Analysis Topic: Commodity Markets - Metals, Softs & Oils

The analysis published under this topic are as follows.Saturday, January 19, 2019

David Morgan: Expect Stagflation and Silver Outperformance in 2019 / Commodities / Gold & Silver 2019

By: MoneyMetals

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up our good friend David Morgan of The Morgan Report joins me for a conversation on a range of topics, including his 2019 outlook for a number of different asset classes, most notably gold and silver. Don’t miss a fantastic preview of 2019 with the Silver Guru, David Morgan, coming up after this week’s market update.

Gold and silver markets are trading relatively quiet this week as the U.S. stock market continues to show surprising strength. It’s surprising at least to investors who expected markets to reflect growing political threats to the economy. As the partial government shutdown enters an unprecedented 28th day, economists are warning of a significant hit to first quarter GDP.

It’s not that furloughed government workers contribute much to economic productivity. It’s that since they are now starting to miss paychecks, they will have less to spend into the economy. GDP measures the nominal size of the economy, not how productive or efficient or free or fair it is.

Read full article... Read full article...

Friday, January 18, 2019

Gold Surges on Stock Selloff / Commodities / Gold and Silver Stocks 2019

By: Zeal_LLC

Gold investment demand reversed sharply higher in recent months, fueling a strong gold rally. The big stock-market selloff rekindled interest in prudently diversifying stock-heavy portfolios with counter-moving gold. These mounting investment-capital inflows into gold are likely to persist and intensify. Both weaker stock markets and higher gold prices will continue to drive more investment demand, growing gold’s upleg.

Gold investment demand reversed sharply higher in recent months, fueling a strong gold rally. The big stock-market selloff rekindled interest in prudently diversifying stock-heavy portfolios with counter-moving gold. These mounting investment-capital inflows into gold are likely to persist and intensify. Both weaker stock markets and higher gold prices will continue to drive more investment demand, growing gold’s upleg.

Early in Q4’18, gold reached a major inflection point. It languished during the first three quarters of 2018, down 8.5% year-to-date by the end of Q3. Investors wanted nothing to do with alternative investments with the stock markets powering to new record highs. The flagship S&P 500 broad-market stock index (SPX) had rallied 9.0% in the first 3/4ths of last year. That left gold deeply out of favor heading into Q4.

But a critical psychological switch was flipped as the SPX started sliding last quarter. After long years with little material downside, stock traders had been lulled into overpowering complacency. They were shocked awake as the SPX plunged 14.0% in Q4, its worst quarter since Q3’11. They poured back into gold as stocks burned, driving it a strong 7.6% higher in Q4! Rekindled investment demand was the driver.

Read full article... Read full article...

Friday, January 18, 2019

Macroeconomic Outlook for 2019 and Gold / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

Will 2019 be better than 2018 for the yellow metal? We invite you to read our today’s article, painting the macroeconomic outlook for 2018 and learn whether fundamental factors will become less or more friendly toward gold.

Will 2019 be better than 2018 for the yellow metal? We invite you to read our today’s article, painting the macroeconomic outlook for 2018 and learn whether fundamental factors will become less or more friendly toward gold.

What will 2019 be like? We do not know the precise answer, but we notice a few important economic trends that will shape the new year.

1. Interest rates will continue to rise.

2. However, the Fed’s monetary tightening will slow down.

3. Just when the ECB will start normalizing its own monetary policy.

4. And when the stimulus of the US fiscal policy will start to dissipate.

Friday, January 18, 2019

Crude Oil Price Will Find Strong Resistance Between $52~55 / Commodities / Crude Oil

By: Chris_Vermeulen

Our Adaptive Fibonacci modeling system is suggesting Crude Oil may have already reached very strong resistance levels just above $50 ppb. It is our opinion that a failed rally above $55 ppb will result in another downward price move where prices could retest the $42 low – or lower.

You can see from this Daily Crude oil chart that price has formed a consolidated price channel between $50 and $53 ppb. This price channel aligns with a November 2018 price consolidation zone. It is our belief that any advance above $55~56 ppb, will result in a new upward price move to $64-65 ppb.

Read full article... Read full article...

Thursday, January 17, 2019

No for Brexit Deal, Yes for May. And What for Gold? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

71 days. That’s all that separates us from the Brexit deadline. And the UK has still no clear path forward exiting the EU. Does gold have one?

71 days. That’s all that separates us from the Brexit deadline. And the UK has still no clear path forward exiting the EU. Does gold have one?

Today's analysis features possible scenarios for the UK and for gold along with their likelihood. In the current political situation, it's a must-read.

Parliament Rejects May’s Brexit Deal

On Tuesday, the UK Parliament voted on Theresa May’s Brexit deal for leaving the EU. As expected, the MPs rejected her proposition. What was really surprising was the scale of defeat. The parliament voted 432-202 against May’s divorce deal, marking the worst defeat in modern British history.

Read full article... Read full article...

Wednesday, January 16, 2019

Gold Holds Steady Over £1,000 – Increased Likelihood Of A Disorderly Brexit / Commodities / Gold & Silver 2019

By: GoldCore

– Gold supported near $1,300/oz ahead of important British Brexit no-confidence vote

– Gold is consolidating in range between $1,280 and $1,300/oz (over £1,000/oz and €1,100/oz) – A break of resistance at $1,300 will likely see gold rise rapidly in all currencies

– Physical demand for gold coins and bars has picked up in the UK and Ireland, aided by Brexit uncertainty

Wednesday, January 16, 2019

Gold Price – US$700 Or US$7000? / Commodities / Gold & Silver 2019

By: Kelsey_Williams

Does either of the above preclude the other? In other words, if we expect gold to reach $7000.00 per ounce, and we are correct, does that mean that we can’t reasonably expect gold to go as low as $700.00 per ounce? Conversely, if we are predicting or expecting gold to decline from its current level and even breach $1000.00 per ounce on the downside, can $7000.00 per ounce, or anything even remotely close to that number, be a reasonable possibility?

Does either of the above preclude the other? In other words, if we expect gold to reach $7000.00 per ounce, and we are correct, does that mean that we can’t reasonably expect gold to go as low as $700.00 per ounce? Conversely, if we are predicting or expecting gold to decline from its current level and even breach $1000.00 per ounce on the downside, can $7000.00 per ounce, or anything even remotely close to that number, be a reasonable possibility?

I do not think either one precludes the other. In fact, I think it is entirely possible that we can see bothfigures. And not necessarily spread over an inordinately long period of time, either.

Here is a possible scenario that would allow that to happen.

As the U.S dollar strengthens, the U.S. dollar price of gold declines. This is clearly evident in the price action of gold since its high point of approximately $1900.00 per ounce in 2011. There is no way to know for certain how long relative dollar strength will last. And it is reasonable that if ongoing dollar strength takes gold below $1000, it might come to rest somewhere between $860 – 890.00 per ounce. In January 1980, gold peaked at $850.00. Revisiting that number is plausible, and well within the realm of realistic speculation. And, yes, there are technical indicators that point to a gold price of as low as $700.00 per ounce.

Read full article... Read full article...

Wednesday, January 16, 2019

Rare earths deja vu: Chinese crackdown = higher prices / Commodities / Rare Earths

By: Richard_Mills

In a scene awfully familiar to those who follow the rare earths market, China is once again threatening to hatchet production of the valuable minerals used in high-tech, renewable energy and military applications.

In a scene awfully familiar to those who follow the rare earths market, China is once again threatening to hatchet production of the valuable minerals used in high-tech, renewable energy and military applications.

Last week it was reported that the Chinese government published new guidelines designed to eliminate illegal mining and encourage more high-end processing. Those sterile words are code for “less polluting”.

Shutting down illegal rare earth mines is nothing new to the Chinese, who have found that the process of extracting rare earth oxides from ore and refining them into useable products has come at a high price to the environment.

Read full article... Read full article...

Wednesday, January 16, 2019

Commodities Are the Right Story for 2019 / Commodities / Commodities Trading

By: Richard_Mills

The markets are up and down like a bride's nightgown, as my dad used to say, bitcoin is in the toilet, and tech stocks, once as steady as the banks, are as unreliable as an old Apple computer. If you’re reluctant to dip your toe back into the stock market, you’re not alone.

The markets are up and down like a bride's nightgown, as my dad used to say, bitcoin is in the toilet, and tech stocks, once as steady as the banks, are as unreliable as an old Apple computer. If you’re reluctant to dip your toe back into the stock market, you’re not alone.

‘The Hunt for Red October’ was a great movie but nobody thought ‘Red October’ would actually happen. In October it did. Anyone that was invested saw their equities turn as red as a Russian submarine commander. The S&P 500 churned. When the calendar mercifully turned to November, the benchmark US stock index had fallen 8.5%, the worst month since February 2009 and the ugliest October since the collapse of Lehman Brothers in 2008. The Dow and the Nasdaq were equally pummeled.

And then it kept going. December was the worst month since the Great Depression. The financial talking heads couldn’t decide what was going on. The trade war with China, speculation that the Federal Reserve would raise interest rates in December (it did) and slowing global growth, were all trotted out as culprits. Algorithmic trading and end-of-the-year tax selling also played a role, as did good old profit-taking by retail investors, who figured it was as good a time as any to exit a nine-year bull market.

Read full article... Read full article...

Monday, January 14, 2019

New Shortfall in Production Capacity for Fabricated Silver and Gold / Commodities / Gold & Silver 2019

By: MoneyMetals

The two largest private producers of bullion bars and rounds in the U.S. have gone defunct over the past two years. Premiums for silver bars and rounds are already on the rise as markets adjust to the lack of supply.At present, demand for these products is manageable. A surge in buying activity, however, could lead to serious difficulty finding low-premium products.

Monday, January 14, 2019

Gold A Rally or a Bull Market? / Commodities / Gold & Silver 2019

By: Jordan_Roy_Byrne

Although the financial media conflates the two, there is a difference between a rally and a bull market.

Although the financial media conflates the two, there is a difference between a rally and a bull market.

A rally implies a rebound after or a reprieve from weakness. A bull market is higher highs and higher lows for a period of at least a few years.

Gold’s strength in the 2000s was not a rally, as many have deemed it, but a bull market. Gold’s rebound in 2016 was a rally.

Nevermind the Gold pundits who insist Gold is in an invisible or stealth bull market or even a correction. A market that pops for seven months then doesn’t make a new high for almost two and a half years is not a bull market.

Read full article... Read full article...

Monday, January 14, 2019

Will Natural Gas Breakout Or Breakdown Next? / Commodities / Natural Gas

By: Chris_Vermeulen

We called the move from $4.75 to $2.90 in Natural Gas, and our predictive modeling solutions are suggesting a new upside rally in price is setting up for early Spring.

We called the move from $4.75 to $2.90 in Natural Gas, and our predictive modeling solutions are suggesting a new upside rally in price is setting up for early Spring.

Very cold weather across the Northwest and Eastern US, as well as moderate demand globally, should prompt a renewed rally in Natural Gas through at least March or April of 2019. A move to, or above, $3.30~$3.40 would indicate there is little chance of a Washout-Low price formation and that a new rally is in place.

Read full article... Read full article...

Monday, January 14, 2019

Gold Stocks, Dollar and Oil Cycle Moves to Profit from in 2019 / Commodities / Gold and Silver Stocks 2019

By: readtheticker

Every thing has a cyclical manner, some more than others. And when price and the cycle runs together, it great to be in it for the ride! Of course fundamentals are the reason for a price move, yet the laws of nature seems to co ordinate fundamentals, price and time together, hence the outcome can be seen via a sine wave cycle. If you use some math called 'Bartels' (more here) you can scan many sine waves periods to see if they fit into your price time series, each time series will have it's own characteristics, some cycles will be a better with either a daily, weekly or monthly periods. Back testing the cycle is critical, as cycles do come into form and fall out of form, but over time they do add to the investors arsenal while working out the next risk reward price move. Consider these possible big movers in 2019.

Every thing has a cyclical manner, some more than others. And when price and the cycle runs together, it great to be in it for the ride! Of course fundamentals are the reason for a price move, yet the laws of nature seems to co ordinate fundamentals, price and time together, hence the outcome can be seen via a sine wave cycle. If you use some math called 'Bartels' (more here) you can scan many sine waves periods to see if they fit into your price time series, each time series will have it's own characteristics, some cycles will be a better with either a daily, weekly or monthly periods. Back testing the cycle is critical, as cycles do come into form and fall out of form, but over time they do add to the investors arsenal while working out the next risk reward price move. Consider these possible big movers in 2019.

Sunday, January 13, 2019

Top Ten Trends Lead to Gold Price / Commodities / Gold & Silver 2019

By: Jim_Willie_CB

The year 2018 was a memorable year of great transitions. They involved changes in the political arena. They saw enormous changes in the debt picture, for both the USGovt and the major Western corporations. They saw a struggle to terminate the QE bond monetization, laced with hype-inflation. They offered staggering damage to California, whose effects are easily 100 times greater than the World Trade Center fallout. They offered resistance to the US-led bully tactics, in slapping sanctions even on the US allies, a forecast by the Jackass two years ago. The globalist cabal agenda has been dealt a powerful damaging blow, perhaps lethal, during a year of great exposure for their criminality. The transitions offered a complete shift away from the perception of USMilitary full spectrum dominance. But the most important changes have come in the finance & economic sectors.

The year 2018 was a memorable year of great transitions. They involved changes in the political arena. They saw enormous changes in the debt picture, for both the USGovt and the major Western corporations. They saw a struggle to terminate the QE bond monetization, laced with hype-inflation. They offered staggering damage to California, whose effects are easily 100 times greater than the World Trade Center fallout. They offered resistance to the US-led bully tactics, in slapping sanctions even on the US allies, a forecast by the Jackass two years ago. The globalist cabal agenda has been dealt a powerful damaging blow, perhaps lethal, during a year of great exposure for their criminality. The transitions offered a complete shift away from the perception of USMilitary full spectrum dominance. But the most important changes have come in the finance & economic sectors.

The Gold Standard has seen a paved road for its implementation, arrival, and acceptance. The road can be identified for its several major constructed arteries. The pathways are built by the Eastern nations, which will continue to champion the financial reform, and thus wrest global control from New York and London. History is being made. It will still take time, but the momentum is gathering in a notable and convincing manner. The common theme of all the leading factors is the movement away from the USDollar, a theme so popular and widespread that it has been given a name, de-Dollarization. In the next year, even the compromised corrupted Wall Street bank community will openly discuss that Gold must be the solution to the unresolved crisis.

Read full article... Read full article...

Sunday, January 13, 2019

Silver: A Long Term Perspective / Commodities / Gold & Silver 2019

By: Rambus_Chartology

Tonight I would like to show you a couple of long term charts for Silver that puts where silver is currently trading into perspective. We can look at the hourly charts or even the daily charts for the short term patterns, but if you really want know where a stock is relative to its history we need to look at the long term view. The more history a stock has the more relative the current price action is.

Tonight I would like to show you a couple of long term charts for Silver that puts where silver is currently trading into perspective. We can look at the hourly charts or even the daily charts for the short term patterns, but if you really want know where a stock is relative to its history we need to look at the long term view. The more history a stock has the more relative the current price action is.

Lets start with a 16 year monthly chart for silver which seems like a long time but in the big picture it only shows us a small part of its history. The dominate chart pattern is the 2011 bear market downtrend channel which is almost perfectly parallel. I purposely left the top rail of the 2011 downtrend channel and the top rail of the 2016 triangle thin so you can see the critical area silver is now trading at, red circle. So far this month silver has traded as high as 15.95 which puts it right against the top rail of the 2011 bear market downtrend channel and the top rail of the 2016 triangle.

Read full article... Read full article...

Saturday, January 12, 2019

Big Silver Move Foreshadowed as Industrial Panic Looms / Commodities / Gold & Silver 2019

By: MoneyMetals

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up we’ll hear one of the more important interviews we’ve ever done on the broken nature of the precious metals’ futures exchanges, and what might be the driving force that ultimately destroys the confidence in these markets, paving the way to true price discovery. Mining analyst and precious metals expert David Jensen joins me to talk about how palladium might just be the straw that breaks the back of the paper market. Don’t miss this must-hear interview, coming up after this week’s market update.

As the government shutdown persists, and a declaration of national emergency by President Donald Trump looms, financial markets are unfazed. The Dow Jones Industrials have swung approximately 500 points higher so far this week.

However, the U.S. Dollar Index did hit a 3-month low on Wednesday. That helped boost oil prices in a big way. Crude climbed 10% to $53 a barrel.

The price action in precious metal markets is more subdued. Gold shows a modest gain of 0.4% this week to bring spot prices to $1,291 per ounce. The yellow metal flirted with the $1,300 level last Friday. More backing and filling may be needed before the market is ready to push through that resistance.

Read full article... Read full article...

Saturday, January 12, 2019

Gold GDXJ Upside Bests GDX / Commodities / Gold and Silver Stocks 2019

By: Zeal_LLC

Gold miners’ exchange-traded funds are surging with gold powering higher. These mounting gains are naturally fueling growing interest in the leading gold-stock investment vehicles. Traders looking to deploy capital are wondering which major gold-stock ETF is superior, offering the best balance between upside potential, component fundamentals, and risks. GDXJ takes the crown, besting its larger big brother GDX.

Gold miners’ exchange-traded funds are surging with gold powering higher. These mounting gains are naturally fueling growing interest in the leading gold-stock investment vehicles. Traders looking to deploy capital are wondering which major gold-stock ETF is superior, offering the best balance between upside potential, component fundamentals, and risks. GDXJ takes the crown, besting its larger big brother GDX.

By my count, there are currently 14 gold miners ETFs trading in US markets. But that’s not authoritative, as the broader ETF industry is constantly in flux. These gold-stock ETFs collectively held $17.5b in net assets as of the middle of this week. And two major ETFs utterly dominated, commanding fully 85.1% of all those gold-stock investments! They are of course GDX and GDXJ, which dwarf everything else in this sector.

Read full article... Read full article...

Friday, January 11, 2019

Is It Time To Prepare For The Precious Metals To Get Whacked? / Commodities / Gold & Silver 2019

By: Avi_Gilburt

This article was originally published on Sun Jan 6 for members of ElliottWaveTrader: Over the last several weeks, I have seen those that were absolutely certain back in September and October that gold was going to drop below $1,000 now turn into major bulls in the metals complex. The silver rally especially has gotten the attention of many metal’s traders, and has everyone now all bulled up for a major break out in the complex.

It really is amazing to watch how price extremes dictate the manner in which investor’s views are driven about a market. Yet, as Roy Prassad, one of our more astute members at Elliottwavetrader.net, noted: “the goal of Elliott Wave is to analyze sentiment, not participate in it.”

Read full article... Read full article...

Thursday, January 10, 2019

Will Powell’s Put Support Gold? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

Fed signals more patience with its monetary tightening, despite strong economy. Why? And what does it mean for the gold market?

Fed signals more patience with its monetary tightening, despite strong economy. Why? And what does it mean for the gold market?

Minutes from December FOMC Meeting and Gold

As everybody knows, in December the FOMC voted unanimously to raise interest rates for the fourth time in 2018. We have analyzed the implications of that hike for gold in two editions of the Gold News Monitor (here and here).

However, yesterday, the Fed published the minutes of its latest monetary policy meeting. The document shows that despite the apparent unanimity, the tensions were growing, as a “few” officials were actually arguing for the central bank to pause:

Read full article... Read full article...

Thursday, January 10, 2019

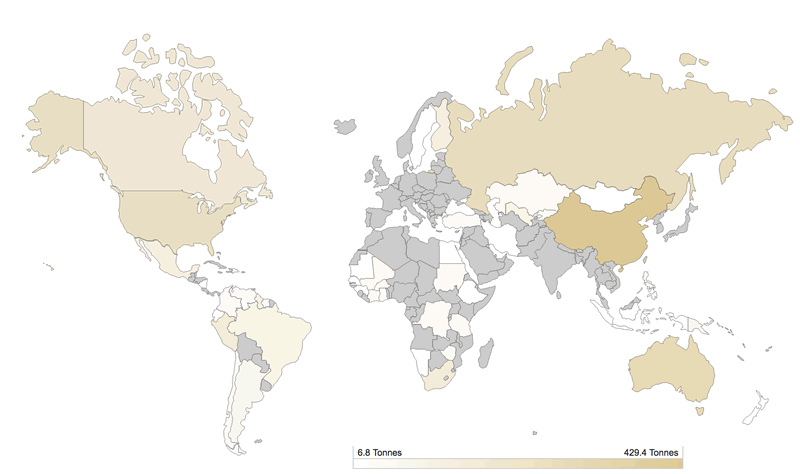

Gold Mine Production by Country / Commodities / Gold & Silver 2019

By: Michael_J_Kosares

Gold mine production by country Divergent paths among the major global producers tell an important tale

Read full article... Read full article...

Sources: MetalsFocus and the World Gold Council with permission.