th Annual Investment Outlook is “Making Money in Troubled Times”. This may be quite a challenge in 2009 if investors continue to do what they've always done. However, there is always a bull market somewhere and making money in troubled times is possible if you correctly identify the dominant trends and adjust your portfolios accordingly. Read full article... Read full article...

Wednesday, January 14, 2009

Forecasting Crude Oil Price Through the Gold Ratio / Commodities / Crude Oil

By: Richard_Shaw

If you assume (and that is a uncertain assumption) that gold is fairly priced, and that oil is in search of its fair price, it may be possible to glimpse the “fair value” of crude oil by examining the historical price relationship between the two commodities.

If you assume (and that is a uncertain assumption) that gold is fairly priced, and that oil is in search of its fair price, it may be possible to glimpse the “fair value” of crude oil by examining the historical price relationship between the two commodities. Read full article... Read full article...

Wednesday, January 14, 2009

Gold Steady as Stock Markets Head Sharply Lower / Commodities / Gold & Silver 2009

By: Adrian_Ash

SPOT GOLD PRICES ticked down from a two-day peak after the London Gold Fix on Wednesday morning, slipping to $823 an ounce as European stock markets slumped for the fifth session running.Crude oil pushed up to $39 per barrel – a level first breached in May 2004 – while government bond prices slipped lower worldwide, pushing the 10-year German bund yield back above 3.0%.

Read full article... Read full article...

Tuesday, January 13, 2009

Upside Continuation for Crude Oil USO ETF / Commodities / Crude Oil

By: Mike_Paulenoff

Let's have a look at my updated hourly chart analytics of the US Oil Fund ETF (NYSE: USO), and bear in mind, that the API (American Petrol Institute) inventory data now come out on Tuesday's after the close (I think 4:30 PM ET), while the DOE data come out on Wed.'s at 10:35 AM ET, which adds a bit of volatility and decision-making to situation.

Let's have a look at my updated hourly chart analytics of the US Oil Fund ETF (NYSE: USO), and bear in mind, that the API (American Petrol Institute) inventory data now come out on Tuesday's after the close (I think 4:30 PM ET), while the DOE data come out on Wed.'s at 10:35 AM ET, which adds a bit of volatility and decision-making to situation. Read full article... Read full article...

Tuesday, January 13, 2009

Agri-Foods Bullish Outlook due to Over Optimistic USDA Crop Forecasts / Commodities / Agricultural Commodities

By: Ned_W_Schmidt

Remember as we have talked before, commodities is not a homogeneous asset class. It includes three asset groups, each with distinctively different dynamics and drivers. Energy group, for one, includes oil, natural gas, uranium, etc. Mineral ores, the second group, includes iron, copper, Gold, etc. Third group is Agri-Food, which includes corn, soybeans, pork, etc. That latter group is now again separating itself from the others, and moving on its own path.

Remember as we have talked before, commodities is not a homogeneous asset class. It includes three asset groups, each with distinctively different dynamics and drivers. Energy group, for one, includes oil, natural gas, uranium, etc. Mineral ores, the second group, includes iron, copper, Gold, etc. Third group is Agri-Food, which includes corn, soybeans, pork, etc. That latter group is now again separating itself from the others, and moving on its own path. Read full article... Read full article...

Tuesday, January 13, 2009

Fuel Cell Cars Provide New Uses for Rhodium, Platinum / Commodities / Renewable Energy

By: Mac_Slavo

The recent price lows of Rhodium ($1200 an ounce) suggest that investors are worried about its future needs in car manufacturing. Rhodium, a noble metal, is primarily used in catalytic converters for combustion engine vehicles. Because of the recent down-turn in the auto industry, investors have stayed away from the metal over concerns of reduced usage in manufacturing. The price of platinum has been affected for similar reasons.Read full article... Read full article...

Tuesday, January 13, 2009

Gold Trends Lower as Dollar Rally Continues / Commodities / Gold & Silver 2009

By: Adrian_Ash

THE PRICE OF GOLD BULLION let slip a 0.9% spike Tuesday lunchtime in London, struggling near a one-month low as world stock markets tumbled for the fourth session running.Both the US Dollar and Japanese rose yet again on the currency market, while crude oil fell back to $36.50 per barrel.

Read full article... Read full article...

Tuesday, January 13, 2009

Gold and the New Era, The Financial Times They Are A'changin' / Commodities / Gold & Silver 2009

By: Darryl_R_Schoon

Change is never easy and extreme change is the most difficult of all - Twelve years ago, the esteemed Financial Times in an editorial announced The Death of Gold ; and, in 2004, another contributor to FT noted, the end of gold as an investment has come a little closer .

Change is never easy and extreme change is the most difficult of all - Twelve years ago, the esteemed Financial Times in an editorial announced The Death of Gold ; and, in 2004, another contributor to FT noted, the end of gold as an investment has come a little closer .

Recently, however, on January 5, 2009 the Financial Times published David Hale's There Is Only One Alternative To The Dollar . Long-time subscribers to FT may be surprised to find that alternative to be gold—or, then again, they may not be surprised at all.

Read full article... Read full article...

Monday, January 12, 2009

Monsanto’s Law Suits, GMO, Commodites and How You Can Profit / Commodities / Agricultural Commodities

By: Mac_Slavo

A recently published story by independent columnist Lynn Cohen-Cole recently, Monsanto Investigator in Illinois Laughs They Are Doing ‘Rural Cleansing' , reports that Monstanto has begun serving warrants on seed cleaners. Though not a well-known profession outside of farming, seed cleaners basically take left over plant material and seperate out the seeds for use in the next season. Because many of these seeds are patented GMO products, farmers are restricted by law from doing this without paying a licensing or royalty fee to the patent owner. Monsanto is targeting the seed cleaners as facilitators of illegal actions.

A recently published story by independent columnist Lynn Cohen-Cole recently, Monsanto Investigator in Illinois Laughs They Are Doing ‘Rural Cleansing' , reports that Monstanto has begun serving warrants on seed cleaners. Though not a well-known profession outside of farming, seed cleaners basically take left over plant material and seperate out the seeds for use in the next season. Because many of these seeds are patented GMO products, farmers are restricted by law from doing this without paying a licensing or royalty fee to the patent owner. Monsanto is targeting the seed cleaners as facilitators of illegal actions. Read full article... Read full article...